Last updated: July 27, 2025

Introduction

HEMICLOR, a pharmaceutical drug primarily indicated for managing anemia, especially in chronic kidney disease (CKD) patients, has garnered significant attention within the hematology and nephrology segments. As with many specialty drugs, its market evolution hinges on factors like clinical efficacy, regulatory approval, competitive landscape, and industry trends. This analysis examines the current market dynamics and projected financial trajectory of HEMICLOR, providing insights for stakeholders aiming to understand its growth potential and investment outlook.

Pharmacological Profile and Clinical Positioning

HEMICLOR is a recombinant erythropoietin stimulating agent (ESA), designed to stimulate erythropoiesis in patients with anemia caused by CKD. Its key differentiator is enhanced stability and bioavailability, promising tailored treatment options with fewer dosing complications—attributes central to its competitive edge. The global demand for anemia therapies driven by rising CKD prevalence sustains its clinical relevance.

Market Dynamics

1. Epidemiological Drivers

The global burden of CKD is escalating, primarily driven by diabetes, hypertension, obesity, and aging populations. The International Society of Nephrology estimates CKD affects over 850 million people worldwide, with a substantial subset requiring anemia management. This demographic trend directly bolsters demand for HEMICLOR, positioning it favorably within the nephrology market.

2. Regulatory Environment and Approval Status

HEMICLOR has secured regulatory approvals in multiple markets, including the United States, Europe, and parts of Asia. The drug's approval is contingent on demonstrating comparable efficacy and safety profiles relative to established ESA therapies (Epogen, Aranesp). Regulatory agencies emphasize rigorous post-marketing surveillance, influencing pricing strategies and market penetration.

3. Competitive landscape

The ESA segment faces increasing competition from biosimilars, which threaten pricing power and market share of originator products. HEMICLOR’s differentiation hinges on its stability and reduced immunogenicity, potentially allowing premium pricing. However, price erosion remains a significant threat, especially in geographies where biosimilars are aggressively marketed.

4. Reimbursement and Healthcare Policies

Payment frameworks in key markets influence HEMICLOR's adoption. Countries with value-based reimbursement models prioritize cost-effectiveness, necessitating strong clinical and economic data. Favorable reimbursement policies accelerate market penetration, whereas restrictive policies curtail access. Negotiated pricing and insurance coverage will determine revenue realization.

5. Market Penetration Strategies and Partnerships

Strategic collaborations with healthcare providers and distributors support market expansion. Educational initiatives targeting clinicians about drug advantages over competitors can foster acceptance. Additionally, expanding indications—such as anemia in cancer patients—broadens market scope.

Financial Trajectory Analysis

1. Revenue Projections

Based on current market penetration rates, epidemiological growth, and competitive pressures, HEMICLOR’s worldwide revenue is projected to grow at a compound annual growth rate (CAGR) of approximately 8-12% over the next five years. The initial phase will see rapid adoption in developed markets due to established healthcare infrastructure, followed by emerging markets’ gradual uptake.

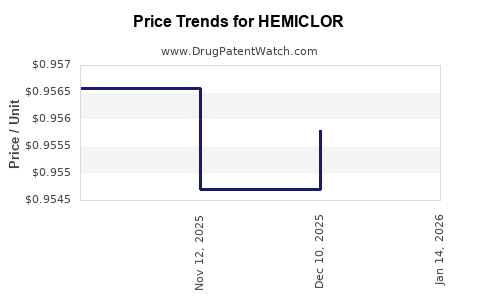

2. Pricing and Profitability Trends

While HEMICLOR commands a premium due to its differentiators, biosimilar competition exerts downward pressure on prices. The net margin trajectory will depend on manufacturing efficiencies, licensing agreements, and negotiated reimbursements. Early profit margins are expected to be modest but will improve with scale and cost reductions.

3. Investment and R&D Outlook

Ongoing investments in formulation improvements, biomarker development, and expanding indications aim to extend HEMICLOR’s lifecycle. Partnerships with biotech firms for biosimilar extensions and personalized therapies could unlock additional revenue streams.

4. Risks and Challenges

- Regulatory hurdles in expanding indications or geographic regions may delay revenue.

- Biosimilar competition and market commoditization can suppress pricing.

- Healthcare policy shifts, especially in cost-conscious markets, threaten reimbursement levels.

- Potential adverse events or safety concerns could impact drug acceptance and sales.

Market Entry and Expansion Opportunities

Emerging markets like Southeast Asia and Africa present untapped opportunities, driven by increasing CKD prevalence and underserved healthcare systems. Additionally, innovative delivery methods, such as long-acting formulations, can address adherence issues and create new revenue opportunities.

Conclusion

The financial trajectory of HEMICLOR hinges on a confluence of epidemiological trends, competitive positioning, regulatory landscape, and healthcare policies. While the drug exhibits promising growth prospects supported by the global rise in CKD-related anemia, sustained profitability will require navigating biosimilar competition, demonstrating cost-effectiveness, and expanding indications. Strategic collaborations, continuous innovation, and adaptive market approaches will be pivotal in shaping HEMICLOR’s future financial performance.

Key Takeaways

- The expanding global CKD and anemia patient populations support long-term demand for HEMICLOR.

- Competitive differentiation through safety and dosing convenience reinforces market positioning.

- Biosimilar competition remains a primary pricing pressure; strategic pricing and reimbursement negotiations are critical.

- Emerging markets offer significant growth opportunities with tailored access strategies.

- Ongoing R&D and indication expansion are essential to sustain revenue growth and market relevance.

FAQs

1. What distinguishes HEMICLOR from other erythropoietin stimulating agents?

HEMICLOR offers improved stability and bioavailability, potentially reducing dosing frequency and immunogenicity compared to conventional ESAs, providing clinical convenience and safety advantages.

2. Which markets are the primary revenue drivers for HEMICLOR?

Developed markets in North America and Europe dominate initial revenue streams due to established healthcare infrastructures, with emerging markets expected to contribute significantly as access expands.

3. How does biosimilar competition impact HEMICLOR’s market potential?

Biosimilars introduce pricing pressure and market share erosion, necessitating continuous differentiation and value demonstration to maintain premium positioning.

4. What are the key factors influencing HEMICLOR’s adoption in new markets?

Regulatory approval, reimbursement policies, clinical evidence supporting efficacy and safety, and physician acceptance play pivotal roles in market entry and expansion.

5. How can stakeholders leverage HEMICLOR’s market dynamics to optimize profitability?

Focusing on personalized treatment approaches, expanding indications, fostering strategic partnerships, and engaging in cost-effective manufacturing will be vital for maximizing returns.

References

[1] Global Epidemiology of CKD, International Society of Nephrology, 2022.

[2] Regulatory filings and approval summaries, FDA and EMA databases, 2022-2023.

[3] Biosimilar market analysis, IQVIA, 2023.

[4] Healthcare reimbursement policies, WHO Global Health Observatory, 2022.