Last updated: July 29, 2025

Introduction

HYZAAR, a combination of valsartan and hydrochlorothiazide, has carved a significant niche within the antihypertensive medication market. Approved by the U.S. Food and Drug Administration (FDA) in 2007, the drug offers a dual mechanism to manage hypertension and reduce cardiovascular risk. This analysis explores the evolving market landscape, regulatory influences, competitive dynamics, and the financial trajectory influencing HYZAAR’s commercial performance.

Market Overview and Demand Drivers

The global antihypertensive market is a cornerstone in cardiovascular disease management, driven primarily by the rising prevalence of hypertension worldwide. According to the World Health Organization (WHO), over 1.2 billion people globally suffer from hypertension, with projections indicating a steady increase, especially in low- and middle-income countries due to urbanization, aging populations, and lifestyle changes [1].

HYZAAR's pharmaceutical profile—combining an angiotensin receptor blocker with a diuretic—addresses the need for effective, combination therapy in patients inadequately managed with monotherapy. The drug's efficacy in reducing blood pressure and cardiovascular events consolidates its position within treatment guidelines, such as those from the American College of Cardiology (ACC) and the American Heart Association (AHA).

Furthermore, increasing awareness about medication adherence and cost-effectiveness favors fixed-dose combinations like HYZAAR, which improve compliance and reduce pill burden. The rising healthcare expenditure and policies favoring the use of generic and combination drugs bolster the drug’s adoption.

Regulatory and Patent Landscape

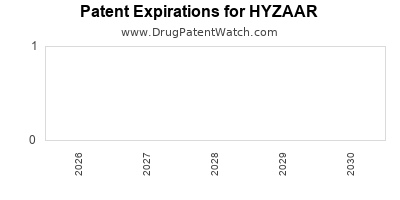

HYZAAR initially benefited from patent exclusivity, ensuring market protection and a period of limited competition. However, key patents on formulations and manufacturing processes expired over the last decade, allowing generic manufacturers to introduce equivalent products, intensifying price competition.

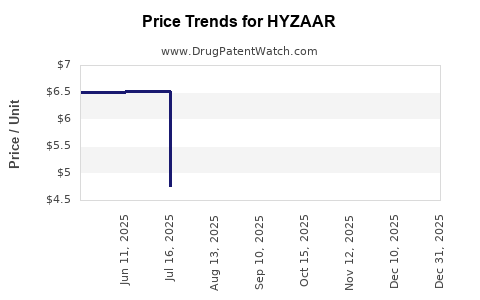

Rumors of patent cliffs in jurisdictions such as the U.S. and Europe have prompted the manufacturer, initially marketed by Sanofi and later contracted to other firms following Merck’s acquisition of the originating rights, to develop next-generation formulations and combination therapies. The expiration of patents has led to a significant decline in the drug’s average selling price (ASP), pressuring revenue streams.

Regulatory bodies have also issued warnings and imposed restrictions following concerns about potential adverse effects and the introduction of biosimilar competition, somewhat dampening market enthusiasm. Nonetheless, regulatory approvals of similar combination drugs using alternative ARBs and diuretics continue to fragment the market share.

Competitive Dynamics

HYZAAR faces stiff competition from both branded and generic antihypertensives. Generic versions surged onto the market post-patent expiration, substantially eroding the original drug’s market share and profitability.

Key competitors include fixed-dose combinations such as:

- Olmesartan/Hydrochlorothiazide

- Amlodipine/Valsartan

- Losartan/Hydrochlorothiazide

These alternatives often feature improved tolerability profiles and differing mechanisms, appealing to physicians seeking tailored patient management. The increasing prominence of novel therapeutics targeting resistant hypertension and patients with complex comorbidities further complicates HYZAAR’s competitive environment.

Additionally, the advent of personalized medicine and digital health monitoring influences treatment choices, emphasizing drugs with proven efficacy and safety profiles, areas where HYZAAR maintains an advantage due to extensive clinical data.

Market Penetration and Geographic Trends

North America remains the largest market for antihypertensive combination drugs, accounting for approximately 45% of sales as of 2022, driven by high prevalence, advanced healthcare infrastructure, and aggressive marketing strategies. Europe follows, with similar but slightly slower growth rates, hampered by pricing pressures and reimbursement constraints.

Emerging markets in Asia-Pacific, Latin America, and Africa present substantial growth opportunities, fueled by increasing hypertension prevalence, expanding healthcare access, and evolving prescribing practices. However, price sensitivity and regulatory hurdles pose challenges for market entry and growth.

