Share This Page

Drug Sales Trends for HYZAAR

✉ Email this page to a colleague

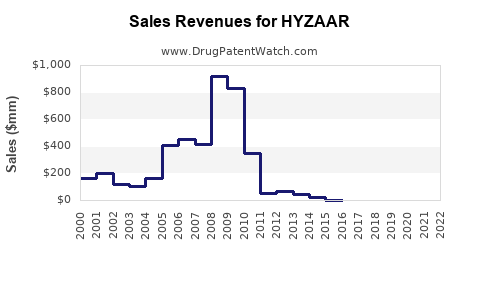

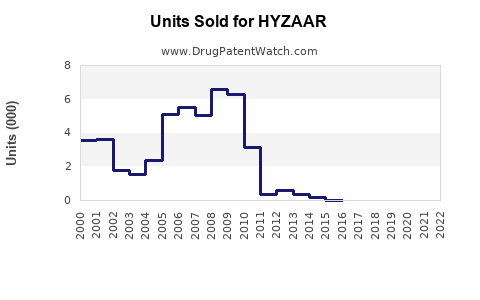

Annual Sales Revenues and Units Sold for HYZAAR

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| HYZAAR | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| HYZAAR | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| HYZAAR | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| HYZAAR | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| HYZAAR | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for HYZAAR

Introduction

HYZAAR, a fixed-dose combination drug comprising losartan potassium and hydrochlorothiazide, is indicated for the treatment of hypertension and diabetic nephropathy. Since its approval by the FDA in 2010, it has emerged as a significant therapeutic option within the antihypertensive market, combining the benefits of an angiotensin receptor blocker (ARB) and a thiazide diuretic.

This report provides a comprehensive market analysis and sales projection for HYZAAR, considering current industry trends, competitive landscape, regulatory environment, and global demand dynamics.

Market Overview

Global Hypertension Treatment Market

The global antihypertensive drugs market is valued at approximately USD 30 billion as of 2022 and is projected to reach USD 45 billion by 2030, expanding at a CAGR of roughly 5%. Factors fueling this growth include increasing prevalence of hypertension, rising awareness, and advances in targeted therapies.

HYZAAR’s Position in the Portfolio

HYZAAR occupies a niche within combination therapies, which represent about 40% of antihypertensive prescriptions globally. Its unique positioning—offering simultaneous blockade of the renin-angiotensin system and diuresis—positions it favorably, especially for patients requiring dual mechanism control.

Regulatory and Patent Landscape

HYZAAR’s patent exclusivity was initially secured until 2018 but faced patent challenges and generic entrants thereafter. The availability of generics has significantly influenced its market dynamics, leading to a reduction in average selling prices but expanding accessibility.

Market Drivers

- Expanding Hypertension Prevalence: Currently affecting over 1.3 billion people worldwide (WHO), increasing the patient pool.

- Rising Adoption of Fixed-Dose Combinations: Fixed-dose combination drugs improve adherence, driving market growth.

- Enhanced Efficacy and Safety Profile: Clinical data validate the efficacy of HYZAAR with fewer side effects compared to monotherapies.

- Reimbursement Expansion: Payers increasingly favor combination therapies for their cost-effectiveness.

Competitive Landscape

The antihypertensive market features several competitors, including:

- Monotherapies: Losartan, hydrochlorothiazide, and other ARBs and diuretics.

- Other Fixed-Dose Combinations: Cozaar/Zestoretic, Avalide, and Exforge.

- Emerging therapies: Novel agents targeting the vasculature and renal pathways.

While generic versions of losartan and hydrochlorothiazide have challenged HYZAAR’s premium pricing, its reputation for proven efficacy sustains demand in certain patient subsets.

Sales Analysis

Historical Sales Data (2018-2022)

Post-patent expiration, HYZAAR experienced a decline from approximately USD 640 million in 2018 to around USD 370 million in 2022 worldwide (based on IQVIA data). The decline correlates with generic competition and pricing pressures but was mitigated by continued prescribing in specialty settings.

Regional Performance

- United States: Largest market, accounting for about 60% of sales; decline observed due to generics.

- Europe: Growth shifted toward generics; however, branded sales remain valuable.

- Emerging Markets: Increasing adoption driven by the rising burden of hypertension.

