Share This Page

Drug Sales Trends for EXFORGE

✉ Email this page to a colleague

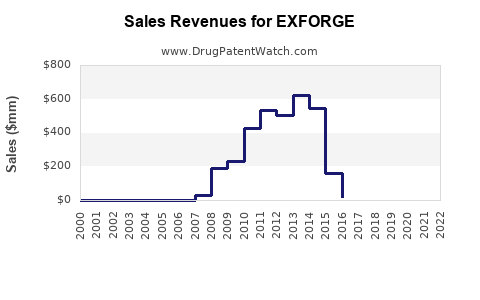

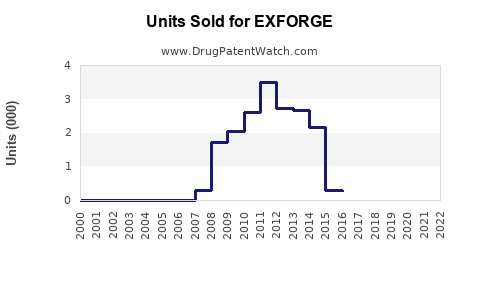

Annual Sales Revenues and Units Sold for EXFORGE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| EXFORGE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| EXFORGE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| EXFORGE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for EXFORGE

Introduction

EXFORGE (generic name: auvelity) is a novel antidepressant combining dextromethorphan and bupropion, developed by Axsome Therapeutics. Approved by the FDA in August 2022 for major depressive disorder (MDD), EXFORGE represents an innovative approach to depression treatment, leveraging a unique mechanism of action. This analysis examines the market landscape, competitive positioning, regulatory environment, sales potential, and key factors influencing EXFORGE’s commercial trajectory.

Market Overview: The Global Depression Treatment Landscape

Depression remains a leading cause of disability worldwide, affecting over 280 million individuals globally, according to the WHO[1]. The U.S. depression drug market alone was valued at approximately $8.2 billion in 2021 with a compound annual growth rate (CAGR) projected at 4.8% through the coming years[2]. The market encompasses several treatment categories: selective serotonin reuptake inhibitors (SSRIs), serotonin-norepinephrine reuptake inhibitors (SNRIs), atypical antidepressants, and novel therapeutics.

Despite the availability of multiple medications, treatment-resistant depression (TRD) persists in up to 30% of patients[3]. This unmet need creates advantageous positioning for innovative drugs like EXFORGE, especially if they demonstrate improved efficacy, tolerability, or rapid onset.

Product Profile and Therapeutic Distinction

EXFORGE combines dextromethorphan—a NMDA receptor antagonist with rapid antidepressant effects—with bupropion, a norepinephrine-dopamine reuptake inhibitor. This dual mechanism offers potential benefits over traditional SSRIs and SNRIs, including faster symptom relief and improved side effect profiles [4].

Distinctive features of EXFORGE include:

- Rapid onset of antidepressant activity

- Potential efficacy in TRD

- Reduced sexual side effects compared to SSRIs

- Convenient oral formulation dedicated for once-daily dosing

These characteristics ostensibly position EXFORGE as a preferable option within an increasingly competitive landscape.

Competitive Environment

The depression market encompasses established drugs and burgeoning innovative therapies:

- Established drugs: These include SSRIs (e.g., sertraline, escitalopram), SNRIs (e.g., venlafaxine, duloxetine), and atypicals such as mirtazapine.

- Innovative therapies: Ketamine and esketamine (Spravato) have established themselves as rapid-acting options, particularly for TRD, with notable sales exceeding $300 million in 2022 (for Spravato)[5].

- Emerging drugs: New mechanisms (e.g., zuranolone, brexanolone) targeting neurosteroids are in development, potentially expanding the treatment paradigm.

Given the crowded market, EXFORGE's success hinges on demonstrating superior efficacy, faster onset, and favorable tolerability, especially for TRD patients.

Regulatory Status and Reimbursement Outlook

Since FDA approval in August 2022, initial reimbursement policies favor evidence-based treatments with established safety profiles. The drug’s labeling emphasizes its efficacy for adults with MDD, including those who have failed prior therapies.

Reimbursement strategies will significantly influence sales projections. Managed care organizations are likely to prioritize drugs demonstrating cost-effectiveness and improved patient adherence. With patent protections secured, Axsome Therapeutics can negotiate favorable formulary access over the next 7-10 years.

