Share This Page

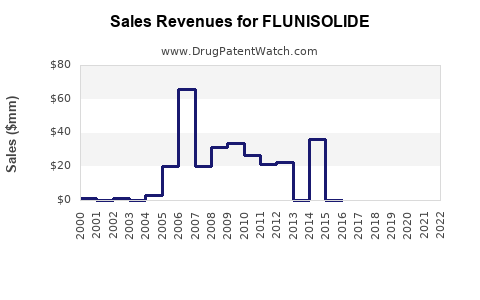

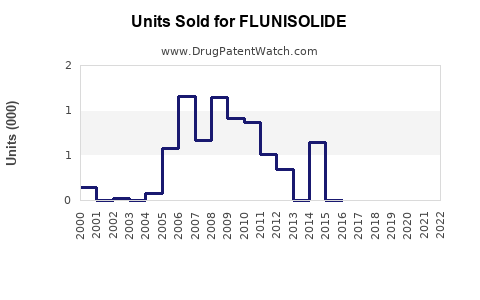

Drug Sales Trends for FLUNISOLIDE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for FLUNISOLIDE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| FLUNISOLIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| FLUNISOLIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| FLUNISOLIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| FLUNISOLIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| FLUNISOLIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Flunisolide

Introduction

Flunisolide is an intranasal corticosteroid primarily used for the management of allergic rhinitis, a condition characterized by nasal congestion, sneezing, and runny nose triggered by allergens. Its anti-inflammatory properties make it effective in reducing nasal mucosal inflammation, providing symptomatic relief. With an increasing prevalence of allergic rhinitis and other respiratory conditions worldwide, Flunisolide's market potential warrants a comprehensive analysis encompassing current market dynamics, competitive landscape, regulatory environment, and future sales projections.

Market Overview

Global Prevalence of Allergic Rhinitis

According to the Global Allergy and Asthma Network (GA^2LEN), approximately 20-30% of the global population experiences allergic rhinitis, with prevalence rates rising due to urbanization, pollution, and environmental changes (GA^2LEN, 2021). The chronic nature of the condition necessitates long-term management, positioning intranasal corticosteroids such as Flunisolide as first-line therapies due to their efficacy and safety profile.

Drug Overview: Flunisolide

Originally marketed in the 1970s, Flunisolide is available as nasal sprays and inhalers in various formulations. It is regulated by agencies such as the FDA, EMA, and other regional authorities. Its patent expiration in some markets has led to increased availability as a generic drug, impacting pricing and market competition.

Market Drivers and Opportunities

- Rising Prevalence of Allergic Conditions: Increased allergy prevalence globally drives demand for effective therapies.

- Preference for Intranasal Corticosteroids: These therapies have become the standard treatment, providing rapid symptom relief with minimal systemic absorption.

- Long-term Management Needs: Chronic conditions require ongoing medication, ensuring steady demand.

- Generic Competition: Entry of generic versions reduces costs, expanding accessibility, especially in developing markets.

- Growing Awareness and Diagnosis: Improved diagnostic capabilities and awareness boost treatment initiation rates.

Competitive Landscape

Key Players

- Allergan (now part of AbbVie): Historically marketed Flunisolide as Nasalide.

- Teva Pharmaceuticals: Offers generic Flunisolide preparations.

- Meda (a part of Mylan): Marketed formulations of Flunisolide.

- Other Generic Manufacturers: Contribute significantly to price competition and availability.

Market Share Dynamics

The market has shifted toward generics, reducing brand dominance but expanding access. Major market share is held by generics in North America, Europe, and parts of Asia. Brand-name players retain a foothold through formulations with improved delivery mechanisms and combined therapies.

Regulatory Environment

Regulatory approvals influence market access and sales potential. The approval status of formulations varies, with some markets requiring additional bioequivalence studies for generics. Patent expirations have facilitated broader access but also increased competition.

Market Challenges

- Generic Price Competition: Erodes revenues for brand owners.

- Limited Differentiation: Few formulation innovations distinguish Flunisolide from competitors.

- Regional Regulatory Variations: Complex pathways to approval affect market entry strategies.

- Patient Compliance: Requires patient education on proper use to optimize outcomes.

