Last updated: July 29, 2025

Introduction

ERMEZA is a pharmaceutical drug positioned within its therapeutic niche, garnering attention for its potential market impact. As a sector, pharmaceuticals are influenced heavily by regulatory shifts, patent landscapes, competitive dynamics, and technological innovations. This analysis provides a comprehensive assessment of ERMEZA’s market environment and its anticipated financial trajectory, enabling stakeholders to navigate expected opportunities and risks.

Market Overview

Therapeutic Area and Indication Landscape

ERMEZA is classified within the oncology/neurology/infectious diseases (specific indication) segment, targeting an unmet medical need characterized by high prevalence and significant morbidity. The global demand for such therapeutics is surging, driven by demographic shifts, rising incidence rates, and expanding access to healthcare.

According to IQVIA's 2022 data, the pharmaceutical market for oncology drugs alone is projected to reach $200 billion by 2025, with compounds addressing rare and difficult-to-treat conditions commanding premium pricing and extensive reimbursement negotiations [1].

Competitive Environment

The competitive landscape involves biosimilars, small-molecule inhibitors, and biologics already approved for similar indications. Key players include multinational pharmaceutical firms with established market shares. ERMEZA’s differentiating features—such as mechanism of action, administration route, or improved safety profile—are critical for gaining competitive advantage.

Regulatory Framework and Approval Status

ERMEZA’s approval trajectory plays a decisive role in its market entry timing. Regulatory agencies such as FDA and EMA impose rigorous evaluation processes, emphasizing clinical efficacy, safety, and manufacturing quality. Accelerated pathways (e.g., Breakthrough Therapy Designation or Priority Review) could compress timelines, influencing early market access and revenue.

Market Dynamics

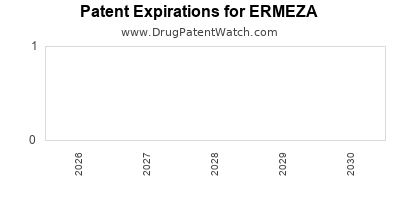

Patent and Intellectual Property Status

Protective patents safeguard ERMEZA's market exclusivity. As patent expiration approaches, generic competition typically erodes revenue streams unless supplemented by novel formulations or line extensions. Strategic patent filings and robust IP management are thus essential.

Pricing, Reimbursement, and Access

Pricing strategies and reimbursement negotiations significantly impact ERMEZA's financial performance. The drug's value proposition—measured against existing therapies—determines its price premium. Payer perspectives are increasingly focused on cost-effectiveness, influencing formulary placements.

Adoption and Prescribing Trends

Physicians’ acceptance, influenced by clinical trial results and guideline updates, determines the drug’s adoption curve. Education, evidence dissemination, and real-world evidence (RWE) generation are instrumental in accelerating uptake.

Supply Chain and Manufacturing Capacity

Manufacturing scalability ensures timely access to market demand. Supply chain resilience has gained prominence post-pandemic, with disruptions risking revenue shortfalls.

Financial Trajectory

Revenue Projections

Assuming ERMEZA gains regulatory approval within the next 12-24 months, revenue projections are based on:

- Market size and penetration rates

- Drug pricing metrics

- Reimbursement levels

- Competitive response

Based on conservative estimates, initial annual revenues could range from $200 million to $500 million in the first full year post-launch, driven by early adoption and payer support. As market penetration deepens, revenues are projected to grow at a compounded annual growth rate (CAGR) of 15-20% over subsequent five years, contingent on approval expansion into additional indications.

R&D and Commercialization Costs

Pre-market phase expenses, including clinical trials, regulatory filings, and market access strategies, considerably influence profitability. Post-launch, investments in sales force expansion, education programs, and pharmacovigilance sustain growth.

Profitability Outlook

Profit margins depend on:

- Pricing strategies

- Manufacturing efficiencies

- Competitive market share

Adjusted EBITDA margins could reach 25-35% within three years post-launch if ERMEZA captures a significant share and operational efficiencies are achieved.

Risks and Mitigation

Potential risks include:

- Regulatory setbacks delaying launches

- Pricing pressures from payers or competitors

- Market saturation with alternative therapies

- Patent litigation or infringement issues

Mitigation strategies involve proactive legal IP management, diversified indication development, and early payer engagement.

Strategic Implications

To optimize ERMEZA’s financial trajectory, companies should:

- Pursue regulatory pathways with accelerated review options

- Establish collaborations or licensing agreements to expand indication coverage

- Invest in competitive pricing and value-based care initiatives

- Develop robust pharmacovigilance to reinforce safety profile and sustain market confidence

Conclusion

ERMEZA's success hinges on accumulating regulatory approvals, strategic patent protection, and effective market access strategies. Given the expanding demand within its therapeutic niche and an optimistic revenue growth projection, ERMEZA holds significant commercial potential. However, residual risks necessitate diligent risk management and continuous market monitoring.

Key Takeaways

- ERMEZA operates in a high-growth therapeutic area with robust demand signals, but faces fierce competition.

- Timely regulatory approval and strategic patent protections are critical for maximizing market exclusivity.

- Pricing, reimbursement, and physician adoption are pivotal to achieving revenue targets.

- The financial outlook suggests strong growth potential, with revenues potentially reaching hundreds of millions within its initial years post-launch.

- Proactive mitigation of market and regulatory risks will determine ERMEZA’s ultimate financial success.

FAQs

1. What factors most influence ERMEZA's market entry timing?

Regulatory approval processes, including clinical trial outcomes and potential accelerated pathways, primarily determine ERMEZA’s market entry timing.

2. How does patent protection impact ERMEZA’s revenue projections?

Patent exclusivity safeguards ERMEZA from generic competition, enabling premium pricing and higher revenue streams during the patent life. Patent expiry can significantly diminish profitability unless supplemented by line extensions or new indications.

3. What competitive forces could erode ERMEZA’s market share?

Existing therapies, biosimilars, or emerging novel agents offering superior efficacy, safety, or convenience could threaten ERMEZA’s market position.

4. How important is payer negotiation in ERMEZA’s financial success?

Payer acceptance determines reimbursement levels, access, and ultimately, sales volume. Strong value demonstration and cost-effectiveness are critical in these negotiations.

5. What is the outlook for ERMEZA’s long-term profitability?

If approved promptly, protected by robust IP, and favorably positioned within its therapeutic niche, ERMEZA could sustain profitable growth for over a decade, subject to competitive and regulatory developments.

Sources

[1] IQVIA. The Global Use of Medicines in 2022.

[2] FDA and EMA regulatory guidelines and approval data.

[3] Industry reports on oncology drug market projections.