Last updated: July 27, 2025

Introduction

Flunisolide, a potent inhaled corticosteroid introduced primarily for managing respiratory conditions such as asthma and allergic rhinitis, has maintained a significant presence within the pharmaceutical landscape. Its pharmacological efficacy, safety profile, and strategic market positioning influence its ongoing market dynamics and financial trajectory. This comprehensive analysis explores the current market environment, competitive landscape, regulatory considerations, and future growth prospects for flunisolide.

Pharmacological Profile and Therapeutic Indications

Developed in the 1970s, flunisolide operates as a corticosteroid that reduces airway inflammation, thereby alleviating symptoms of obstructive respiratory diseases. It is primarily marketed as an intranasal spray or inhaler, with indications including:

- Asthma management

- Allergic rhinitis

- Other inflammatory respiratory conditions

Despite its established profile, the drug faces competition from newer inhaled corticosteroids with superior bioavailability and reduced adverse effects, such as fluticasone and mometasone.

Market Dynamics

Global Market Overview

The global respiratory drug market is projected to reach approximately USD 36.4 billion by 2027, growing at a CAGR of 4.7% from 2020 to 2027 (Fortune Business Insights, 2022). Flunisolide, while a mature product, remains part of this expanding segment primarily in North America and parts of Europe due to its longstanding safety profile and familiarity among clinicians.

Key Drivers

-

Increasing Prevalence of Respiratory Diseases: The World Health Organization estimates over 339 million people suffer from asthma globally, with rising incidences in urbanized regions driven by pollution, allergens, and lifestyle factors (WHO, 2021).

-

Growing Awareness and Early Diagnosis: Enhanced screening and diagnosis protocols promote wider utilization of inhaled corticosteroids, including flunisolide, especially in resource-constrained markets.

-

Generic Entry and Cost-Effectiveness: The availability of generic formulations reduces costs and enhances accessibility, incentivizing continued use in cost-sensitive health systems.

Market Challenges

-

Competition from Newer Agents: Fluticasone propionate and mometasone have eclipsed older corticosteroids like flunisolide in efficacy and safety, diminishing its market share. For instance, fluticasone’s higher receptor affinity offers increased potency, making it the preferred choice among prescribers.

-

Limited Advancement and Innovation: As a generic or established product, flunisolide faces limited innovation incentives, constraining its growth potential.

-

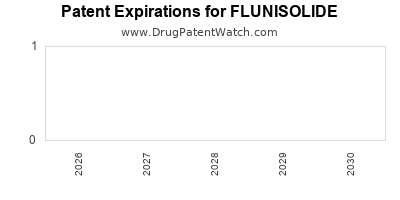

Regulatory and Patent Expirations: Expiry of patents and regulatory hurdles in different regions impact revenue streams, especially as biosimilars and generics flood markets.

Financial Trajectory and Revenue Outlook

Current Financial Position

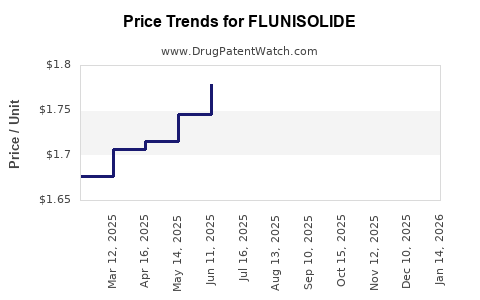

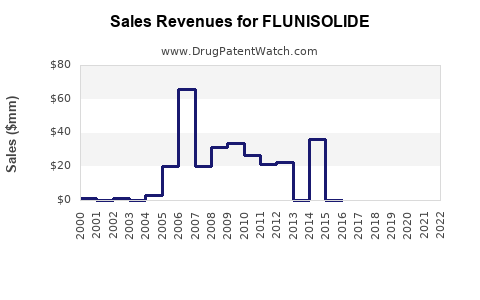

Flunisolide’s revenue streams mainly derive from inhaler and nasal spray formulations sold across developed markets. Given its patent expirations, revenue has plateaued or declined in regions where generic versions dominate. Nevertheless, it retains importance in certain low- to middle-income markets, sustained by affordability.

Revenue Trends and Projections

-

Stagnation in Mature Markets: In North America and Europe, where branded sales peaked decades ago, revenues are diminishing due to stiff generic competition.