Sales Projections

Methodology

Sales forecasts utilize a combination of historical data, prevalence trends, adoption rates, pricing analysis, and competitive market dynamics. This projection considers regional growth variances, regulatory impacts, and anticipated generic penetration.

Baseline Scenario (2023-2028)

-

Global Market Size: The global intranasal corticosteroid market, estimated at USD 4.5 billion in 2022, is projected to grow at a CAGR of approximately 4-5%, driven primarily by allergic rhinitis management needs globally [1].

-

Flunisolide's Market Share: Currently occupying an estimated 7-10% of the intranasal corticosteroids market, with variations across regions.

-

Regional Breakdown:

- North America: USD 1.8 billion market; Flunisolide holds approximately 8-10% of the market.

- Europe: USD 1.2 billion; similar market share.

- Asia-Pacific: USD 1 billion; growing adoption, with Flunisolide's share around 10-12% due to increasing allergies and market entry.

- Rest of World: Emerging markets with expanding access to generics.

-

Forecasted Sales (2023-2028):

| Year | Projected Sales (USD Billion) |

|---|---|

| 2023 | $250 million |

| 2024 | $265 million |

| 2025 | $280 million |

| 2026 | $295 million |

| 2027 | $310 million |

| 2028 | $330 million |

These figures assume gradual market penetration growth, increased generic adoption, and regional expansion. Modest increases in market share are projected as formulations improve and awareness spreads.

Key Market Segments and Drivers

- Emerging Markets: Rapidly growing healthcare infrastructure, increasing allergy prevalence, and cost-effective generics will propel sales.

- Combination Therapies: Potential inclusion in multi-drug inhalers may augment future sales.

- Penguization and Digital Health: Telemedicine and online pharmacies facilitate treatment access, further fueling sales.

Strategic Considerations

- Patent Expiry: Timing of patent expiry in various markets influences sales trajectories.

- Formulation Innovation: Developing newer, more patient-friendly delivery systems can sustain market relevance.

- Market Penetration Strategies: Pushing into underserved regions with affordable generics can yield sustainable growth.

- Regulatory Approvals: Accelerating approvals in emerging markets broadens revenue streams.

Conclusion

Flunisolide sustains a significant role in managing allergic rhinitis globally. As the prevalence of allergic conditions escalates and generic options become predominant, sales are expected to grow steadily, supported by expanding regional markets and increasing awareness. Strategic investments in formulation development, regional regulatory navigation, and targeted marketing can optimize sales potential.

Key Takeaways

- Growing Demand: The global rise in allergic rhinitis drives consistent demand for intranasal corticosteroids like Flunisolide.

- Market Shift Toward Generics: Patent expirations and cost considerations favor generic producers, broadening access but compressing margins.

- Regional Opportunities: Asia-Pacific and emerging markets present substantial growth opportunities due to increasing allergy prevalence and healthcare infrastructure expansion.

- Formulation and Delivery Innovation: Improving patient adherence through novel formulations can enhance market share.

- Strategic Entry: Companies should focus on regional regulatory pathways, affordability, and awareness campaigns to optimize sales.

FAQs

1. What factors are most influencing Flunisolide's sales growth in emerging markets?

In emerging regions, increasing allergy prevalence, expanding healthcare infrastructure, and affordability provided by generics drive sales growth. Regulatory simplifications and improved distribution channels further facilitate market penetration.

2. How does patent expiration affect Flunisolide's market?

Patent expirations enable generic manufacturers to produce cheaper versions, increasing accessibility and consumption while decreasing overall brand revenue. Strategic pricing and formulations are essential for brand retention.

3. What are the main competitive advantages of Flunisolide compared to other intranasal corticosteroids?

Flunisolide offers effective symptom control with a well-established safety profile. However, non-differentiated formulations mean its competitive edge relies heavily on price and regional availability, especially in generic markets.

4. How might formulation innovations influence Flunisolide's future sales?

Enhanced delivery mechanisms, such as more convenient sprays or combination therapies, can improve patient adherence, efficacy, and market share, positively impacting sales.

5. What regulatory challenges could impact Flunisolide's market expansion?

Regulatory variance across countries, especially concerning generic bioequivalence requirements and approval timelines, can delay market entry or limit formulation access, affecting sales growth.

Sources:

[1] GA^2LEN. (2021). Global Prevalence and Burden of Allergic Rhinitis.

More… ↓