HyZAAR’s sales trends mirror these regional dynamics. Initial rapid uptake in the U.S. benefited from early market exclusivity; subsequent erosion of market share due to generics has led to a plateau in revenue growth. Conversely, growth in emerging markets remains nascent but promising, contingent on local regulatory approvals and market penetration strategies.

Financial Trajectory and Revenue Outlook

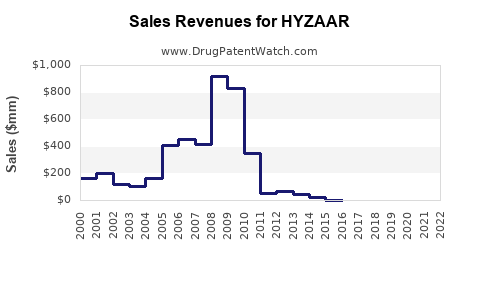

HYZAAR's revenue trajectory has experienced notable shifts:

-

Pre-Patent Expiry (2007–2017): Revenue experienced robust growth, supported by patent protection, widespread clinician adoption, and favorable pricing strategies. Peak sales exceeded several billion dollars annually.

-

Post-Patent Expiry (2018 onward): Introduction of generics caused sharp declines, with revenues falling by approximately 70% over five years. Pricing pressure intensified, with discounts and rebates eroding profit margins.

-

Market Diversification and Lifecycle Management: To sustain revenues, manufacturers introduced new formulations, fixed-dose combination variants employing different ARBs, and secured approvals in emerging markets.

-

Impact of Regulatory and Legal Challenges: Ongoing litigation linked to patent disputes and safety concerns has also influenced financial performance, sometimes causing volatility in income streams.

Projections indicate that, absent strategic repositioning or pipeline innovations, HYZAAR’s sales will stabilize or decline marginally in mature markets. Conversely, potential growth arises from expanding indications, increased use of fixed-dose combinations in emerging markets, and the introduction of biosimilars.

Strategic Considerations and Future Outlook

Given the expiration of patents and intense price competition, the future of HYZAAR hinges on:

-

Pipeline Innovation: Development of next-generation antihypertensives with improved side effect profiles, longer durations of action, and personalized treatment options.

-

Market Expansion: Strengthening presence in underserved regions and leveraging local partnerships to penetrate emerging markets.

-

Lifecycle Management: Portfolio diversification with newer fixed-dose combinations, combination pills tailored for resistant hypertension, and formulations with improved adherence features.

-

Regulatory Engagement: Active pursuit of expanded indications and biosimilar development to mitigate revenue erosion.

-

Cost Optimization: Reducing manufacturing costs and leveraging digital health initiatives to improve prescribing efficiency.

Key Takeaways

-

Growing Global Burden of Hypertension sustains demand for combination therapies like HYZAAR, though market share faces pressure from generic competition.

-

Patent Expirations and Market Saturation significantly impacted revenue, necessitating strategic innovation and diversification.

-

Regional Market Dynamics position North America as the primary revenue driver, with emerging markets offering long-term growth prospects contingent on regulatory and economic factors.

-

Competitive Landscape is consolidating with biosimilar entries and newer clinical guidelines emphasizing personalized and resistant hypertension management.

-

Strategic Adaptation through product evolution, pipeline development, and geographic expansion is crucial for sustaining financial performance.

FAQs

1. How has patent expiration affected HYZAAR’s market share?

Patent expiry led to the entry of generic competitors, causing a substantial decline in HYZAAR’s market share and revenues, with estimates indicating a 70% revenue reduction over five years.

2. What are the primary competitors to HYZAAR?

HYZAAR faces competition from other fixed-dose antihypertensive combinations such as olmesartan/hydrochlorothiazide, amlodipine/valsartan, and losartan/hydrochlorothiazide, as well as emerging novel therapies for resistant hypertension.

3. What strategic moves can manufacturers employ to sustain HYZAAR’s market presence?

Innovating with new formulations, expanding indications, entering emerging markets, and developing biosimilars are key strategies for maintaining or growing revenues.

4. How do regional healthcare policies influence HYZAAR’s sales?

Stringent reimbursement policies, pricing regulations, and market access frameworks in Europe and North America affect sales, while expanding healthcare coverage in emerging markets offers growth opportunities.

5. What is the outlook for HYZAAR’s future financial performance?

Without new innovations, revenues will likely plateau or decline due to generic competition; however, strategic diversification and market expansion may offset some decline, especially in emerging regions.

References

[1] World Health Organization. (2021). Hypertension. Retrieved from WHO website.