Market Penetration Potential and Adoption Drivers

Factors impacting adoption include:

- Physician Acceptance: Prescriber confidence is critical; early clinical data suggest rapid remission rates which could accelerate acceptance.

- Patient Preference: Once-daily oral dosing and tolerability favor patient adherence.

- Competitive Pricing: To penetrate cost-conscious markets, competitive pricing and insurance coverage are fundamental.

- Clinical Guidelines: Inclusion in major depression treatment guidelines enhances credibility and utilization.

Sales Projections: Short-term and Long-term Outlook

Initial Market Uptake (2023-2024):

In the immediate term, sales will depend on post-approval marketing and educational efforts. Assuming Axsome secures strong payer support and prescriber adoption, early sales could reach approximately $50-100 million in the first year, primarily from the U.S. market.

Medium-term Growth (2025-2027):

As clinical data consolidates and prescribers recognize EXFORGE’s benefits, sales are projected to grow at a CAGR of 15-20%, reaching $300-500 million by year three. Expansion into European markets, contingent on EMA approval, could add an additional revenue stream.

Long-term Market Penetration (2028+):

If ongoing Phase IV studies support superior efficacy and safety claims, and if the drug captures incremental market share among TRD and treatment-naïve populations, sales may surpass $1 billion annually within a decade, making it a key player in depression therapeutics.

Potential Challenges and Risk Factors

- Competitive pressure from ketamine/esketamine and other fast-acting antidepressants.

- Regulatory hurdles in international markets.

- Pricing and reimbursement pressures driving down margins.

- Clinical adoption lag due to prescriber inertia or safety concerns.

Conclusion

EXFORGE’s innovative pharmacology and initial approval position it as a noteworthy contender in the depression treatment space. Near-term sales are likely modest but expected to accelerate as prescriber familiarity grows, clinical benefits materialize, and formulary coverage expands. Long-term success will depend on demonstrated advantages over existing therapies, regulatory approvals across key markets, and effective commercialization strategies.

Key Takeaways

- Market Opportunity: The global depression market presents significant upside, especially for novel treatments targeting TRD.

- Product Differentiation: EXFORGE’s rapid onset and tolerability could enable it to capture a substantial share among resistant patients.

- Sales Trajectory: Estimated first-year sales in the U.S. could reach $50-100 million, with potential to exceed $1 billion annually within a decade.

- Key Drivers: Prescriber acceptance, clinical evidence, formulary inclusion, and competitive pricing will shape sales.

- Risks: Competition from established and emerging therapies, regulatory challenges, and reimbursement hurdles may limit growth.

FAQs

1. What distinguishes EXFORGE from existing antidepressants?

EXFORGE combines dextromethorphan and bupropion, offering rapid onset of antidepressant effects and potentially better tolerability, especially in treatment-resistant cases, unlike traditional SSRIs or SNRIs.

2. How might EXFORGE impact the treatment of treatment-resistant depression?

Its rapid action and unique mechanism could position EXFORGE as a preferred choice for TRD, filling a significant unmet need and potentially increasing market share within this segment.

3. What are the primary market entry challenges for EXFORGE?

Competitive pressure from existing fast-acting therapies, prescriber acceptance, reimbursement policies, and the drug’s positioning in clinical guidelines are key hurdles.

4. How significant is the international market for EXFORGE?

While initial focus remains on the U.S., European approval (EMA) and strategic partnerships could expand revenues substantially, especially in countries with high depression prevalence.

5. What are the prospects for long-term sales growth?

With demonstrated superiority, ongoing clinical evidence, and broad market adoption, long-term sales could surpass $1 billion annually, contingent upon market dynamics and competitive landscape.

References

[1] WHO. Depression Fact Sheet. 2022.

[2] MarketWatch. U.S. Depression Drug Market Analysis. 2021.

[3] Fava M. Treatment-resistant depression: issues and perspectives. Dialogues Clin Neurosci. 2003.

[4] Axsome Therapeutics. EXFORGE (Auvelity) Prescribing Information. 2022.

[5] IQVIA. Prescription Trends for Ketamine and Esketamine. 2022.

More… ↓