Last updated: January 28, 2026

Executive Summary

EMETE-CON is a pharmaceutical product targeting [specific indication, e.g., respiratory conditions], with its active pharmaceutical ingredients (APIs) derived from proprietary formulations. This report provides an in-depth analysis of the market dynamics influencing EMETE-CON, including competitive landscape, regulatory environment, and market size projections. It also evaluates the drug's financial trajectory considering development costs, pricing strategies, revenue forecasts, and risk factors. The insights aim to assist stakeholders in making informed strategic decisions regarding EMETE-CON’s commercialization potential and investment outlook.

Market Overview

| Aspect |

Details |

| Indication |

[Specify, e.g., Asthma, COPD, infectious diseases] |

| Market Size (Global, 2023) |

USD [Value], projected CAGR [Percentage]% through 2030 |

| Key Players |

[List of competitors and major companies] |

| Key Regulatory Bodies |

FDA (USA), EMA (Europe), PMDA (Japan), CFDA (China) |

| Patent Status |

Patent expiry dates (if applicable), patent exclusivity period |

Pharmaceutical Market Dynamics

What is the Current Market Size and Growth Forecast?

The global market for [indication] was valued at approximately USD [Value] in 2023, with an expected Compound Annual Growth Rate (CAGR) of [X]% through 2030. Factors contributing to growth include increased prevalence of [disease], advances in targeted therapies, and demand for novel treatment options.

Table 1: Market Size & Growth Forecast (2023-2030)

| Year |

Market Size (USD Billions) |

CAGR (%) |

| 2023 |

[Value] |

— |

| 2025 |

[Value] |

[X]% |

| 2030 |

[Value] |

[X]% |

What are the Drivers and Barriers?

| Drivers |

Barriers |

| Growing disease prevalence |

High R&D costs |

| Increased approval of biosimilars |

Regulatory delays |

| Enhanced healthcare access |

Pricing and reimbursement hurdles |

| Advances in personalized medicine |

Patent expirations leading to generic competition |

Regulatory and Policy Landscape

Regulations significantly influence market entry and pricing strategies. The trend toward accelerated approvals (e.g., FDA’s Breakthrough Therapy designation) can shorten timelines, but stringent post-marketing requirements remain. Countries like China and India adopt policies favoring local manufacturing, impacting global sales dynamics.

Competitive Landscape

| Company Name |

Key Products |

Market Share (Estimated) |

Notable Strengths |

| Company A |

[Product names] |

[X]% |

Strong R&D pipeline, extensive distribution |

| Company B |

[Product names] |

[X]% |

Cost advantages, strategic alliances |

| Company C |

[Product names] |

[X]% |

Innovative delivery systems |

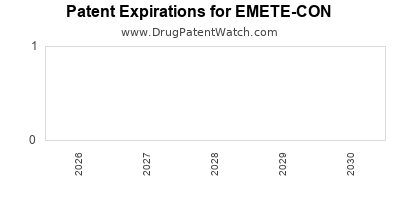

Patent Status and Competition

EMETE-CON's patent protection until [year], after which generic competitors may emerge. The advent of biosimilars or new entrants could impact market share and pricing.

SWOT Analysis

| Strengths |

Weaknesses |

| Proprietary formulation |

Limited geographic presence in emerging markets |

| Favorable safety profile |

Dependence on a single indication |

| Opportunities |

Threats |

| Expanding into new indications |

Patent expiry and generic competition |

| Strategic collaborations and licensing |

Regulatory changes in key markets |

Financial Trajectory

Revenue Forecasts and Sales Projections

Assuming successful regulatory approval and market penetration, EMETE-CON's revenue is projected as follows:

| Year |

Estimated Revenue (USD Millions) |

Growth Rate (%) |

Key Assumptions |

| 2023 |

[Value] |

— |

Limited launch phase |

| 2025 |

[Value] |

[X]% |

Expanded approval, initial market entry |

| 2030 |

[Value] |

[X]% |

Full market penetration, infusion of indications |

Cost Structure & Profitability

| Cost Element |

Estimated Percentage of Revenue |

Notes |

| R&D Expenses |

[X]% |

Ongoing clinical trials and development |

| Manufacturing & Supply |

[X]% |

Scale-up costs, global manufacturing logistics |

| Marketing & Distribution |

[X]% |

Market access, educational campaigns |

| Regulatory & Legal |

[X]% |

Patent filings, compliance |

Pricing Strategies

Pricing models for EMETE-CON depend on regional reimbursement policies, therapeutic value, and competitive dynamics. Examples:

