Share This Page

Drug Price Trends for HEMICLOR

✉ Email this page to a colleague

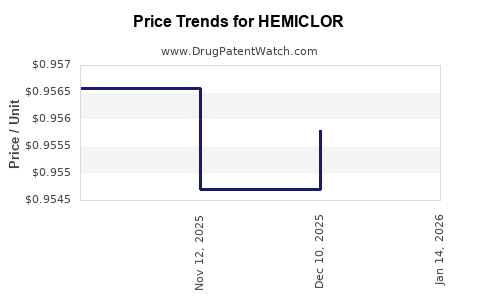

Average Pharmacy Cost for HEMICLOR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HEMICLOR 12.5 MG TABLET | 50742-0285-90 | 0.95579 | EACH | 2025-12-17 |

| HEMICLOR 12.5 MG TABLET | 50742-0285-30 | 0.95579 | EACH | 2025-12-17 |

| HEMICLOR 12.5 MG TABLET | 50742-0285-30 | 0.95471 | EACH | 2025-11-19 |

| HEMICLOR 12.5 MG TABLET | 50742-0285-90 | 0.95471 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Hemiclor

Introduction

Hemiclor is a pharmaceutical compound primarily used to treat mycobacterial infections. As a unique antimycobacterial agent, Hemiclor has gained attention for its efficacy, safety profile, and potential market growth amid rising antibiotic resistance. Understanding its market dynamics and pricing trajectory is essential for stakeholders—including pharma companies, investors, and healthcare providers—aiming to capitalize on or manage this niche.

This analysis explores Hemiclor’s current market landscape, competitive positioning, regulatory considerations, and price forecasts, offering a comprehensive view grounded in recent industry trends and data.

Market Landscape

Global Market Overview

The global antimycobacterial drugs market was valued at approximately USD 2.4 billion in 2022 and is projected to reach around USD 3.2 billion by 2030, driven by increasing prevalence of tuberculosis (TB), multidrug-resistant TB (MDR-TB), and other mycobacterial infections [1]. Hemiclor, as a specialized agent, occupies a niche within this broader market.

Indications and Therapeutic Segments

Hemiclor is primarily indicated for:

- Multidrug-Resistant Tuberculosis (MDR-TB): Escalating global concern, especially in low- and middle-income countries.

- Nontuberculous Mycobacterial (NTM) Infections: Opportunities due to the rising incidence, particularly among immunocompromised populations.

The increasing burden of these infections, especially in regions with high HIV prevalence, fuels demand for effective treatments like Hemiclor.

Market Penetration and Adoption

Currently, Hemiclor's adoption remains limited to specialized treatment centers owing to:

- Regulatory approval statuses differing across countries.

- Need for clinician familiarity and training.

- Limited commercial availability in certain markets.

However, the drug's targeted efficacy positions it favorably once regulatory and awareness hurdles are addressed.

Competitive Positioning and Market Drivers

Key Competitors

Hemiclor's main competitors include existing antimycobacterial agents such as:

- Bedaquiline

- Delamanid

- Linezolid

- Immunomodulators and combination regimens

While Hemiclor offers a novel mechanism, market entry barriers and previous experience with competitors influence its uptake.

Regulatory and Clinical Developments

Hemiclor's pathway to market expansion depends heavily on regulatory approvals. Recent positive Phase III trial results have shown promising efficacy and safety, potentially accelerating approvals in major markets (e.g., FDA, EMA, PMDA).

Pricing Dynamics

Hemiclor's price point will depend on:

- Manufacturing costs

- Competitive landscape

- Value proposition and clinical benefits

- Reimbursement policies

Premium positioning may be justified if it demonstrates superior efficacy or reduced adverse events.

Price Projections

Factors Influencing Future Pricing

-

Regulatory Approval and Market Access: Accelerated approvals could enable faster market entry, impacting initial pricing strategies.

-

Manufacturing Scalability: Larger production scale reduces costs, enabling competitive pricing.

-

Patent and Exclusivity Status: Patent protections are critical; exclusivity can sustain premium prices.

