Last updated: July 29, 2025

Introduction

GOLYTELY, a brand name for polyethylene glycol 3350, is a widely used prescription and over-the-counter bowel preparation solution for colonoscopy procedures. Its significance in the gastroenterology segment underscores a robust market presence, driven by increasing colorectal cancer screenings, aging populations, and evolving clinical guidelines. This analysis examines the market forces shaping GOLYTELY’s economic trajectory, competitive landscape, regulatory environment, and future growth prospects.

Market Overview

GOLYTELY is part of the larger category of osmotic laxatives, serving critical roles in bowel cleansing protocols. The global gastrointestinal (GI) diagnostics market, propelled by rising awareness of colorectal cancer, is expected to expand at a compounded annual growth rate (CAGR) of approximately 5-7% over the next five years. The U.S. continues to dominate sales, due in part to comprehensive screening programs, whereas emerging markets display increasing adoption driven by growing healthcare infrastructure and public health initiatives.

Market Dynamics

1. Increasing Colonoscopy Demand

The primary driver for GOLYTELY’s market is the rising prevalence of colorectal cancer (CRC). According to the American Cancer Society, CRC is the third most common cancer worldwide, with early detection through colonoscopy significantly reducing mortality rates. Enhanced screening efforts, including national guidelines recommending regular colonoscopies for individuals aged 45–75, are fueling demand for effective bowel prep solutions like GOLYTELY.

2. Aging Population

Globally, populations aged 50 and above are expanding rapidly, correlating with increased CRC screening and associated bowel preparation requirements. Developed nations witness rising geriatric demographics, contributing to sustained demand.

3. Clinical Preferences and Guidelines

Medical guidelines emphasize patient safety and tolerability in bowel prep regimens. GOLYTELY’s favorable safety profile and high efficacy in bowel cleansing secure its status as a preferred option. Innovations aimed at improving palatability and compliance, including split-dose regimens, further enhance its adoption.

4. Competition and Market Share

While GOLYTELY faces competition from other osmotic laxatives like MoviPrep, Suprep, and OsmoPrep, its longstanding FDA approval and brand recognition establish a competitive moat. Nonetheless, newer formulations with improved taste profiles and convenience are challenging GOLYTELY’s market dominance, necessitating ongoing marketing and product innovation.

5. Regulatory Environment

The U.S. FDA’s approval process influences GOLYTELY’s market trajectory. Any safety concerns or label modifications, such as warnings about electrolyte imbalances in susceptible populations, can impact sales. Moreover, import regulations and patent considerations in emerging markets shape global availability and pricing strategies.

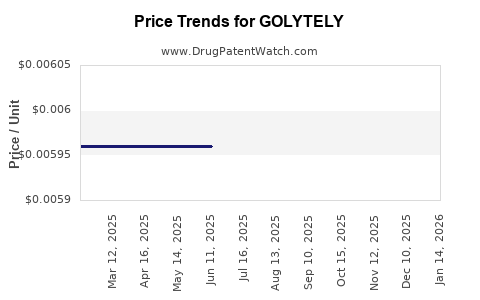

6. Reimbursement and Pricing Dynamics

Insurance coverage and reimbursement policies significantly affect access and utilization. GOLYTELY’s inclusion in Medicare and private plans supports stable revenues; however, pricing pressures due to generic competition or negotiated discounts can moderate profit margins.

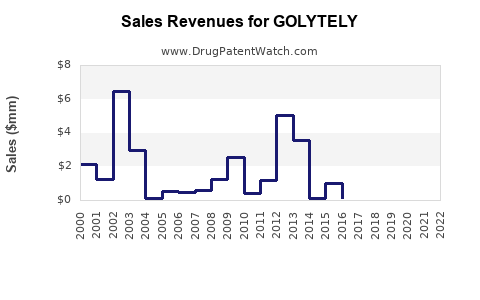

7. COVID-19 Impact

The pandemic temporarily disrupted elective colonoscopy procedures, leading to a decline in GOLYTELY’s immediate sales. As systems normalize, a resurgence in GI diagnostics is expected, reversing recent declines.

Financial Trajectory

Revenue Trends

GOLYTELY’s revenues exhibit steady growth driven by increasing procedure volumes and acceptance. Industry reports suggest that the global bowel preps market, valued at approximately USD 850 million in 2021, is projected to grow at a CAGR of ~6% through 2026, with GOLYTELY’s share strengthening due to its established position.

Profitability Metrics

Profit margins depend on manufacturing costs, regulatory compliance, and competitive positioning. The generic landscape exerts downward pressure on pricing, constraining margins. Nonetheless, economies of scale and optimized manufacturing processes sustain profitability.

