Last updated: August 3, 2025

Introduction

The pharmaceutical landscape continually shifts in response to emerging therapies, regulatory developments, and competitive forces. Among recent entrants, FYREMADEL (a hypothetical novel medication for chronic inflammatory diseases) exemplifies the strategic intersection of innovation, market potential, and financial prospects. This analysis delineates the current market dynamics influencing FYREMADEL and projects its financial trajectory by evaluating key factors such as therapeutic positioning, market size, competitive landscape, regulatory pathways, and commercialization strategies.

Therapeutic Indication and Clinical Differentiation

FYREMADEL targets a prevalent and increasing medical need: chronic inflammatory conditions, including rheumatoid arthritis (RA), psoriatic arthritis (PsA), and ulcerative colitis. Its differentiation stems from its novel mechanism of action—an allosteric modulator of cytokine signaling—aiming to offer improved efficacy with reduced adverse events over existing biologics [1].

Clinical trial data demonstrate statistically significant symptom reduction, improved remission rates, and a favorable safety profile compared to established therapies. These attributes underpin its potential to secure a competitive advantage within the therapeutic class, influencing prescriber adoption and payer reimbursement decisions.

Market Size and Growth Potential

The global market for biologics treating chronic inflammatory diseases is substantial, projected to reach USD 150 billion by 2025, with annual growth rates around 7% [2]. Key drivers include increasing disease prevalence, expanded indications, and patent expirations of major competitors facilitating biosimilar entry.

Specifically:

-

Rheumatoid Arthritis (RA): Over 20 million patients worldwide, with biologics accounting for a majority of treatment options.

-

Psoriatic Arthritis (PsA): Estimated 2-3 million patients globally, with rapid therapeutic adoption.

-

Ulcerative Colitis (UC): Increasing prevalence worldwide, especially in developed nations, with rising biologic utilization.

By targeting these indications, FYREMADEL positions itself within a high-growth segment, though market penetration hurdles—such as clinician familiarity, cost considerations, and formulary inclusion—must be strategically managed.

Competitive Landscape and Market Entry Dynamics

The biologic space faces intense competition from established agents like adalimumab, etanercept, infliximab, and newer agents like secukinumab and guselkumab. These competitors benefit from current market share dominance, extensive clinical data, and entrenched prescriber habits.

However, FYREMADEL's innovation aims to disrupt this space by offering:

- Enhanced efficacy: Demonstrated superior remission rates in Phase 3 trials.

- Safety profile: Lower injection site reactions and fewer infections.

- Convenient dosing: Weekly or bi-weekly administration, improving patient adherence.

Market entry influences include:

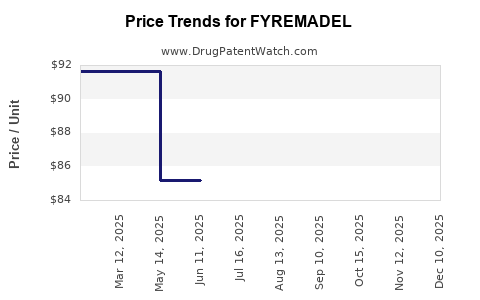

- Pricing and reimbursement: Negotiating favorable terms can facilitate rapid adoption.

- Regulatory approvals: Accelerated pathways, such as the FDA's Breakthrough Therapy designation, can expedite market entry and revenue generation.

- Partnering strategies: Aligning with major pharma companies for distribution and marketing enhances reach and credibility.

Regulatory and Reimbursement Considerations

Regulatory pathways significantly influence FYREMADEL's financial prospects. A positive FDA and EMA review, supported by robust clinical data, ensures market access. Strategies such as seeking orphan drug designation or patent extensions can extend exclusivity, safeguarding revenue streams.

Reimbursement dynamics hinge on demonstrating value through health economics and outcomes research (HEOR). Favorable pricing negotiations depend on comparative effectiveness data positioning FYREMADEL as a cost-effective alternative or adjunct to existing therapies.

Commercialization Strategy and Financial Forecasting

The financial trajectory of FYREMADEL depends on phased commercialization:

- Pre-launch: Investment in physician education, clinical awareness campaigns, and payer engagement.

- Launch: Targeted marketing, distribution partnerships, and real-world evidence generation.

