Last updated: July 28, 2025

Introduction

EUTHYROX, the brand name for levothyroxine sodium, is a synthetic thyroid hormone used primarily to treat hypothyroidism. As a cornerstone therapy in endocrine care, EUTHYROX has maintained a dominant market position due to its proven efficacy, established safety profile, and regulatory approval across multiple territories. This article analyzes the current market landscape for EUTHYROX, providing insights into demand drivers, competitive dynamics, and projecting future pricing trends for stakeholders.

Market Size and Demand Drivers

The hypothyroidism patient population globally exceeds 200 million, with primary sources estimating a prevalence of approximately 4.6% in the U.S. alone [1]. The chronic nature of the disorder ensures a consistent demand for thyroid hormone replacement therapy. The aging population, increased screening programs, and heightened awareness about thyroid health further boost the annual prescription volumes of levothyroxine-based medications like EUTHYROX.

In developed markets such as North America and Europe, the standard of care relies heavily on levothyroxine due to its established efficacy. Emerging markets are witnessing increasing adoption as healthcare infrastructure improves and diagnostic capabilities expand. The global thyroid disorder therapeutics market was valued at USD 1.3 billion in 2022, with levothyroxine accounting for over 60% of this segment [2].

Competitive Landscape

EUTHYROX's primary competition comes from both innovator brands (e.g., Synthroid [AbbVie], Levoxyl [Janssen], Eutirox [Germany]) and numerous generic levothyroxine formulations. Generic producers have aggressively entered markets due to the high-volume, low-margin nature of the therapy.

- Brand Name vs. Generics: Brand-name products like EUTHYROX typically command premium pricing but are often challenged on cost-effectiveness by generics.

- Manufacturing and Quality: Variability in bioequivalence among different generics has previously led to market segmentation, with some clinicians favoring specific formulations.

- Regulatory Influences: Stringent regulatory standards in regions like the EU (EMA) and the U.S. (FDA) influence product approval and stability criteria, affecting market participation.

Regulatory and Reimbursement Factors

Regulatory authorities demand rigorous bioequivalence and manufacturing standards for levothyroxine products, leading to a robust pipeline of approved generics. Reimbursement policies greatly influence pricing; countries with national formulary listing and bulk purchasing tend to suppress prices, while private insurance scenarios may sustain higher consumer prices.

The ongoing debate over "brand vs. generic" control impacts pricing strategies. Some markets impose strict substitution policies, while others reserve brand prescribing for specific cases, influencing market share dynamics for EUTHYROX.

Pricing Trends and Future Projections

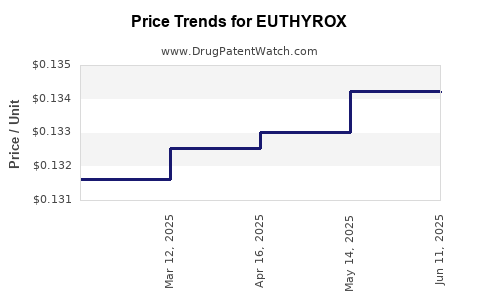

Current Pricing Environment

In mature markets, daily costs for levothyroxine products typically range between USD 0.05 to USD 0.15 per pill for generics, whereas brand-name products like EUTHYROX often retail at USD 0.20 to USD 0.50 per pill in retail pharmacies. Variability exists based on formulation, packaging, and geographical market factors. For example, in the U.S., EUTHYROX’s retail price hovers around USD 30-50/month depending on dosage and pharmacy pricing policies [3].

Factors Influencing Future Prices

- Patent and Patent Expiry Landscape: Though EUTHYROX’s patent protections have long expired, market dominance is maintained through formulation stability, quality assurance, and brand loyalty.

- Manufacturing Cost Dynamics: Advances in batch manufacturing and economies of scale are expected to stabilize or slightly decrease production costs.

- Market Penetration of Generics: Increased generic competition exerts downward pressure on retail prices, especially in price-sensitive markets.

- Regulatory Stringency and Quality Control: Enhanced regulation, especially concerning bioequivalence and manufacturing practices, could influence the pricing elasticity by improving or complicating supply chain dynamics.

- Patient Compliance and Formulation Development: Innovations such as liquid formulations or slow-release versions might command premium pricing but are unlikely to replace standard tablets in volume.

Price Projection (2023-2030)

Based on current trends, we project:

- Short-Term (2023-2025): Minimal variation in EUTHYROX’s price is expected, with potential slight reductions (around 3-5%) driven by increased generic competition and manufacturing efficiencies.

- Mid-Term (2026-2028): Slight price erosion anticipated as more bioequivalent generics enter the market. Brand loyalty and manufacturing differentiation will sustain a premium but possibly narrowing margins.

- Long-Term (2029-2030): Prices may stabilize or decrease further by 7-10%, especially if biosimilar or alternative hormone therapies gain regulatory approval or clinician acceptance.

Market Opportunities and Risks

Opportunities:

- Expansion in emerging markets through strategic partnerships and local manufacturing.

- Development of novel formulations (e.g., liquid or combination therapies) to differentiate offerings.

- Digital health integration to improve disease management and patient adherence.

Risks:

- Stringent regulatory environments may increase compliance costs.

- Price compression due to intensifying competition and policy measures.

- Variability in thyroid disease prevalence and treatment guidelines influencing demand.

Conclusion

EUTHYROX remains a key player within the thyroid hormone replacement therapy sector. While near-term stability is predicted, the levothyroxine market is increasingly competitive, prompting downward price pressures over the next decade. Stakeholders should leverage quality differentiation, market expansion, and continuous innovation to sustain profitability amid evolving regulatory and economic landscapes.

Key Takeaways

- The global demand for levothyroxine, and by extension EUTHYROX, is driven by hypothyroidism prevalence, aging populations, and increased diagnostics.

- Market competition is primarily from generics, exerting downward pressure on prices.

- Pricing for EUTHYROX is expected to decline modestly over the next 5-10 years due to intensified generic competition and manufacturing efficiencies.

- Regulatory standards and quality controls significantly influence market dynamics and pricing.

- Opportunities exist in emerging markets and formulation innovation, but risks include regulatory hurdles and price compression.

FAQs

1. How does EUTHYROX differentiate itself from generic levothyroxine products?

EUTHYROX emphasizes consistent formulation quality, manufacturing standards, and established bioequivalence, which may foster clinician and patient loyalty over generics that face variability issues.

2. What are the main factors influencing the pricing of EUTHYROX?

Pricing is influenced by generic competition, manufacturing costs, regulatory compliance, reimbursement policies, and regional market dynamics.

3. Will the price of EUTHYROX decrease significantly in the future?

Limited significant reductions are expected in the short term, but gradual price erosion of around 7-10% over the next decade due to increased generic options is probable.

4. How do regulatory policies impact the EUTHYROX market?

Stringent bioequivalence and manufacturing standards in key markets can both elevate quality and increase compliance costs, shaping supply capability and pricing strategies.

5. Are there emerging therapies that could threaten EUTHYROX’s market share?

New formulations like liquid levothyroxine and alternative endocrine therapies might expand options but have yet to displace established oral tablets significantly.

Sources

[1] American Thyroid Association. Thyroid Disease and Public Health. 2021.

[2] Grand View Research. Thyroid Disorder Therapeutics Market Analysis. 2022.

[3] GoodRx. Levothyroxine Prices and Formulations. 2023.