AZATHIOPRINE - Generic Drug Details

✉ Email this page to a colleague

What are the generic drug sources for azathioprine and what is the scope of patent protection?

Azathioprine

is the generic ingredient in four branded drugs marketed by Aaipharma Llc, Alkem Labs Ltd, Amneal, Rising, Zydus Pharms Usa, Legacy Pharma, Hikma, and Casper Pharma Llc, and is included in eight NDAs. Additional information is available in the individual branded drug profile pages.There are sixteen drug master file entries for azathioprine. Sixteen suppliers are listed for this compound.

Summary for AZATHIOPRINE

| US Patents: | 0 |

| Tradenames: | 4 |

| Applicants: | 8 |

| NDAs: | 8 |

| Drug Master File Entries: | 16 |

| Finished Product Suppliers / Packagers: | 16 |

| Raw Ingredient (Bulk) Api Vendors: | 1 |

| Clinical Trials: | 357 |

| Patent Applications: | 7,934 |

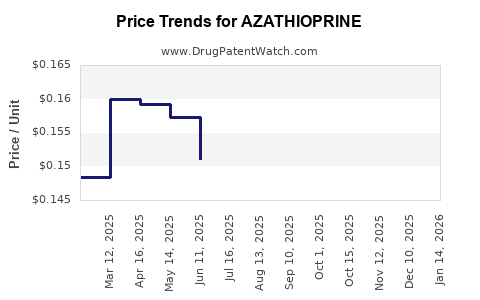

| Drug Prices: | Drug price trends for AZATHIOPRINE |

| What excipients (inactive ingredients) are in AZATHIOPRINE? | AZATHIOPRINE excipients list |

| DailyMed Link: | AZATHIOPRINE at DailyMed |

Recent Clinical Trials for AZATHIOPRINE

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| NovelMed Therapeutics | PHASE2 |

| University Hospital Schleswig-Holstein | PHASE4 |

| First Affiliated Hospital of Wenzhou Medical University | PHASE3 |

Pharmacology for AZATHIOPRINE

| Drug Class | Purine Antimetabolite |

| Mechanism of Action | Nucleic Acid Synthesis Inhibitors |

Medical Subject Heading (MeSH) Categories for AZATHIOPRINE

Anatomical Therapeutic Chemical (ATC) Classes for AZATHIOPRINE

US Patents and Regulatory Information for AZATHIOPRINE

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Alkem Labs Ltd | AZATHIOPRINE | azathioprine | TABLET;ORAL | 208687-002 | Mar 27, 2020 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Aaipharma Llc | AZASAN | azathioprine | TABLET;ORAL | 075252-001 | Jun 7, 1999 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Amneal | AZATHIOPRINE | azathioprine | TABLET;ORAL | 074069-001 | Feb 16, 1996 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Aaipharma Llc | AZASAN | azathioprine | TABLET;ORAL | 075252-003 | Feb 3, 2003 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for AZATHIOPRINE

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Nova Laboratories Ireland Limited | Jayempi | azathioprine | EMEA/H/C/005055Jayempi is indicated in combination with other immunosuppressive agents for the prophylaxis of transplant rejection in patients receiving allogenic kidney, liver, heart, lung or pancreas transplants. Azathioprine is indicated in immunosuppressive regimens as an adjunct to immunosuppressive agents that form the mainstay of treatment (basis immunosuppression).Jayempi is used as an immunosuppressant antimetabolite either alone or, more commonly, in combination with other agents (usually corticosteroids) and/ or procedures which influence the immune response.Jayempi is indicated in patients who are intolerant to glucocorticosteroids or if the therapeutic response is inadequate despite treatment with high doses of glucocorticosteroids, in the following diseases:severe active rheumatoid arthritis (chronic polyarthritis) that cannot be kept under control by less toxic agents (disease-modifying anti-rheumatic -medicinal products – DMARDs)auto-immune hepatitis systemic lupus erythematosusdermatomyositispolyarteritis nodosapemphigus vulgaris and bullous pemphigoidBehçet’s diseaserefractory auto-immune haemolytic anaemia, caused by warm IgG antibodieschronic refractory idiopathic thrombocytopenic purpuraJayempi is used for the treatment of moderately severe to severe forms of chronic inflammatory bowel disease (IBD) (Crohn’s disease or ulcerative colitis) in patients in whom glucocorticosteroid therapy is necessary, but where glucocorticosteroids are not tolerated, or in whom the disease is untreatable with other common means of first choice.It is also indicated in adult patients in relapsing multiple sclerosis, if an immunomodulatory therapy is indicated but beta interferon therapy is not possible, or a stable course has been achieved with previous treatment with azathioprine. 3Jayempi is indicated for the treatment of generalised myasthenia gravis. Depending on the severity of the disease, Jayempi should be given in combination with glucocorticosteroids because of slow onset of action at the beginning of treatment and the glucocorticosteroid dose should be gradually reduced after several months of treatment. | Authorised | no | no | no | 2021-06-21 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

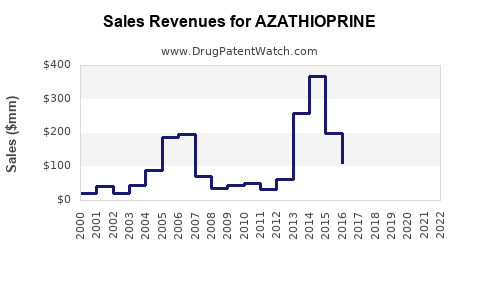

Market Dynamics and Financial Trajectory for the Pharmaceutical Drug: Azathioprine

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.