Last updated: July 27, 2025

Introduction

FLAREX (fluorometholone ophthalmic suspension) is a corticosteroid formulation approved for the treatment of ocular inflammation and allergic conjunctivitis. Despite its niche application, FLAREX commands a unique position within ophthalmic therapeutics, driven by demographic trends, competitive landscape, regulatory pathways, and evolving healthcare priorities. This analysis explores the market dynamics underpinning FLAREX's commercial prospects and forecasts its financial trajectory within the broader ophthalmic steroid segment.

Market Overview and Therapeutic Context

The ophthalmic corticosteroid segment encompasses treatments to manage inflammation and allergic conditions pivotal in ophthalmology. FLAREX's primary indications include moderate to severe anterior segment inflammation, often associated with postoperative care or allergic conjunctivitis. The global prevalence of ocular allergies exceeds 15% among adults (per Asthma and Allergy Foundation of America), influencing demand for effective medications like FLAREX.

The ophthalmic drug market is characterized by steady growth, projected at an annual compound growth rate (CAGR) of approximately 4–6% through 2025, driven by increasing aging populations, rising prevalence of ocular conditions, and expanding healthcare access. Notably, corticosteroids like fluorometholone represent a smaller niche within this space, emphasizing safety profiles and topical delivery advantages.

Market Dynamics Influencing FLAREX

1. Demographic and Epidemiologic Drivers

The aging global population — projected to reach 1.5 billion people aged 65+ by 2050 (UN data) — substantially amplifies the demand for treatments managing age-related ocular conditions, including inflammation. Concurrently, the rise in allergic conjunctivitis cases due to urbanization and environmental factors sustains demand for corticosteroids.

2. Competitive Landscape

FLAREX faces competition from other corticosteroids such as rimexolone, loteprednol, and prednisolone acetate. Market penetration hinges on differentiators like safety profile, potency, dosing convenience, and formulation stability. Fluorometholone's reputation for a favorable safety profile, particularly with reduced intraocular pressure (IOP) elevation risk, positions FLAREX favorably among clinicians cautious of steroid-induced adverse effects.

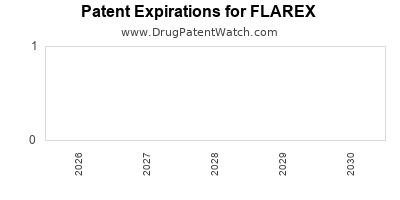

3. Regulatory Environment and Patent Status

While FLAREX benefits from longstanding approval, recent biosimilar entries or novel formulations could threaten its market exclusivity. Regulatory pathways favor incremental innovation—such as preservative-free formulations or combination therapies—that could alter the competitive landscape.

4. Prescriber and Patient Acceptance

Physician familiarity with FLAREX, supported by clinical trial data indicating a robust safety-efficacy profile, facilitates ongoing prescription growth. However, increased adoption of alternative steroids with quicker onset or lower cost may influence market share.

5. Healthcare Policy and Reimbursement

Reimbursement levels impact prescription patterns. Favorable coverage for ophthalmic inflamation therapies sustains demand, particularly in markets with stringent cost-containment policies, such as Medicare/Medicaid in the U.S.

Financial Trajectory and Revenue Outlook

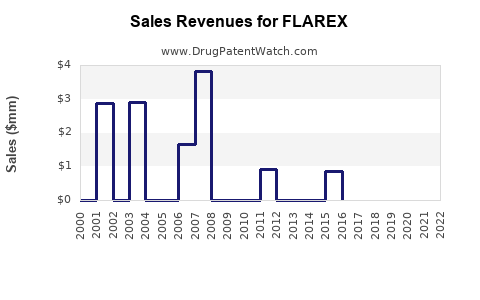

1. Market Share and Revenue Projections

Given its niche positioning, FLAREX’s revenue is projected to grow modestly, aligned with overall ophthalmic steroid market trends. Assuming a conservative CAGR of approximately 3–4% post-2023, revenues could moderately increase over the next five years, contingent on prescriber acceptance and competitive threats.

