Last updated: July 29, 2025

Introduction

EUTHYROX, a synthetic levothyroxine sodium formulation, is a cornerstone in managing hypothyroidism. With its longstanding history and widespread clinical adoption, understanding its market dynamics and financial trajectory offers vital insights for stakeholders—including pharmaceutical companies, healthcare providers, and investors. This report delves into the factors influencing EUTHYROX's market, growth prospects, competitive landscape, and economic indicators shaping its future.

Pharmaceutical Profile and Therapeutic Significance

EUTHYROX is a generic version of levothyroxine, a hormone replacement therapy critical for regulating thyroid function. It addresses hypothyroidism, a condition affecting an estimated 4.6% of the U.S. population, translating into significant global demand. Its efficacy, safety profile, and relatively low cost have established it as the treatment standard ([1]).

Market Dynamics

1. Demographic and Epidemiological Drivers

The prevalence of hypothyroidism predominantly among women and the elderly fuels sustained demand for levothyroxine therapies like EUTHYROX. Aging populations in North America and Europe further bolster long-term market stability. The increasing diagnosis rates driven by heightened awareness and advanced screening techniques amplify market volume ([2]).

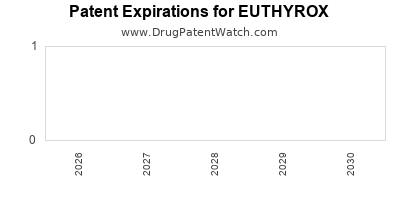

2. Competitive Landscape

EUTHYROX operates within a commoditized segment of thyroid hormone replacements, characterized by high generic penetration and intense price competition. Major pharmaceutical players include Teva Pharmaceuticals, Mylan, and international generic manufacturers. Patent expirations of brand-name drugs, such as Synthroid (AbbVie), have historically expanded generic utilization, fostering market growth ([3]).

3. Regulatory Environment

Stringent regulatory standards influence market access and product formulations. EUTHYROX's approval pathways typically involve bioequivalence benchmarks for generics, enabling expedited entry. Recent regulatory shifts towards quality control and manufacturing transparency aim to stabilize market offerings, reducing variability and enhancing consumer trust ([4]).

4. Manufacturing and Supply Chain Considerations

Supply chain integrity is paramount, given the widespread reliance on levothyroxine. Disruptions—such as those observed during the COVID-19 pandemic—can cause shortages, affecting market stability. Manufacturing quality, raw material sourcing, and distribution networks are critical factors that influence pricing and availability.

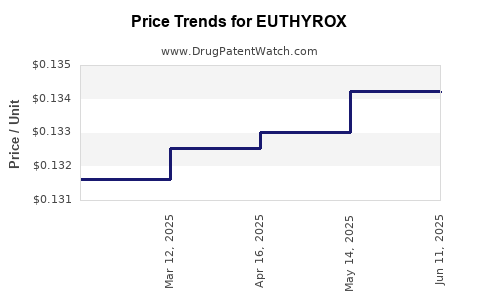

5. Pricing and Reimbursement Policies

Price sensitivity remains high in this segment, influenced by national healthcare schemes and payer negotiations. In regions with universal healthcare, strict formulary controls can pressure prices downward, while private insurers may offer broader reimbursement options. Cost-effectiveness analyses position EUTHYROX favorably due to its low price point ([5]).

6. Innovation and Formulation Advancements

Though generics dominate, there is emerging interest in novel formulations—such as liquid levothyroxine or sustained-release variants—to improve patient adherence and bioavailability. However, these innovations face high R&D costs and regulatory hurdles, limiting immediate impact on EUTHYROX's core market.

Financial Trajectory

1. Revenue Streams and Market Share

EUTHYROX commands robust revenue in the generic thyroid hormone segment, estimated to be worth approximately USD 2 billion globally in 2022 ([6]). Its market share remains high, driven by established efficacy and cost advantages. The U.S. remains the largest market, comprising roughly 60% of global sales, with steady growth projected through 2027 ([7]).

2. Growth Drivers

- Population Growth & Aging: Rising elderly populations lead to increased hypothyroidism diagnoses, translating into higher medication consumption.

- Increased Diagnosis Rates: Advancements in diagnostic techniques and screening programs expand the treated population.

- Generic Market Expansion: Patent expirations and healthcare policies favoring generics continue to stimulate sales.

- Global Market Penetration: Emerging markets in Asia and Latin America show increasing adoption, driven by rising healthcare expenditure and regulatory acceptance.