-

Emerging Markets Growth Potential: Countries in Southeast Asia, Latin America, and Africa show increasing adoption of inhaled corticosteroids, including flunisolide, driven by expanding healthcare access and affordability.

-

Impact of Formulation Innovations: Limited new formulations or delivery methods for flunisolide inhibit revenue growth prospects.

-

Market Share Analysis: Current estimates suggest flunisolide's market share in inhaled corticosteroids has declined to below 10% in major markets, with an expected gradual decrease unless differentiated offerings emerge.

Future Financial Outlook

Industry analysts forecast a continued decline in flunisolide’s standalone revenues, barring strategic repositioning. However, in niche markets or as part of combination therapies, it could retain residual relevance. Potential revenue stabilization could occur via:

-

Formulation Improvements: Developing novel delivery mechanisms, such as targeted inhalers or nasal sprays with enhanced bioavailability.

-

Market Expansion: Penetrating into developing regions with limited access to newer agents.

Regulatory Environment

Regulatory considerations significantly influence flunisolide’s market development:

-

Regulatory Approvals: Globally, flunisolide’s approval relies on established safety and efficacy profiles, but regulatory agencies like the FDA may restrict additional indications or formulations without robust clinical data.

-

Patent and Exclusivity Status: Many formulations are off-patent, enabling generic competition which diminishes profitability for original manufacturers.

-

Biosimilars and Competition: The advent of biosimilars or alternative corticosteroids may trigger price erosion and market share decline.

Strategic Opportunities and Challenges

-

Combination Therapies: Incorporating flunisolide into fixed-dose combinations with bronchodilators could extend market relevance.

-

Niche Market Focus: Developing countries and specific patient populations with limited access to advanced therapies could sustain demand.

-

Innovation Limitations: without significant formulation or delivery innovations, growth remains constrained.

-

Partnerships and Licensing: Collaborations with regional pharmaceutical companies could facilitate market expansion.

Key Market Players

Major pharmaceutical companies involved in corticosteroid manufacturing include GlaxoSmithKline, Sanofi, AstraZeneca, and Mylan. Many of these firms have discontinued or reduced marketing efforts for flunisolide, redirecting focus toward newer derivatives.

Conclusion

While flunisolide remains a foundational corticosteroid in respiratory therapeutics, its market trajectory is characterized by decline in mature markets driven by patent expirations and better efficacy profiles of competitors. Its future hinges on strategic market repositioning, innovation, and extending reach into underserved regions. For investors and stakeholders, balancing the drug’s established safety profile against the competitive pressures of newer agents is crucial for sustained financial planning.

Key Takeaways

- Flunisolide’s market is consolidating, with revenues increasingly derived from emerging markets and niche applications.

- Competition from higher-potency corticosteroids limits growth potential; innovation in delivery and formulation is necessary for extension.

- Patent expirations and generic competition exert downward pressure on profitability, demanding strategic diversification.

- Opportunities exist in combination therapies and expanding access in developing regions.

- Continuous monitoring of regulatory trends and competitive landscape shifts is vital for informed decision-making.

FAQs

1. What are the main therapeutic advantages of flunisolide over other corticosteroids?

Flunisolide is known for its favorable safety profile and efficacy in managing respiratory inflammation. However, newer corticosteroids like fluticasone offer higher potency and longer duration of action, limiting flunisolide's competitive advantage.

2. How has patent expiration affected flunisolide’s market share?

Patent expirations have led to the proliferation of generic versions, significantly reducing revenue for original manufacturers and diminishing market share, especially in developed regions.

3. Can flunisolide be used in combination therapies?

Yes, attempts have been made to incorporate flunisolide into fixed-dose combinations with bronchodilators, which may help sustain its relevance in comprehensive asthma management.

4. What emerging markets hold potential for flunisolide?

Regions such as Southeast Asia, Latin America, and parts of Africa present opportunities due to increasing respiratory disease prevalence and limited access to newer, more expensive therapies.

5. What strategic measures could extend flunisolide’s market life?

Innovating delivery systems, expanding indications, forming regional partnerships, and targeting underserved markets can help prolong its market presence.

References

[1] Fortune Business Insights. (2022). Respiratory Therapeutics Market Size, Share & Industry Analysis.

[2] WHO. (2021). Global surveillance, prevention and control of chronic respiratory diseases.

[3] MarketWatch. (2022). Inhaled Corticosteroids Market Forecasts and Trends.