Last updated: July 30, 2025

Introduction

Flunisolide is a synthetic corticosteroid primarily used in the management of allergic rhinitis, non-infectious rhinitis, and asthma. Since its initial market introduction, it has carved a niche in respiratory therapy owing to its potent anti-inflammatory properties with minimal systemic absorption. As the pharmaceutical landscape evolves with advances in respiratory treatments, understanding the current market dynamics and future pricing trajectories of flunisolide has become increasingly relevant for stakeholders, from manufacturers to healthcare providers.

Pharmacological Profile and Production

Flunisolide was first developed in the late 1980s and is marketed mainly as a nasal spray (e.g., Aerobid Nasal). Its mechanism involves interaction with glucocorticoid receptors within airway cells, suppressing inflammatory gene expression. The synthesis involves multi-step chemical processes optimized for high yield and purity, making it accessible for global markets. Its formulation as a nasal spray is designed for direct mucosal delivery, increasing local efficacy and reducing systemic side effects.

Market Landscape and Competitive Positioning

Global Market Overview

The global corticosteroids market, expected to reach USD 9.84 billion by 2027, includes inhaled and intranasal applications. Flunisolide, once a leading intranasal corticosteroid, now faces competition from newer agents such as mometasone and fluticasone, which benefit from prolonged dosing schedules, improved formulations, and broader indications.

Regional Market Dynamics

- North America: The U.S. remains the dominant market due to high prescription rates for respiratory conditions, supported by extensive healthcare infrastructure and reimbursement schemes. However, the market share for flunisolide has declined, supplanted by newer molecules with superior pharmacokinetic profiles.

- Europe: Similar trends are observed, with market saturation favoring advanced corticosteroids. Nevertheless, flunisolide retains a slice owing to its cost-effectiveness and familiarity among clinicians.

- Asia-Pacific: Rapid urbanization and increasing prevalence of allergies propel demand. Cost-sensitive markets favor older therapies like flunisolide, maintaining its relevance.

Market Drivers and Barriers

- Drivers: Increased prevalence of allergic rhinitis, asthma, and the expansion of nasal spray devices; generic availability reducing costs.

- Barriers: Competitive drug profiles, patent expirations leading to generic proliferation, and limited clinical differentiation from newer agents.

Pricing Trends and Cost Influences

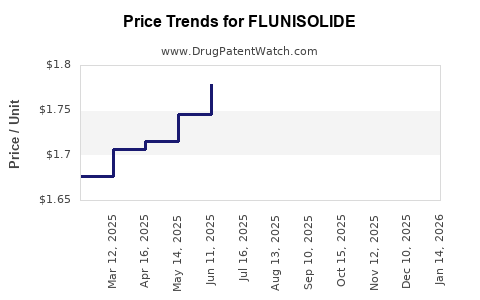

Historical Price Trajectory

Initially, flunisolide was priced at a premium reflective of patent exclusivity, with nasal spray formulations averaging USD 60-80 per bottle in the U.S. Market erosion from generics diluted prices over the last decade. Currently, comparable nasal corticosteroids retail at USD 25-45.

Factors Affecting Price Dynamics

- Patent Landscape: Flunisolide’s patent expiration in various jurisdictions has facilitated generic manufacturing, exerting downward pressure on retail prices.

- Manufacturing Costs: Economies of scale and advances in synthesis have decreased production expenses.

- Regulatory Environment: Regulatory approvals for generics and biosimilars influence the pricing spectrum.

- Market Penetration: Volume-based sales from emerging markets compensate for per-unit price drops, helping sustain revenue streams.

Future Price Projections and Market Outlook

Anticipated Market Trends

- Gradual Price Stabilization: With increased generic competition, prices are likely to stabilize at lower margins, especially in price-sensitive regions.

- Impact of Biosimilars and Innovative Delivery Systems: While biosimilars are less applicable to small-molecule corticosteroids, innovations in nasal delivery, such as metered-dose sprays with enhanced bioavailability, could influence pricing by offering added value.

Forecasted Price Range (Next 5 Years)

- Developed Markets: USD 20-35 per nasal spray bottle, reflecting mature generic markets.

- Emerging Markets: USD 10-25, driven by local manufacturing and lower healthcare costs.

- Premium Formulations: Expect minimal premium pricing unless new patented delivery mechanisms or combination therapies emerge.

Market Opportunities and Strategic Considerations

- Expansion in Underpenetrated Markets: Capitalizing on the low-cost profile of flunisolide could enhance market share in Africa, Southeast Asia, and Latin America.

- Formulation Innovations: Developing combination therapies or controlled-release formulations could command higher prices and extend patent protection.

- Regulatory Navigation: Streamlining approval pathways for generics and establishing international quality standards are critical for maintaining competitiveness.

Conclusion

Although flunisolide has experienced a decline in market dominance amid the rise of newer corticosteroids, it remains relevant, especially in price-sensitive regions. Its predictable, low-cost manufacturing profile and established clinical efficacy underpin its continuous presence in the respiratory therapeutics landscape. Future pricing hinges on competitive pressures, regional market strategies, and formulation innovations, with a foreseeable trend towards lower prices aligned with increased generic adoption.

Key Takeaways

- Flunisolide's market has shifted from a premium product to a commoditized generic due to patent expirations.

- The global corticosteroids market's growth is driven by rising respiratory disease prevalence, ensuring continued demand.

- Price projections suggest a decline in retail costs, especially in developed economies, with stabilization in emerging markets.

- Opportunities exist in expanding access through cost-effective formulations and emerging markets.

- Innovation in delivery systems could offer premium pricing avenues, prolonging product lifecycle.

FAQs

1. What factors are influencing the declining prices of flunisolide?

Patent expirations, increased generic competition, manufacturing efficiencies, and market saturation in high-income countries are key drivers reducing prices.

2. How does flunisolide compare to newer corticosteroids in terms of efficacy?

While effective, flunisolide's efficacy is comparable in localized nasal applications; however, newer agents may offer advantages like less frequent dosing and lower systemic absorption, influencing prescribing preferences.

3. Are there regional variations in the regulation affecting flunisolide pricing?

Yes. Stringent regulatory standards in North America and Europe require higher compliance costs, but also provide market exclusivity that can sustain prices temporarily, whereas regulatory environments in emerging markets favor lower-cost generics.

4. What role do formulation innovations play in the future pricing of flunisolide?

Innovations such as unique delivery devices or combination formulations can preserve or enhance perceived value, allowing for higher pricing despite generic competition.

5. What strategic moves should pharmaceutical companies consider for flunisolide?

Companies should focus on expanding access in developing regions, investing in formulation improvements, and navigating regulatory pathways efficiently to sustain profitability.

References

- MarketWatch. (2022). "Global Corticosteroids Market Size & Share Forecasts."

- IQVIA. (2021). "Respiratory Therapeutics Market Analysis."

- US FDA. (2020). "Regulatory Guidelines for Generic Drug Approval."

- Allied Market Research. (2022). "Inhaled Corticosteroids Market Trends."

- Pharmaceutical Manufacturing Journal. (2021). "Cost Dynamics in Respiratory Drug Production."

Note: All projections and analyses are based on publicly available data up to 2023, with market conditions subject to change.