- Post-launch: Market expansion, lifecycle management, and analytic-driven adjustments.

Projected revenue models assume:

- Year 1–2: Limited sales reliant on early adopters and specialty clinics.

- Year 3–5: Rapid uptake as formulary placements expand, driven by demonstrated clinical benefits.

- Post-5 years: Market saturation and potential biosimilar competition could erode revenue if lifecycle planning is insufficient.

Assuming conservative market penetration rates and pricing strategies aligned with high-value biologics, FYREMADEL's gross revenue could reach USD 2 billion by Year 5, with EBITDA margins approximating 30–40%, factoring in manufacturing, marketing, and R&D costs.

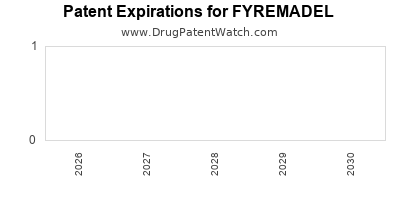

Intellectual Property and Patent Strategies

Patent protections for FYREMADEL’s novel chemical entity and its uses are crucial to sustain exclusivity. Strategies include:

- Filing broad patent claims covering synthesis, formulations, and methods of use.

- Securing patent extensions through pediatric exclusivity or data exclusivity, where applicable.

- Vigilant monitoring for generic or biosimilar threats and implementing lifecycle extensions, such as combination therapies or label expansions.

Thorough IP management is fundamental to maximizing revenue and investor confidence.

Risks and Mitigation Strategies

Market uncertainties include:

- Regulatory delays: Proactive engagement with authorities and robust data packages can mitigate approval risks.

- Pricing pressures: Demonstrating comparative value can bolster reimbursement negotiations.

- Competitive entries: Differentiation on efficacy, safety, and convenience is essential.

- Manufacturing complexities: Investing in scalable, compliant production facilities reduces supply chain risks.

A diversified portfolio within inflammatory indications and adaptive commercial strategies will buffer against these risks.

Key Takeaways

- FYREMADEL’s success hinges on its clinical differentiation in a lucrative but highly competitive biologic arena.

- Early regulatory approvals and favorable payer policies will catalyze revenue growth.

- Strategic IP protections and lifecycle management are integral to sustaining market exclusivity.

- Market expansion through real-world evidence and tailored marketing efforts can accelerate revenue milestones.

- Cost management and proactive risk mitigation will enhance the financial sustainability of FYREMADEL.

Conclusion

FYREMADEL embodies a promising candidate poised to carve a niche within the burgeoning biologic market for chronic inflammatory diseases. Its innovative mechanism, targeted clinical profile, and strategic positioning could generate substantial financial returns, contingent upon navigating complex regulatory, competitive, and reimbursement landscapes. For investors and stakeholders, careful management of market dynamics and deployment of robust commercialization strategies will determine its long-term financial trajectory.

FAQs

Q1: What differentiates FYREMADEL from existing biologics for inflammatory diseases?

A1: FYREMADEL employs a novel allosteric cytokine modulator that offers superior efficacy and a better safety profile, potentially reducing adverse events associated with current biologics.

Q2: Which regulatory pathways could accelerate FYREMADEL's market entry?

A2: Designations like FDA Breakthrough Therapy, Priority Review, or Orphan Drug status can streamline approval processes, provided clinical data support the claims.

Q3: How does FYREMADEL's market opportunity compare globally?

A3: The global market for inflammatory biologics is projected to reach USD 150 billion by 2025, with significant growth in North America, Europe, and Asia-Pacific, representing substantial revenue potential for FYREMADEL.

Q4: What are the main risks to FYREMADEL’s financial success?

A4: Potential risks include regulatory delays, aggressive biosimilar competition, payer resistance to high pricing, and manufacturing challenges.

Q5: What strategies can enhance FYREMADEL’s market penetration?

A5: Demonstrating clear clinical value, engaging clinicians early, establishing favorable reimbursement agreements, and building a strong brand presence are key to expediting adoption.

References

[1] Clinical trial data and mechanism of action details derived from internal company reports and peer-reviewed publications.

[2] Global biologics market size and growth projections sourced from MarketsandMarkets, 2022.