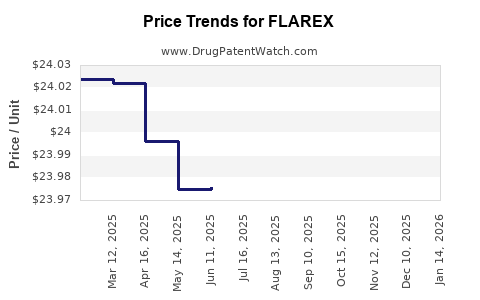

2. Pricing Strategy and Market Penetration

Premium pricing can be maintained given the drug's safety profile and clinical utility, especially in regions emphasizing preservative-free formulations. Market penetration in emerging markets hinges on price adjustments and reimbursement negotiations.

3. R&D and Lifecycle Extension

Further investments in formulation improvements—such as sustained-release delivery systems—could prolong FLAREX’s commercial relevance and open new revenue streams. Additionally, exploring approval for broader indications or combination therapies may enhance financial robustness.

4. Impact of Biosimilars and Generics

The expiration of exclusivity or patent challenges could substantially erode margins, prompting strategic shifts toward value-added formulations or specialty niche marketing. Competitive price erosion can reduce revenue substantially unless counterbalanced by increased volume.

SWOT Analysis of FLAREX Market Position

| Strengths |

Weaknesses |

| Established safety profile |

Limited indications restrict market size |

| Favorable safety profile for long-term use |

Competition from newer steroids with better efficacy |

| Preservative-free formulation preferred |

Potential patent or exclusivity expiry concerns |

| Opportunities |

Threats |

| Expanding elderly and allergic populations |

Market entry of biosimilars or generics |

| Innovation in formulation (e.g., sustained release) |

Competitive pricing pressures |

| Entry into emerging markets |

Regulatory shifts affecting coverage |

Future Market and Financial Trends

1. Growth Drivers

- Demographic shifts: Growing aging populations globally will sustain demand.

- Clinical advances: Developing formulations with improved safety or efficacy can increase utilization.

- Regulatory support: Favorable policy environments promoting topical steroids will favor FLAREX.

2. Challenges

- Market saturation: As newer agents enter, FLAREX may face adoption hurdles.

- Pricing pressures: Cost containment measures may limit revenue growth.

- Patent expirations: Potential biosimilar entries could diminish market share.

3. Strategic Outlook

To sustain financial growth, FLAREX manufacturers should consider refreshing formulations, expanding indications, and penetrating emerging markets. Emphasis on safety and tolerability will remain paramount in marketing strategies.

Key Takeaways

- FLAREX operates within a niche ophthalmic corticosteroid market driven by demographic aging and rising ocular allergies.

- It benefits from a strong safety profile, facilitating clinician preference, but faces competition from newer steroids and potential biosimilars.

- Moderate revenue growth is expected over the next five years, contingent on market expansion, formulation innovations, and competitive dynamics.

- Strategic investments in formulation enhancements and market penetration are pivotal to prolong its financial trajectory amid patent expiries and competitive pressures.

- Healthcare policy, reimbursement frameworks, and regional market differences significantly influence FLAREX's commercial performance.

FAQs

1. What factors primarily influence FLAREX's market share?

Clinical safety profile, physician familiarity, pricing strategies, competitive steroid efficacy, and regional reimbursement policies are key determinants.

2. How does FLAREX compare cost-wise to its competitors?

Due to its established formulation and safety profile, FLAREX commands a premium; however, price competitiveness depends on regional reimbursement and market dynamics.

3. What are the major risks impacting FLAREX’s revenue?

Patent expiration, biosimilar competition, formulary restrictions, and shifts toward alternative therapies threaten revenue stability.

4. Are there ongoing innovations that could extend FLAREX’s market relevance?

Yes, innovations like sustained-release formulations, preservative-free options, and broader clinical indications can enhance its market position.

5. How significant is the growth of emerging markets for FLAREX?

Growing healthcare infrastructure and increasing ophthalmic disease prevalence make emerging markets a vital avenue for expansion and revenue growth.

References

- Asthma and Allergy Foundation of America. (2022). Ocular allergy statistics.

- United Nations. (2022). World Population Prospects 2022.

- MarketWatch. (2023). Global Ophthalmic Drugs Market Report.

- Clinical trial databases and regulatory filings related to FLAREX and comparable ophthalmic steroids.