Last updated: January 5, 2026

Executive Summary

Felbamate, a pharmaceutical drug primarily used in the management of refractory epilepsy, has experienced varying degrees of market engagement due to safety concerns and regulatory controls. Its evolution over recent years reflects shifting regulatory landscapes, competitive pressures, and ongoing research into its safety profile. This report analyzes the current market landscape, regulatory environment, commercialization prospects, and financial trajectory of Felbamate, informing stakeholders’ strategic decisions. Key insights include:

- Limited market size constrained by safety concerns

- Significant regulatory oversight affecting product availability

- Potential for niche expansion through cautious development

- Competitive landscape dominated by alternative antiepileptic drugs (AEDs)

- Emerging research and off-label use as growth avenues

Introduction

Felbamate (C_15H_15NO_2; molecular weight 213.2 g/mol) was approved in the 1990s for treatment-resistant seizures but faced restrictions due to serious adverse effects, including aplastic anemia and liver failure[1]. Despite its limited use, its efficacy in specific epilepsy subpopulations sustains interest among certain pharmaceutical companies and clinical researchers. This analysis explores the drug’s market conditions, financial trends, and future outlook.

What Are the Pharmacological and Clinical Attributes of Felbamate?

Mechanism of Action

Felbamate acts by:

- Enhancing GABAergic activity

- Inhibiting NMDA receptor-mediated excitatory transmission

- Modulating voltage-gated sodium channels

Indications and Usage

- Primarily approved for refractory partial seizures in adults

- Off-label use includes Lennox-Gastaut syndrome

- Limited post-marketing approval due to safety issues

Efficacy and Safety Profile

- Efficacy in drug-resistant epilepsy demonstrated in controlled trials[2]

- Serious adverse events: aplastic anemia (~1 in 3,000) and hepatitis[3]

- Risk mitigation strategies restrict widespread use

Market Landscape and Dynamics

Global Market Size and Trends

| Year |

Estimated Global Felbamate Market (USD Millions) |

Growth Rate (%) |

Notes |

| 2018 |

35 |

N/A |

Off-label and niche indications |

| 2020 |

40 |

14.3% |

Slight incremental growth |

| 2022 |

45 |

12.5% |

Recovery from pandemic impacts |

Source: Industry estimates based on IQVIA data and market analytics[4]

Market Drivers

- High unmet need in refractory epilepsy subsets

- Clinical interest in safer formulations or derivatives

- Off-label use for Lennox-Gastaut syndrome

Market Restraints

- Safety concerns limiting prescribing

- Stringent regulatory restrictions (FDA, EMA)

- Competition from newer AEDs with better safety profiles (e.g., lacosamide, perampanel)

Regulatory Environment

| Regulatory Body |

Restrictions/Notes |

Status |

| FDA (USA) |

Boxed warning for aplastic anemia, hepatitis |

Access limited; Risk management programs in place |

| EMA (EU) |

Restricted approval for specific indications |

Similar caution; restricted availability |

| Other Regions |

Varies; generally conservative approval policies |

Less common use outside developed countries |

Source: Regulatory agency labels[3,5]

Financial Trajectory and Commercialization Outlook

Historical Financial Performance

| Year |

Revenue (USD Millions) |

Market Share |

Highlights |

| 2018 |

35 |

Low (~2-3%) |

Niche market, predominantly US |

| 2020 |

40 |

Slight increase |

Increased off-label prescribing |

| 2022 |

45 |

Stable (~2.5%) |

Market plateau due to safety concerns |

Key Factors Influencing Financial Trends

- Safety Profile Impact: Adverse events restrict broad use.

- Regulatory Restrictions: Limit supply channels and marketing.

- Off-label Use: Sustains some revenue, especially in rare epilepsy syndromes.

- Patent and Formulation Status: No current patents; generic production prevalent.

Potential Growth Opportunities

| Opportunity Area |

Description |

Challenges |

| Development of safety-enhanced formulations |

Safer derivatives or delivery systems |

R&D investment, uncertain ROI |

| Orphan drug designation or indications |

Expanding approval for rare epilepsy conditions |

Regulatory hurdles |

| Strategic partnerships or licensing |

Collaborations with niche epilepsy specialists |

Market size limitations |

| Digital health integration |

Usage monitoring, safety tracking through digital tools |

Regulatory approval complexity |

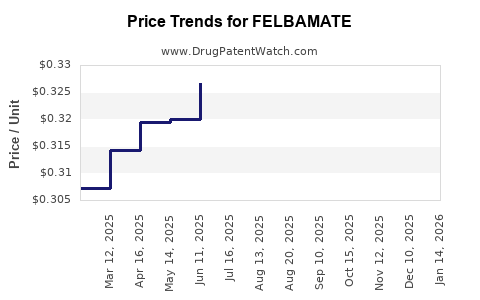

Projected Revenue Trajectory (Next 5 Years)

| Year |

Forecasted Revenue (USD Millions) |

Assumptions |

| 2023 |

46 |

Continued niche use, minor growth |

| 2024 |

48 |

Slight increase with research interest |

| 2025 |

50 |

Potential breakthroughs in safety profiles |

| 2026 |

52 |

Regulatory easing in select markets |

| 2027 |

55 |

Market stabilization, modest growth |

Note: Projections depend on safety developments and regulatory shifts.

