Last updated: August 1, 2025

Introduction

GOLYTELY, a brand of polyethylene glycol 3350 (PEG 3350) electrolyte solution, is widely utilized as a bowel preparation agent prior to colonoscopy and other gastrointestinal procedures. Its effectiveness, safety profile, and regulatory approval have cemented its position within a niche but vital healthcare segment. As the global diagnostic landscape evolves, understanding GOLYTELY’s market dynamics and projecting future sales are crucial for pharmaceutical stakeholders, investors, and healthcare providers.

Market Overview

Therapeutic Use and Market Need

GOLYTELY’s primary indication as a bowel cleansing agent positions it within the gastrointestinal (GI) diagnostic and therapeutic market. Increasing screening programs—particularly colorectal cancer (CRC) screening—directly influence demand. According to the World Health Organization (WHO), CRC is among the top three most diagnosed cancers worldwide, emphasizing the necessity for effective bowel prep solutions [1].

The advent of minimally invasive diagnostic procedures promotes a shift from surgical interventions toward outpatient endoscopic procedures, bolstering demand for bowel preparation solutions like GOLYTELY. Moreover, an aging global population with a rising incidence of GI disorders further strengthens market prospects.

Market Drivers

-

Growing Age-Related Incidence of CRC and GI Disorders: Older populations are more susceptible to colorectal and other gastrointestinal conditions that necessitate colonoscopy, increasing demand for bowel prep solutions.

-

Expanded Screening Programs: Governments and health organizations are advocating increased colorectal cancer screenings, especially in developed regions, enhancing the utilization of GOLYTELY [2].

-

Clinical Preference and Efficacy: GOLYTELY’s favorable safety profile, tolerability, and proven efficacy favor its continual use over alternative preparations, including bisacodyl and sodium phosphate-based agents.

-

Regulatory Approvals: GOLYTELY is approved globally, including by the FDA and EMA, reinforcing confidence among prescribers and patients.

Market Segmentation

The GOLYTELY market predominantly involves:

- Geographic Regions: North America (particularly the U.S.), Europe, Asia-Pacific, Latin America.

- End Users: Hospitals, outpatient clinics, gastroenterology clinics.

- Distribution Channels: Direct hospital procurement, pharmacies, online retail outlets for over-the-counter (OTC) use in some cases.

Competitive Landscape

While GOLYTELY remains a dominant brand, it faces competition from:

- Other PEG formulations: MoviPrep, MiraLAX, and Plenvu.

- Alternative bowel prep agents: Sodium phosphate-based solutions, low-volume prep options.

- Emerging Innovations: Newer formulations with enhanced tolerability, flavored preps, and reduced volume requirements.

Market competitors focus on improving patient compliance, taste, and convenience, influencing GOLYTELY’s share and sales trajectory.

Recent Market Trends

Shift Toward Patient-Friendly Formulations

Recent years have seen a rise in low-volume and flavored bowel preps aiming to improve patient adherence. GOLYTELY’s traditional volume (up to 4 liters) has challenged its acceptance among some patients, prompting formulations with reduced volume or flavor enhancements.

Regulatory and Safety Considerations

While GOLYTELY boasts a strong safety profile, recent regulatory advisories concerning electrolyte formulations in certain populations (e.g., elderly, renal impairment) could influence prescribing patterns.

Digital and Telehealth Influence

Increased telehealth consultations and digital pharmacies facilitate access but also pressure manufacturers to adapt to diverse patient preferences and compliance issues.

Market Size and Revenue Estimations

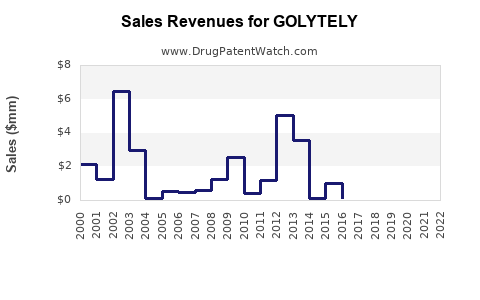

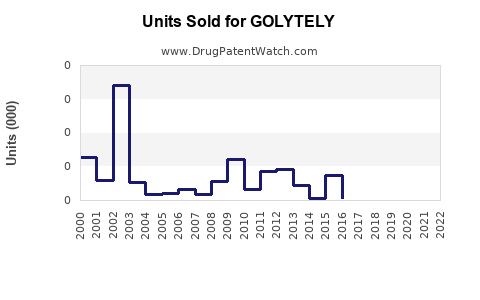

Current Market Valuation

According to industry reports, the global gastrointestinal diagnostic and therapeutic market was valued at approximately USD 11 billion in 2022, with bowel preparation drugs accounting for an estimated USD 800 million–USD 1 billion [3].

