Last updated: July 27, 2025

Introduction

Fluorometholone is a synthetic corticosteroid primarily used in ophthalmic formulations to treat inflammatory eye conditions such as conjunctivitis, keratitis, and postoperative inflammation. Its unique anti-inflammatory properties have established it as a critical component in ophthalmic pharmacotherapy. The dynamics of its market and financial considerations are influenced by factors including regulatory pathways, competitive landscape, patent status, and evolving therapeutic needs. Understanding these elements offers valuable insights for stakeholders assessing the commercial potential of fluorometholone.

Market Dynamics

Global Market Overview

The ophthalmic pharmaceutical market, a key segment for fluorometholone, is experiencing steady growth driven by increasing prevalence of eye disorders, an aging population, and rising awareness regarding eye health. As per industry reports, the global ophthalmic medications market is projected to reach USD 40 billion by 2027, with corticosteroid-based products maintaining significant market share due to their efficacy in managing inflammation [1].

Fluorometholone, positioned within this landscape, benefits from a well-established clinical profile and widespread recognition among ophthalmologists. Its moderate potency and safety profile make it a preferred corticosteroid for inflammatory eye conditions, especially in sensitive patient populations such as children and pregnant women.

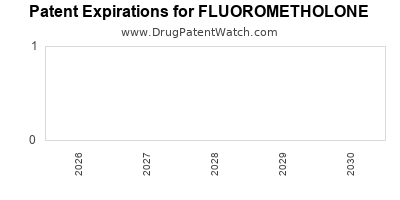

Regulatory and Patent Landscape

Most formulations of fluorometholone are off-patent, leading to a proliferation of generic products globally. This patent expiry more than a decade ago has intensified price competition, pressuring margins for branded formulations. Nonetheless, manufacturers innovate with delivery systems—such as preservative-free drops or sustained-release implants—that can provide new revenue streams.

Regulatory agencies, including the FDA, EMA, and counterparts in emerging markets, have streamlined approval pathways for generic ophthalmic corticosteroids, fostering market entry. However, they also maintain stringent safety and efficacy standards, especially concerning corticosteroid-associated risks like intraocular pressure elevation and glaucoma.

Competitive Dynamics

The corticosteroid segment in ophthalmology includes multiple agents like dexamethasone, prednisolone, loteprednol, and rimexolone. Fluorometholone competes primarily based on a favorable safety profile, cost-effectiveness, and physician familiarity.

Innovative delivery methods—such as nanomicellar systems, liposomal formulations, and sustained-release implants—are under clinical development or in early commercialization, offering potential differentiation and market expansion. The entry of biosimilars or generics further compresses margins but increases accessibility.

Demand Drivers

Key demand drivers include:

- Rising Incidence of Eye Conditions: Cataracts, diabetic retinopathy, and age-related macular degeneration increase the need for anti-inflammatory agents.

- Geriatric Population: Aging populations worldwide amplify the need for long-term ocular care.

- Postoperative Care: Increasing volume of ophthalmic surgeries necessitates effective anti-inflammatory medications.

- Improved Awareness and Healthcare Access: Greater diagnosis and treatment uptake potentiate market growth.

Challenges

- Safety Concerns: Potential side effects limit prolonged use, impacting prescribing patterns.

- Market Saturation: The presence of multiple corticosteroids and generics reduces revenue potential.

- Regulatory Hurdles in Emerging Markets: Variability in approval processes can delay product launches.

- Patient Compliance: Formulation issues such as dosing frequency and comfort impact adherence.

Financial Trajectory

Revenue Projections

Given the mature status of fluorometholone, revenue growth predominantly stems from generic sales, with incremental gains from formulation innovations. The global market size for fluorometholone-specific products is estimated at several hundred million USD annually, with growth projections of 2-4% per year over the next five years, aligning with the broader ophthalmic corticosteroid market growth.