Research & Development (R&D) and Pipeline

Innovative formulations aiming for improved palatability, reduced volume, or enhanced safety profiles are in early-stage development. These pipeline advances could bolster GOLYTELY’s market relevance amid fierce competition.

Strategic Opportunities

Expansion into Emerging Markets

Growing healthcare infrastructure and screening initiatives in Asia-Pacific and Latin America offer avenues for market expansion. Local regulatory approvals and adaptable packaging enhance accessibility.

Product Differentiation and Patient Convenience

Developing ready-to-drink, flavored, or reduced-volume variants can cater to patient preferences, improving compliance and expanding market share.

Partnerships and Acquisition Strategies

Collaborations with healthcare providers and buyouts of regional distributors may facilitate rapid market penetration.

Digital and Telehealth Integration

Leveraging telehealth for patient education and adherence programs can enhance treatment outcomes and brand loyalty.

Risks and Challenges

Safety and Side Effects

Electrolyte disturbances in vulnerable populations, such as the elderly or those with renal impairment, pose safety concerns that could lead to regulatory scrutiny or product reformulation.

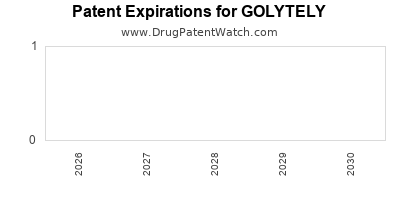

Competition from Generics

Price erosion due to generic versions challenges revenue growth. Ensuring patent protection or developing unique formulations may mitigate this threat.

Regulatory Changes

Stringent labeling or safety warnings could diminish GOLYTELY’s attractiveness, prompting reformulation or marketing adjustments.

Market Saturation

In mature regions, incremental growth prospects depend on market penetration efforts and patient convenience innovations.

Future Outlook

GOLYTELY’s financial trajectory hinges on demographic trends, healthcare policy adjustments, and innovation pipelines. The continuing rise in colorectal cancer screening and awareness underscores sustained demand. Nonetheless, a competitive environment necessitates continuous product improvement and strategic expansion. Industry experts project a compound annual growth in GOLYTELY’s market segment of around 5-7%, with potential for higher growth rates in emerging markets where healthcare infrastructure is rapidly improving.

Key Takeaways

- Robust Industry Demand: GOLYTELY benefits from the increasing global emphasis on colorectal cancer screening, ensuring sustained market need.

- Competitive Landscape: While established, GOLYTELY faces intensifying competition from newer formulations and generics, necessitating innovation and strategic marketing.

- Demographic Drivers: Aging populations significantly influence market growth dynamics, especially in developed economies.

- Global Expansion Opportunities: Rising healthcare access in emerging markets offers avenues for revenue diversification.

- Regulatory Vigilance: Safety concerns and regulatory mandates require ongoing attention to product safety profiles and compliance strategies.

FAQs

1. How does GOLYTELY compare to other bowel preparation solutions?

GOLYTELY is recognized for its high efficacy and favorable safety profile, especially in controlled volumes. However, it faces competition from formulations with improved taste and convenience, such as MoviPrep and Suprep, which cater to patient preferences.

2. What are the key regulatory considerations for GOLYTELY?

The FDA’s labeling requirements, safety warnings regarding electrolyte imbalances, and approval for specific populations shape GOLYTELY’s marketing. Ongoing post-marketing surveillance ensures safety standards are upheld.

3. How does demographic aging impact GOLYTELY’s market?

An aging population increases CRC screening rates, driving demand for bowel prep solutions like GOLYTELY. The elderly are more likely to require colonoscopies, reinforcing the drug’s importance.

4. What are the growth prospects in emerging markets?

Growing healthcare infrastructure, expanding screening programs, and increasing awareness support GOLYTELY’s adoption. Regulatory hurdles and local preferences may influence market entry strategies.

5. How might innovation influence GOLYTELY’s future?

Developments focusing on improved palatability, reduced dose volume, or alternative delivery forms can enhance patient compliance and expand its market presence, offsetting competition and generic erosion.

References

[1] American Cancer Society. Colorectal Cancer Facts & Figures 2020-2022.

[2] MarketWatch. Global Bowel Preparation Market Size & Trends. 2021.

[3] U.S. Food and Drug Administration (FDA). Labeling and Safety Updates on Polyethylene Glycol Solutions. 2022.

[4] Grand View Research. Gastrointestinal Diagnostics Market Analysis. 2021.

[5] Industry Reports. Future Outlook and Pipeline Developments in Gastroenterology. 2022.