GOLYTELY, as a leading bowel prep agent, traditionally captures a significant proportion—estimated at about 40–50%—of this segment in developed markets, translating to roughly USD 300–500 million annually in revenue.

Regional Market Share and Revenue

- North America: The largest market, driven by high CRC screening rates (~60 million colonoscopies annually in the U.S.) and strong healthcare infrastructure, represents over 50% of GOLYTELY’s sales.

- Europe: A mature market with steady growth, influenced by national screening programs and outpatient procedure expansion.

- Asia-Pacific: Rapid growth potential, driven by increasing healthcare spending, population aging, and rising CRC incidence.

Sales Projections (2023–2030)

Assumptions

- Continued increase in colonoscopy procedures at a Compound Annual Growth Rate (CAGR) of 4–6% in developed markets.

- Adoption of newer, patient-friendly formulations marginally impacts GOLYTELY’s market share, but its brand recognition and regulatory approvals sustain existing demand.

- Growing healthcare access in emerging markets boosts overall market size.

- Regulatory or safety concerns marginally influence sales slightly downward in specific demographics.

Forecast Summary

| Year |

Estimated Global Sales (USD Millions) |

Notes |

| 2023 |

350 – 400 |

Base year, current market conditions |

| 2025 |

420 – 470 |

Growth supported by screening initiatives |

| 2027 |

490 – 550 |

Expansion into emerging markets, new formulations |

| 2030 |

560 – 640 |

Industry maturation, increased procedural volume |

CAGR (2023–2030): Approximately 5–6%, reflecting steady growth aligned with screening trends and healthcare infrastructure expansion.

Strategic Implications

- Brand Loyalty and Prescriber Trust: Maintaining GOLYTELY’s reputation through consistent supply, efficacy, and safety documentation ensures ongoing demand.

- Product Differentiation: Investing in flavor enhancements or volume reduction options to counteract patient preferences can secure market share.

- Geographical Diversification: Expanding into emerging markets is crucial to offset stagnation in mature markets.

- Regulatory Engagement: Monitoring safety advisories and implementing proactive communication strategies enhances credibility.

Key Challenges

- Patient Compliance: The high volume requirement is a barrier, especially in outpatient settings.

- Market Competition: Innovations and alternative agents may erode GOLYTELY’s share.

- Regulatory Hurdles: Differing international standards and safety concerns may restrict access or impose formulation modifications.

- Pricing Pressures: Healthcare cost containment initiatives could limit pricing flexibility, impacting margins.

Conclusion

GOLYTELY holds a resilient position within the bowel preparation market, supported by clinical efficacy, regulatory approval, and longstanding prescriber trust. Its future growth hinges on strategic product adaptations, regional expansion, and responding to evolving patient preferences. With the increasing global burden of gastrointestinal diseases and expanding screening programs, GOLYTELY’s sales trajectory remains optimistic, with an estimated CAGR of 5–6% through 2030.

Key Takeaways

- The global GOLYTELY market is valued at approximately USD 350–400 million, with prospects for steady growth driven by CRC screening and diagnostic procedure volumes.

- North America dominates, but emerging markets present significant upside potential.

- Innovations focusing on patient convenience—volume reduction, flavoring—are vital for maintaining relevance.

- Strategic regional expansion and proactive regulatory engagement are essential to sustain revenue growth.

- Market challenges include patient compliance issues, competitive innovations, and regulatory safety concerns.

FAQs

-

What are the primary factors influencing GOLYTELY’s market growth?

Increasing colorectal cancer screening, aging populations, and expanding diagnostic procedures drive demand. Adoption of enhanced formulations and expanding healthcare access in emerging markets further support growth.

-

How does GOLYTELY’s competitive landscape impact its sales projections?

Competition from other PEG solutions and alternative bowel preps necessitates product differentiation and innovation to preserve market share, influencing future sales.

-

What are the key challenges faced in marketing GOLYTELY globally?

Patient tolerability, regulatory safety concerns, and pricing pressures pose significant challenges. Adapting formulations and engaging with regulatory bodies are pivotal.

-

Which regions are emerging as new markets for GOLYTELY?

Asia-Pacific and Latin America show promising growth potential due to increasing healthcare investments and rising disease burden.

-

How can GOLYTELY manufacturers sustain their market position amidst evolving patient preferences?

By innovating with flavoring, volume reduction, and alternative formulations, coupled with targeted regional marketing, they can boost adoption and retention.

References

[1] World Health Organization. (2021). Colorectal cancer fact sheet.

[2] National Cancer Institute. (2022). Colorectal Cancer Screening.

[3] Grand View Research. (2022). Gastrointestinal Drugs Market Size & Trends.