3. Competitive Risks and Market Saturation

The high degree of genericization triggers price erosion, compressing profit margins. Moreover, market saturation in mature regions could cap future growth, emphasizing the importance of expansion into emerging markets.

4. Investment and R&D Outlook

Pharmaceutical companies investing in bioequivalent formulations and delivery innovations aim to diversify revenue streams. However, given EUTHYROX's generic nature, high R&D expenditure is less prioritized compared to innovative therapeutics, maintaining a focus on manufacturing efficiency and supply chain resilience.

5. Impact of Regulatory and Policy Changes

Potential regulatory changes—such as stricter bioequivalence standards or drug usability guidelines—could influence manufacturing costs and market access. Additionally, pricing controls or reimbursement reductions could further impact profitability.

6. External Economic Factors

Currency fluctuations, inflation rates, and global supply chain dynamics influence procurement costs and pricing strategies. Geopolitical uncertainties, especially in regions reliant on imported raw materials, pose additional risks.

Future Outlook and Strategic Considerations

The trajectory for EUTHYROX remains positive but cautious, with steady growth within the existing market framework. Companies focusing on operational efficiency, quality assurance, and geographic expansion will likely capitalize on ongoing demand. Adoption of digital health tools and patient adherence programs could further bolster sales.

Emerging competitors offering alternative formulations (liquid, softgel) or biomarker-driven personalized therapy could disrupt traditional sales patterns. Also, ongoing research into thyroid replacement therapies may eventually challenge the dominance of levothyroxine, though such shifts are likely decades away.

Key Takeaways

- Sustained Market Presence: EUTHYROX benefits from a broad, stable demand base driven by epidemiology and diagnosis trends.

- Price Competition and Margin Compression: High generic penetration exerts downward pressure on prices, emphasizing efficiency and cost-control.

- Growth Opportunities in Emerging Markets: Increasing healthcare investment and diagnosis rates in developing regions project future expansion.

- Supply Chain and Regulatory Vigilance: Ensuring quality, consistency, and compliance remains essential amid evolving standards and potential shortages.

- Innovation Limitations: The commoditized nature of the product constrains significant R&D investments, underpinning a focus on manufacturing and distribution.

FAQs

1. How does EUTHYROX compare to other levothyroxine formulations in the market?

EUTHYROX offers bioequivalent, cost-effective therapy, similar in efficacy to other generic and branded formulas such as Synthroid. Its appeal largely stems from affordability and consistent quality, though some patients may respond differently to formulation excipients.

2. What regulatory challenges could impact EUTHYROX’s market growth?

Regulatory changes emphasizing stricter bioequivalence standards, quality control, and manufacturing transparency could increase compliance costs or lead to formulation alterations, affecting market dynamics.

3. How do global supply chain disruptions affect EUTHYROX sales?

Disruptions can lead to shortages, impacting patient care and reducing sales. Ensuring diversified sourcing and robust manufacturing processes is critical to maintain supply stability.

4. What are the primary drivers for growth in the EUTHYROX market?

Demographics (aging populations), increased diagnosis, and expansion into emerging markets are key drivers. Furthermore, healthcare policies favoring generics contribute significantly to growth stability.

5. What does the future hold for innovation in thyroid hormone replacement therapy?

While current focus remains on established formulations like EUTHYROX, future innovations could encompass novel delivery mechanisms or personalized therapies. However, these are unlikely to significantly impact the existing market in the near term.

Conclusion

EUTHYROX maintains a dominant position within the global hypothyroidism treatment landscape. Its market stability hinges on demographic trends, healthcare policies favoring generics, and supply chain resilience. While growth prospects look promising, companies must navigate pricing pressures and regulatory landscapes adeptly. Strategic focus on geographic expansion and operational excellence will be key to capitalizing on the enduring demand for levothyroxine therapy.

Sources

- National Institutes of Health, Office of Dietary Supplements. Hypothyroidism Fact Sheet.

- World Health Organization. Thyroid Disorders Epidemiology Reports.

- IMS Health / IQVIA Data. Global Thyroid Hormone Market Analysis.

- U.S. Food & Drug Administration (FDA). Bioequivalence Guidelines.

- Health Economics Journal. Cost-Effectiveness of Generic Levothyroxine.

- GlobalData Strategic Insights. 2022 Market Analysis.

- MarketWatch. Levothyroxine Market Outlook, 2022–2027.