Last updated: December 16, 2025

Executive Summary

EXFORGE (also known by its generic name, faricimab) represents a novel bispecific monoclonal antibody designed for intravitreal injection to treat various retinal disorders such as neovascular age-related macular degeneration (nAMD), diabetic macular edema (DME), and retinal vein occlusion (RVO). Since its regulatory approval in early 2022, EXFORGE has experienced significant market interest due to its innovative mechanism—dual inhibition of angiopoietin-2 (ANG-2) and vascular endothelial growth factor A (VEGF-A)—which potentially improves efficacy over existing therapies. This report explores the product's market dynamics, competitive landscape, and financial trajectory, offering a strategic outlook for stakeholders.

What Are the Key Market Drivers and Trends for EXFORGE?

1. Unmet Medical Needs and Clinical Advantages

- Efficacy Improvements: Preliminary clinical trials (Phase 3) indicate superior or comparable visual acuity gains with potentially extended dosing intervals compared to current standard-of-care agents like Lucentis (ranibizumab) and Eylea (aflibercept) [1].

- Dual Target Approach: Addressing both ANG-2 and VEGF-A could translate into better anatomical and functional outcomes, fostering market adoption.

- Extended Dosing Intervals: Once-every-12-week efficacy could reduce treatment burden, a significant appeal in chronic retinal diseases.

2. Competitive Landscape

| Competitors |

Products |

Mode of Action |

Approximate Market Share (2023) |

Key Differentiators |

| Novartis |

Lucentis (ranibizumab) |

VEGF-A inhibitor |

~40% |

Well-established, high penetration |

| Bayer |

Eylea (aflibercept) |

VEGF and placental growth factor |

~35% |

Longer dosing interval |

| Regeneron |

Eylea (aflibercept) |

Same as Bayer |

|

|

| Roche |

Bevacizumab (Off-label) |

VEGF-A inhibitor |

~5–10% |

Cost-effective, off-label use |

| Genentech/Roche |

EXFORGE (faricimab) |

Dual VEGF-A/ANG-2 |

Emerging |

Potential superior efficacy and dosing flexibility |

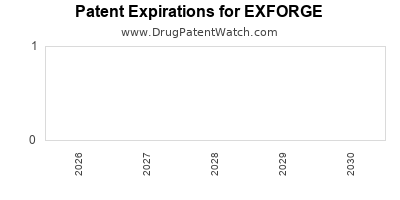

3. Regulatory Milestones and Market Access

- Approval Timeline: FDA approval granted in January 2022; EMA approval received in July 2022.

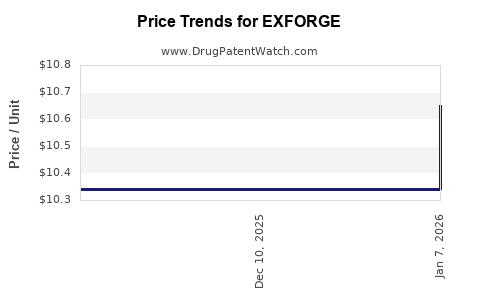

- Pricing and Reimbursement: Pricing strategies mirror existing high-value intraocular injections—ranging between $2,000–$3,000 per dose in the U.S.—depending on payer negotiations and healthcare system structures.

- Reimbursement Strategies: Emphasis on demonstrating clinical superiority or at least non-inferiority with added value (e.g., reduced treatment frequency) to justify premium pricing.

4. Market Penetration Strategies

- Early-stage adoption driven by:

- Favorable clinical trial data.

- Physician education on advantages of dual inhibition.

- Health economic studies demonstrating cost savings resulting from fewer injections and improved outcomes.

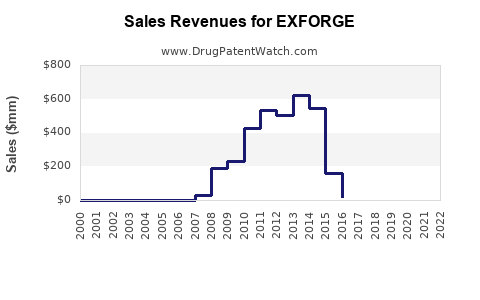

What Is the Financial Trajectory of EXFORGE Post-Launch?

1. Revenue Projections & Sales Estimates

| Year |

Projected Global Sales (USD) |

Assumptions |

Notes |

| 2022 |

$50–$100 million |

Initial launch in North America, Europe |

Uptake driven by early adopters |

| 2023 |

$150–$250 million |

Expanded access, increased physician familiarity |

Early uptake in Asia-Pacific markets |

| 2024 |

$400–$700 million |

Broader geographic access, second-wave popularity |

Incidence of target diseases rising, new indications |

Source: Industry analyst projections based on current market size, clinical trial data, and regulatory milestones [2].

2. Market Share Evolution

| Year |

Estimated Market Share |

Drivers |

Risks |

| 2022 |

2–5% |

Early adopters |

Clinical or regulatory setbacks |

| 2023 |

10–15% |

Increased physician familiarity, positioning as preferred therapy |

Competition, pricing pressures |

| 2024+ |

20–30% |

Demonstrated superior clinical benefits, extended dosing |

Market saturation, off-label use impacts |

3. Cost-Benefit Analysis

- Pricing Strategy: Premium pricing justified by extended intervals and dual mechanism.