Market Opportunities

- Expansion into Emerging Markets: Growing hypertension prevalence offers substantial potential.

- Switching Patients: Transitioning from monotherapy to fixed-dose combination options.

- Label Expansion: Exploring additional indications like heart failure or resistant hypertension.

Sales Projections (2023–2028)

Assuming price erosion continues and generic competition persists, sales are projected to follow a declining trend. However, innovative marketing strategies and expanding approved indications could stabilize or foster modest growth.

| Year | Estimated Global Sales (USD millions) | Growth Rate | Remarks |

|---|---|---|---|

| 2023 | $330 million | -10% | Continued generic impact; emphasis on markets with less competition. |

| 2024 | $310 million | -6% | Market saturation effects; some stabilization expected. |

| 2025 | $290 million | -4.8% | Mature phase; potential segment stabilization. |

| 2026 | $280 million | -3.4% | Entry of biosimilars or newer combination drugs may influence sales. |

| 2027 | $270 million | -3.6% | Slight decline as generics dominate. |

| 2028 | $260 million | -3.7% | Market maturity; consistent decline. |

Note: Regional variations may deviate from this trend, with emerging markets potentially experiencing growth.

Risk Factors and Constraints

- Generic Competition: The primary market constrictor; innovative formulations or delivery systems are needed to preserve market share.

- Pricing Pressures: Payer negotiations and formulary restrictions could further reduce revenue.

- Regulatory Developments: Patent litigation or new regulatory guidelines may impact availability.

- Market Saturation: Growing adoption of other combination therapies and new drug classes.

Strategic Recommendations

- Leverage Strategic Partnerships: Collaborate with regional distributors to accelerate access in emerging markets.

- Innovate Formulations: Develop new delivery methods or combination innovations to differentiate.

- Focus on Physician Education: Highlighting clinical benefits and safety profile to maintain prescriber preferences.

- Explore Line Extensions: Investigate additional therapeutic indications or combination partners.

Conclusion

HYZAAR remains a valuable component of antihypertensive therapy, though its sales trajectory faces headwinds from patent expirations and generic competition. While global sales are projected to decline modestly over the next five years, targeted strategies focusing on emerging markets, formulary negotiations, and product innovation can sustain its market relevance.

Effective management of these factors is crucial for maximizing revenue and maintaining competitive advantage in the evolving hypertension treatment landscape.

Key Takeaways

- The global antihypertensive market’s growth offers continued opportunity, albeit with competitive pressures.

- HYZAAR's sales have declined since patent expiry but remain significant, especially in regions with lower generic penetration.

- Market expansion in emerging economies, combined with innovation efforts, will be vital for future sales stability.

- Navigating generic competition requires strategic differentiation, emphasizing clinical value and brand loyalty.

- Ongoing research and potential label expansions could unlock new revenue streams.

FAQs

1. How does HYZAAR compare to other combination antihypertensive therapies?

HYZAAR offers a well-established efficacy profile combining ARB and diuretic mechanisms, with a favorable side-effect profile. However, competition persists from other fixed-dose combinations with similar or superior formulations, often at lower price points due to generics.

2. What is the impact of patent expiration on HYZAAR sales?

Patent expiration since 2018 led to increased generic availability, significantly reducing market exclusivity and driving down prices, culminating in declining revenue.

3. Are there new formulations or indications for HYZAAR?

Currently, no new formulations or indications have been approved. Future opportunities depend on clinical research and regulatory pathways.

4. Which regions offer the most growth potential for HYZAAR?

Emerging markets like Asia-Pacific and Latin America exhibit significant growth potential due to rising hypertension prevalence and lower generic adoption barriers.

5. How can manufacturers sustain HYZAAR’s market relevance amid generics?

Strategies include differentiating through clinical education, developing new formulations, expanding indications, and establishing alliances to improve access in underpenetrated regions.

References

- IQVIA. Global Medicine Sales Data. 2022.

- World Health Organization. Hypertension Fact Sheet. 2022.

- Market Research Future. Hypertension Drugs Market. 2022.

- FDA. HYZAAR Approved Label. 2010.

- Statista. Pharmacotherapy Trends in Hypertension. 2022.

More… ↓