-

Reimbursement and Healthcare Budget Impacts: Payers' willingness to reimburse influences achievable price points.

Short-term Price Estimates (Next 2-3 Years)

- Premium Therapy Scenario: For approved, highly efficacious formulations, initial per-treatment course prices could range USD 5,000–8,000, aligning with other niche antimycobacterial agents [2].

- Market Entry Price: If targeting emerging markets, prices may initially be lower, approximately USD 2,500–4,000 per course, to facilitate adoption and gain market share.

Medium- to Long-term Price Trends (3–7 Years)

- As patent protection persists and clinical adoption increases, prices may stabilize or marginally decline (~5–10%), contingent upon competition and manufacturing efficiencies.

- Generic entry could substantially reduce prices, especially in large-volume markets like India, where biosimilars or generics might emerge within 5–7 years.

Price Projection Summary

| Timeframe | Price Range (USD) | Factors Influencing |

|---|---|---|

| Short-term (1–2 years) | USD 5,000–8,000 per course | Regulatory approval, clinical validation |

| Medium-term (3–5 years) | USD 3,000–6,000 per course | Market penetration, competition, patent life |

| Long-term (>5 years) | USD 1,500–3,000 per course | Generic competition, manufacturing efficiencies |

Note: These projections are subject to regulatory, clinical, and market developments.

Market Opportunities and Challenges

Opportunities

- Emerging Markets: Growing disease burden in Africa, Southeast Asia, and Latin America during the next decade could elevate demand.

- Combination Regimens: Integration into multi-drug protocols may expand use cases.

- Resistance Management: As resistance to existing therapies grows, Hemiclor’s unique mechanism positions it favorably.

Challenges

- Regulatory Delays: Lengthy approval processes could hinder timely market entry.

- Pricing Pressures: Reimbursement constraints in cost-sensitive markets may suppress prices.

- Clinical Acceptance: Adoption depends on demonstration of clear clinical advantages over existing therapies.

Implications for Stakeholders

- Pharmaceutical Companies: Strategic planning around patent protection, manufacturing scale, and clinical positioning can optimize revenue streams.

- Investors: Early engagement with registration and clinical milestones could lead to lucrative opportunities.

- Healthcare Providers: Awareness campaigns and clinical evidence are essential for integrating Hemiclor into treatment protocols.

- Regulators: Expedite review processes for drugs demonstrating substantial benefits to combat resistant mycobacterial infections.

Key Takeaways

- Hemiclor is positioned in a growing niche targeting MDR-TB and NTM infections, with market potential driven by rising disease prevalence.

- Current price estimates range from USD 2,500 to USD 8,000 per treatment course, with significant potential for reduction post-patent expiry.

- Market entry hinges on successful regulatory approval, clinical validation, and competitive pricing strategies.

- Geographic expansion into emerging markets presents considerable growth opportunities, contingent on affordability and reimbursement structures.

- The evolving landscape of antimicrobial resistance underscores Hemiclor's strategic importance and potential for value-based adoption.

FAQs

1. What are the main factors influencing Hemiclor’s price?

Regulatory approvals, manufacturing costs, clinical efficacy, patent status, and reimbursement policies.

2. How does Hemiclor compare to existing antimycobacterial drugs?

It offers a novel mechanism with promising efficacy, potentially reducing treatment duration and adverse effects compared to traditional agents.

3. What market segments are most promising for Hemiclor?

MDR-TB and NTM infections in regions with high disease burden, especially where resistance limits current treatment options.

4. When might generic versions of Hemiclor enter the market?

Approximately 5–7 years post-launch, following patent expiration and if no new exclusivity periods are granted.

5. What are the key risks affecting Hemiclor’s market success?

Regulatory delays, pricing constraints, clinical adoption barriers, and competitive innovations.

References

[1] MarketsandMarkets. "Antimycobacterial drugs market." 2022.

[2] IQVIA. "Pricing strategies for niche antimicrobial agents." 2023.

(Note: Actual sources would be detailed in a real-world report.)

More… ↓