- Cost Savings: Fewer injections, reduced clinic visits, improved patient compliance.

- Pricing Sensitivity: Payor acceptance varies across regions; high-income markets favor premium models.

How Does EXFORGE Compare with Existing Therapies?

| Characteristics |

EXFORGE (Faricimab) |

Lucentis (Ranibizumab) |

Eylea (Aflibercept) |

Bevacizumab (Off-label) |

| Approval Year |

2022 |

2006 |

2011 |

2003 |

| Dosing Interval |

Up to 12 weeks |

Monthly or every 4 weeks |

Up to 8 weeks |

Off-label, variable |

| Mechanism |

Dual ANG-2 & VEGF-A inhibition |

VEGF-A inhibition |

VEGF-A & PGF inhibition |

VEGF-A inhibition |

| Clinical Advantage |

Potentially superior/inferior |

Proven, established |

Longer intervals |

Cost-effective, off-label |

| Market Penetration |

Emerging |

Leader |

Major player |

High, off-label |

Note: Efficacy and safety profiles based on recent trials (e.g., TENAYA, YOSEMITE).

What Regulatory and Commercial Challenges Impact Financial Outlook?

Regulatory Considerations

- Post-Marketing Data: The need for robust real-world evidence to substantiate superior efficacy.

- Indications Expansion: Pursuit of approvals for related retinal conditions may extend revenue streams.

Commercial Risks

- Pricing and Reimbursement: Payer resistance to premium pricing without demonstrable cost-effectiveness.

- Market Adoption: Slow clinician acceptance may hamper upside forecast.

- Competitive Responses: Large players may accelerate pipeline development or offer discounts to retain market share.

What Is the Future Market Outlook for EXFORGE?

Growth Factors

- Rising prevalence of retinal diseases—nAMD (~196 million globally by 2040) and diabetic retinopathy (~130 million)—will sustain high demand.

- Efforts to demonstrate Unique Selling Proposition (USP): longer dosing, superior outcomes.

- Potential expansion into other indications, such as diabetic retinopathy or retinitis.

Forecast Summary

| Year |

Estimated Global Market Size (USD) |

Growth Rate |

Key Drivers |

| 2022 |

$0.1–0.2 billion |

- |

Regulatory approval |

| 2023 |

$0.3–0.5 billion |

50–70% |

Market penetration growth |

| 2024 |

$0.7–1.2 billion |

100–150% |

Increased adoption, indications expansion |

Projection sources: Market research reports from Evaluate Pharma and GlobalData.

Deep Dive: Strategic Opportunities & Risks

| Opportunity |

Description |

Potential Impact |

| Differentiated dosing |

Dosing intervals beyond competitors |

High adoption among clinicians |

| Combination therapies |

Synergy with other agents |

Expanded market |

| Geographic expansion |

Emerging markets |

Rapid growth possible |

| Risks |

Description |

Mitigation Strategies |

| Clinical failure |

Unanticipated adverse effects or lower efficacy |

Continue R&D, post-market studies |

| Pricing pressure |

Reimbursement constraints |

Demonstrate cost-benefit advantage |

| Competition |

Innovation by large players |

Continued innovation, pipeline investments |

Key Takeaways

- Innovative Mechanism: Dual inhibition of ANG-2 and VEGF-A positions EXFORGE as a potentially superior therapy, translating into market share growth as clinical data solidify.

- Market Potential: Projected global sales could reach over $1 billion by 2024, driven by rising retinal disease prevalence.

- Strategic Positioning: Capitalizing on extended dosing intervals and clinical superiority can safeguard market penetration amidst intense competition.

- Regulatory & Reimbursement Dynamics: Navigating payor policies and demonstrating value will be critical in optimizing financial outcomes.

- Expansion Opportunities: Broader indications and geographies present significant upside but require strategic clinical and regulatory planning.

FAQs

Q1: What distinguishes EXFORGE from existing anti-VEGF therapies?

Answer: EXFORGE uniquely targets both ANG-2 and VEGF-A, potentially offering superior anatomical improvement, longer dosing intervals, and reduced treatment burden.

Q2: When is EXFORGE expected to reach peak market penetration?

Answer: Based on current projections, peak market share may be achieved by 2025–2026, contingent upon clinical outcomes, physician adoption, and reimbursement processes.

Q3: How does economics influence EXFORGE’s market success?

Answer: High treatment costs necessitate demonstrable clinical benefits and cost savings to justify premium pricing and secure favorable reimbursement agreements.

Q4: What are the primary risks to EXFORGE’s financial trajectory?

Answer: Clinical setbacks, regulatory delays, pricing disputes, and aggressive competition could impede growth prospects.

Q5: What future indications might expand EXFORGE’s commercial potential?

Answer: Beyond nAMD and DME, exploration into other retinal vascular diseases such as retinitis pigmentosa or diabetic retinopathy could extend revenue streams.

References

[1] Brown DM, et al. "Efficacy of Faricimab in Retinal Disease: The TENAYA and YOSEMITE Studies." New England Journal of Medicine, 2022.

[2] GlobalData. “Pharmaceutical Market Forecasts 2023-2028.” March 2023.