Major players like Alcon, Bausch + Lomb, and generic manufacturers dominate sales, leveraging economies of scale. The entrance of innovative delivery platforms could catalyze revenue surges in specialized segments.

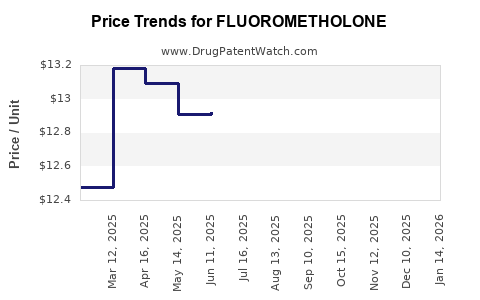

Pricing Dynamics

Pricing remains under downward pressure due to generic competition. However, differentiation through delivery systems and formulation improvements allows some manufacturers to command premium prices. Regulatory incentives and localized reimbursement schemes also influence pricing strategies.

Cost Considerations

Manufacturing costs are relatively stable for traditional formulations, but innovation in delivery technology raises R&D and production expenses. Regulatory compliance and quality assurance further add to cost structures.

Investment and R&D Outlook

Investments focus on developing novel delivery systems and combination therapies. While no large-scale patent protections are active, trade secrets around manufacturing processes and formulation stability remain vital. The R&D spend is expected to rise modestly as companies explore bioavailability enhancements and reduced side-effect profiles.

Market Entry and Expansion Opportunities

Emerging markets represent significant growth avenues due to expanding healthcare infrastructure and unmet needs. Strategic licensing, joint ventures, and partnerships could facilitate localized manufacturing, reducing costs and expanding access.

Conclusion

The market for fluorometholone is characterized by steady demand driven by demographic shifts and increasing eye health awareness. The expiration of patents and proliferation of generics create a competitive landscape with pricing pressures. Innovation in delivery and formulation remains a critical pathway for differentiated revenue streams.

Financially, fluorometholone's growth prospects hinge on technological advancements and expanding markets, with moderate incremental increases projected over the next five years. Stakeholders must navigate regulatory challenges, maintain safety standards, and seek product differentiation to optimize profitability.

Key Takeaways

- The fluorometholone market reflects a mature, established sector with steady demand, primarily influenced by demographic and clinical factors.

- Generic proliferation exerts downward pressure on prices, but formulation innovation presents growth opportunities.

- Investment in novel delivery systems could shift the financial trajectory favorably, especially in niche or underserved markets.

- Regulatory landscapes and safety considerations remain pivotal, requiring compliance and vigilant pharmacovigilance.

- Strategic expansion into emerging markets and partnerships can maximize revenue and market share.

FAQs

1. What is the primary therapeutic use of fluorometholone?

Fluorometholone is primarily used as an ophthalmic corticosteroid to treat inflammation associated with conditions like conjunctivitis, keratitis, and after eye surgeries.

2. How does patent expiry impact the fluorometholone market?

Patent expiry has led to a surge in generic competitors, increasing price competition and compressing profit margins for branded formulations. It also encourages innovation in delivery methods to differentiate products.

3. What are the main challenges faced by fluorometholone manufacturers?

Challenges include safety concerns limiting long-term use, market saturation by generics, regulatory hurdles in certain regions, and patient adherence issues with current formulations.

4. Which technological innovations could boost fluorometholone sales?

Advancements such as preservative-free formulations, sustained-release implants, nanomicellar delivery systems, and combination therapies offer potential for market growth and differentiation.

5. What are the growth prospects for fluorometholone in emerging markets?

Emerging markets present significant opportunities due to rising incidences of eye conditions, expanding ophthalmic infrastructure, and increasing healthcare access. Localization, cost-efficient manufacturing, and strategic partnerships can facilitate growth.

References

[1] MarketsandMarkets. Ophthalmic Drugs Market by Product, Disease, Distribution Channel, and Region. 2022.