Last updated: July 28, 2025

Introduction

HYZAAR, a fixed-dose combination of losartan potassium and hydrochlorothiazide, is marketed primarily for managing hypertension and reducing cardiovascular risk. Since its approval by the FDA in 2002, HYZAAR has established a significant presence in the antihypertensive market, driven by the widespread prevalence of hypertension worldwide. This analysis provides a comprehensive overview of the current market landscape, competitive positioning, and price projection forecasts for HYZAAR over the next five years.

Market Overview

Global Hypertension Treatment Market

The global antihypertensive drugs market was valued at approximately USD 22 billion in 2021 and is projected to reach USD 37 billion by 2028, registering a compound annual growth rate (CAGR) of around 8%[1]. Hypertension remains a primary contributor to cardiovascular morbidity and mortality worldwide, creating ongoing demand for effective treatments.

Key Attributes of HYZAAR

HYZAAR combines two classes of antihypertensives: losartan, an angiotensin II receptor blocker (ARB), and hydrochlorothiazide, a thiazide diuretic. The combination offers improved compliance due to reduced pill burden and synergistic efficacy. It is especially preferred in patients requiring combination therapy with well-tolerated side effects.

Market Position and Competitive Landscape

HYZAAR is branded by Merck & Co. (known as MSD outside the US and Canada), maintaining a solid position in the combination antihypertensive segment. Competition arises from other fixed-dose combinations such as:

- Amlodipine/Benazepril

- Olmesartan/Hydrochlorothiazide

- Valsartan/Hydrochlorothiazide

Generic rivalry has increased since the patent expiry of the original compounds; however, HYZAAR retains exclusivity partly due to its fixed-dose formulation, brand recognition, and prescriber preference.

Market Dynamics Influencing HYZAAR

- Patent and Regulatory Environment

HYZAAR’s patent expired in 2012, leading to a surge in generic competition. Nonetheless, branded formulations often maintain market share through physician loyalty and formulary placements. Merck has explored new formulations and combination variants to prolong market presence.

- Pricing Strategies and Payer Dynamics

In the U.S., list prices for branded hypertension drugs generally range from USD 150 to USD 250 per month. Reimbursement policies, discounts, and tiered formularies significantly influence actual patient costs and prescriber choices.

- Regional Market Penetration

HYZAAR is predominantly marketed in North America, Europe, and select Asia-Pacific regions. Diffusion varies based on local regulatory approvals, healthcare infrastructure, and the prevalence of hypertension.

- Patient and Physician Preferences

Ease of administration and tolerability favor fixed-dose combinations like HYZAAR. However, generic alternatives with similar efficacy have pressured prices downward, impacting margins.

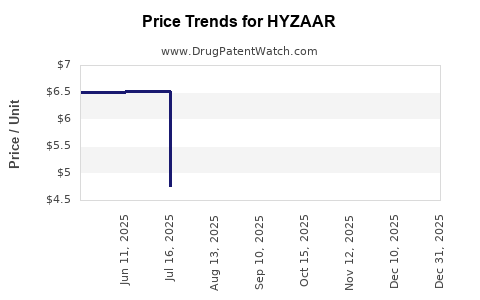

Price Trends and Historical Data

The pricing of HYZAAR has experienced a gradual decline over the past decade, chiefly due to generic entries post-patent expiry. For instance, the average wholesale price (AWP) for branded HYZAAR has decreased approximately 40-50% since 2012[2].

In recent years, wholesale acquisition costs (WAC) for branded HYZAAR in the U.S. have been around USD 200-230 per month. Generic versions are available at approximately USD 80-120 per month, influencing the branded product's market share and pricing strategies.

Forecasting Price Projections (2023-2028)

Scenario 1: Conservative Decline

- Continued downward pressure from generics, stable demand, and increased market saturation suggest a further price decrease of approximately 5-10% annually.

- By 2028, the average price of branded HYZAAR could fall to USD 150-180 per month, driven by increased generic penetration and competitive pricing.

Scenario 2: Stabilization through Differentiation

- Merck’s potential development of new formulations, extended-release variants, or combination patents could stabilize or slightly increase prices.

- Under this scenario, prices may plateau around USD 200-220 per month, supported by physician loyalty and formulary exclusion of lower-cost generics.

Scenario 3: Market Disruption

- Entry of biosimilars or alternative combination therapies might accelerate price erosion.

- Prices could decline by up to 15% annually, resulting in USD 130-160 by 2028.

Key Factors Affecting Future Prices

- Patent litigation and exclusivity periods: Any new patent extensions could delay generic competition.

- Regulatory approvals: Registration of generic rivals across regions influences price competition.

- Market uptake of alternatives: If newer or more effective antihypertensives gain favor, demand for HYZAAR may decline.

Implications for Stakeholders

- Pharmaceutical companies should consider lifecycle management strategies, including formulation innovations.

- Payers will continue to leverage generics to reduce medication costs, further pressuring the branded drug’s pricing.

- Patients and providers benefit from increased access due to reduced costs but may face trade-offs in perceived efficacy or tolerability.

Conclusion

HYZAAR remains a relevant antihypertensive treatment at the intersection of efficacy and convenience, albeit under intense pricing pressure from generics. Its future pricing trajectory appears to trend downward, with potential stabilization if Merck leverages innovation and strategic patent protections. Stakeholders must monitor patent landscapes, regulatory shifts, and market dynamics to optimize pricing and market positioning.

Key Takeaways

- The global antihypertensive market is expanding, with fixed-dose combinations like HYZAAR responding to demand for simplified regimens.

- Patent expiry has driven a significant decline in HYZAAR’s price, with continued downward trends expected due to generic competition.

- Price projections suggest a decline of approximately 5-10% annually, potentially stabilizing if Merck introduces new formulations.

- Market dynamics favor increased use of generics, impacting branded product pricing and sales.

- Strategic lifecycle management and innovative formulations are essential for maintaining profitability amid declining prices.

FAQs

-

What is the main competitor to HYZAAR in the antihypertensive market?

Key competitors include other fixed-dose combinations such as amlodipine/benazepril and olmesartan/hydrochlorothiazide, along with generic versions of losartan and hydrochlorothiazide.

-

How does patent expiration affect HYZAAR’s pricing?

Patent expiry typically leads to generic entry, significantly reducing prices due to increased competition. Branded formulations often retain some market share through loyalty and formulary strategies.

-

What factors could stabilize HYZAAR’s price in the future?

Development of new formulations, patent extensions, or expanded indications could help maintain or slightly increase prices despite generic competition.

-

Are biosimilars relevant to HYZAAR’s market?

No, as biosimilars mainly apply to large biologic drugs, whereas HYZAAR is a small-molecule combination therapy. However, biosimilars could influence broader antihypertensive market dynamics.

-

How do healthcare policies influence HYZAAR’s market value?

Payer policies favoring generics and formularies restrict the use of branded drugs, which in turn exerts downward pressure on HYZAAR’s pricing and sales volumes.

References

[1] Grand View Research. “Antihypertensive Drugs Market Size & Share Report 2021-2028.”

[2] RedBook. “Average Wholesale Price Trends for HYZAAR.”