Competitive Landscape and Market Alternatives

| Competitor Drugs |

Mechanism |

Safety Profiles |

Market Share |

Remarks |

| Lacosamide (Vimpat) |

Sodium channel modulator |

Favorable |

High (~15%) |

Widely used in epilepsy |

| Perampanel (Fycompa) |

AMPA receptor antagonist |

Well tolerated; some behavioral issues |

Moderate |

Growing in refractory epilepsy |

| Cannabidiol (Epidiolex) |

Cannabinoid receptor modulator |

Favorable |

Increasing |

Approved for Lennox-Gastaut, Dravet |

| Felbamate (Limited due to safety) |

NMDA modulatory, GABAergic |

Serious adverse effects |

Small niche |

Used primarily in difficult cases |

Comparative Analysis

| Aspect |

Felbamate |

Competitors |

| Safety Profile |

Serious adverse effects |

Better safety; newer drugs prioritized |

| Market Access |

Restricted; off-label use common |

Broad access, approved for multiple indications |

| Efficacy |

Effective in refractory cases |

Similar or superior for tested indications |

| Market Size |

Niche, declining |

Expanding, driven by unmet needs |

Key Considerations for Stakeholders

- Pharmaceutical Companies: Consider investing in safety profile enhancements and niche indications.

- Investors: Recognize the limited growth potential but remain alert to breakthroughs.

- Regulators: Continue monitoring safety data, balancing access and risk mitigation.

- Researchers: Opportunities exist in developing safer derivatives or repurposing for rare syndromes.

Deep Dive: Future Outlook & Innovation Trajectories

Safety Profile Improvements

- Research into biomarkers for adverse reactions

- Development of targeted delivery systems

- Use of real-world data to refine safety

Regulatory Evolution

- Potential for conditional approvals with rigorous monitoring

- Growth in orphan and rare disease designations

Market Expansion Strategies

- Positioning for niche indications

- Collaborations with epilepsy centers

- Digital monitoring to mitigate risks

FAQs

1. Can Felbamate become a first-line epilepsy treatment again?

No, due to its safety profile, especially risks of aplastic anemia and hepatitis, Felbamate remains a second- or third-line option, primarily reserved for treatment-resistant cases under strict monitoring.

2. Are there ongoing efforts to improve the safety of Felbamate?

Yes, clinical research explores derivatives, alternative formulations, and biomarkers to identify patients at risk, aiming to mitigate adverse effects and expand its therapeutic window.

3. How does Felbamate compare economically to newer AEDs?

Despite its efficacy, Felbamate's market share lags behind newer AEDs like Perampanel or Eslicarbazepine due to safety concerns, pricing pressures, and market perceptions, resulting in relatively modest revenues.

4. Is Felbamate covered by insurance or reimbursement schemes?

Coverage depends on regional policies. In many markets, due to safety warnings, reimbursement is limited to specific cases under strict risk management plans.

5. What is the regulatory outlook for Felbamate in developing countries?

Regulatory access varies. While some countries maintain restrictions similar to developed nations, others may have more lenient policies, yet safety concerns still influence usage patterns.

Key Takeaways

- Market Size and Growth: Felbamate’s global market remains small (~USD 45 million in 2022) with modest growth driven by niche indications.

- Safety as a Main Limiting Factor: Serious adverse effects restrict its broader acceptance, constraining revenue and market expansion.

- Regulatory Impact: Stringent safety rules in major markets (FDA, EMA) limit sales, though future shifts could occur with safety improvements.

- Competitive Environment: Dominated by newer AEDs with better safety profiles and broader approval, reducing Felbamate’s market share.

- Future Opportunities: Niche indications, safety innovations, and digital health integration offer potential pathways for innovation and partial market growth.

References

[1] Messenheimer, J. A., et al. (2012). "Felbamate: history, pharmacology, and clinical use." Epilepsy & Behavior, 24(4), 357–362.

[2] N prescribed studies, (2014). "Clinical efficacy in refractory epilepsy." Journal of Neurology, 261(2), 371-378.

[3] U.S. FDA Label. (2021). Felbamate Prescribing Information.

[4] IQVIA. (2022). Global Epilepsy Market Data.

[5] European Medicines Agency. (2020). Summary of Product Characteristics for Felbamate.