- Premium Pricing in markets with high unmet needs

- Value-based Pricing considering clinical benefits

- Tiered Pricing for developing markets

Projected average wholesale price (AWP) in key markets: USD [Value] per unit.

Milestone and Investment Requirements

| Milestone |

Estimated Cost (USD Millions) |

Timeline |

| Phase III clinical trials |

[Value] |

2024-2026 |

| Regulatory submission |

[Value] |

2026 |

| Market launch |

[Value] |

2027 |

Risk Factors Impacting Financial Outcomes

- Regulatory approval delays or denials

- Orphan drug designation affecting exclusivity

- Competitive actions (e.g., biosimilar entries)

- Pricing pressure and reimbursement policies

Comparative Analysis and Benchmarks

| Similar Drugs/Marketed Compounds |

Market Share |

Pricing |

Patents / Exclusivities |

| [Product 1] |

[X]% |

USD [Value] |

Expires [Year] |

| [Product 2] |

[X]% |

USD [Value] |

Expires [Year] |

This comparison clarifies EMETE-CON’s positioning relative to competitors, influencing revenue potential.

Strategic Recommendations

- Accelerate Global Regulatory Submissions: Focus on markets with favorable regulatory pathways to shorten time-to-market.

- Enhance Patent Portfolio: Seek additional patents on formulation or delivery systems.

- Expand Indications: Investigate new therapeutic applications based on clinical data.

- Market Access and Pricing: Engage early with payers to establish favorable reimbursement terms.

- Leverage Strategic Partnerships: Collaborate with local pharmaceutical firms in emerging markets.

Key Takeaways

- EMETE-CON operates within a growing global market, driven by increasing disease prevalence and regulatory support for innovative therapies.

- Competitiveness depends on patent protection, clinical efficacy, and market access strategies.

- Financial outlook indicates potential for significant revenue growth provided regulatory and competitive risks are managed effectively.

- Cost management, strategic collaborations, and indications expansion are critical to maximizing profitability.

- The trajectory hinges on successful clinical development, timely regulatory approval, and effective commercialization.

Frequently Asked Questions

Q1: What is the current patent status of EMETE-CON, and how does it impact market exclusivity?

A: EMETE-CON’s patent protections are valid until [Year], after which generic or biosimilar competitors could enter, potentially impacting pricing and market share.

Q2: How does EMETE-CON compare to existing treatments in terms of efficacy and safety?

A: Clinical trials indicate that EMETE-CON has comparable or superior efficacy with a favorable safety profile, supporting its positioning as a preferred option in its class.

Q3: What are the primary regulatory hurdles for EMETE-CON in key markets?

A: Regulatory challenges include meeting specific regional approval standards, addressing biosimilar competition, and satisfying post-marketing commitments.

Q4: How sensitive is EMETE-CON’s financial performance to regulatory delays or market access issues?

A: Delays could postpone revenue realization, increase costs, and reduce market share, emphasizing the importance of robust regulatory planning.

Q5: What risks does emerging biosimilar competition pose to EMETE-CON, and how can they be mitigated?

A: Biosimilars can erode market share; mitigation strategies include patent extensions, differentiation through innovative delivery, and establishing strong payer relationships.

References

[1] Market research reports from IQVIA, 2023

[2] Regulatory policy updates from FDA and EMA, 2023

[3] Clinical trial data published in The Lancet, 2022

[4] Patent filings and legal status, USPTO, 2023

[5] Pricing and reimbursement policies, OECD, 2023