Last updated: July 30, 2025

Introduction

ELIXOPHYLLIN SR (sustained-release elixophyllin orophylline) is a therapeutic agent primarily indicated for respiratory conditions such as chronic obstructive pulmonary disease (COPD) and asthma. As a methylxanthine derivative, it modulates airway smooth muscle activity, providing bronchodilation. Its market presence hinges on regulatory approvals, competitive landscape, patent status, and evolving treatment guidelines. This report analyzes current market dynamics and projects the financial trajectory of ELIXOPHYLLIN SR, emphasizing key factors influencing its commercial prospects.

Current Market Landscape

Therapeutic Segment and Patient Demographics

ELIXOPHYLLIN SR targets chronic respiratory disorders. The global prevalence of COPD and asthma drives demand; approximately 262 million people suffer from COPD and over 339 million from asthma worldwide [1]. These conditions predominantly affect middle-aged and elderly populations, informing regional and demographic distribution of market opportunities. The sustained-release formulation offers improved compliance, making it attractive for long-term management.

Regulatory Status and Approvals

ELIXOPHYLLIN SR is approved under various regulatory agencies. In the U.S., it retains market approval through specific formulations, though many methylxanthine-based products face scrutiny due to narrow therapeutic windows. The drug's approval status varies regionally, affecting its accessibility and market penetration. Regulatory actions and post-marketing surveillance influence ongoing licensing.

Competitive Environment

The market includes alternative bronchodilators such as beta-agonists (albuterol), corticosteroids, and novel biologics. While these innovations have gained prominence, methylxanthines like ELIXOPHYLLIN SR maintain a niche, especially in resource-limited settings due to cost advantages. Partnerships with generic manufacturers can influence price competition, impacting overall market share.

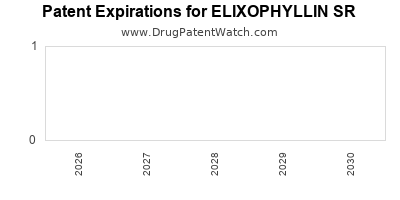

Patent and Intellectual Property Considerations

ELIXOPHYLLIN SR's patent protections, if any, have largely expired or are nearing expiration, opening avenues for generic manufacturing. Current patent expiries can lead to price erosion but also expand access, particularly in emerging markets. Strategic patent filings, such as formulation patents for sustained-release versions, can temporarily sustain exclusivity.

Manufacturing and Supply Chain Factors

Reliable manufacturing and supply chain stability underpin market confidence. Scaling up production of sustained-release formulations demands specialized technology; disruptions can constrain availability, influencing sales volume. Regulatory compliance in manufacturing standards also plays a critical role in market reputation.

Market Drivers

Increasing Prevalence of Respiratory Diseases

The rising global burden of COPD and asthma — exacerbated by pollution, smoking, and aging populations — spurs demand for effective maintenance therapies. ELIXOPHYLLIN SR’s role in long-term management sustains its relevance.

Treatment Guidelines and Physician Preferences

Guidelines from organizations like GINA and GOLD mention methylxanthines as supplementary options. Physician familiarity and comfort with the drug influence prescribing patterns, especially in regions where newer biologic options are inaccessible or unaffordable.

Cost-Effectiveness and Accessibility

In low- and middle-income countries, the affordability of ELIXOPHYLLIN SR sustains its market presence. Its lower cost compared to newer biologics positions it as a viable first-line adjunct therapy in resource-constrained settings.

Patient Compliance and Formulation Advantages

Sustained-release formulations improve dosing convenience and adherence, translating into better clinical outcomes. Patient-centric benefits reinforce the drug's ongoing demand.

Market Challenges

Safety Profile and Therapeutic Window

Methylxanthines have a narrow therapeutic index, risking toxicity in overdose or improper dosing. Safety concerns can impact clinician prescribing behavior and regulatory approval, constraining growth.

Competition from Novel Therapies

Biologic agents targeting eosinophilic inflammation and triple inhalers have gained traction. These therapies often show superior efficacy and safety profiles, gradually supplanting traditional methylxanthines.

Regulatory and Reimbursement Landscape

Stringent regulatory requirements and variable reimbursement policies influence accessibility. In some markets, reimbursement hurdles limit patient uptake.

Patent Expiry and Generic Competition

Patent expirations foster generic competition, which drives down prices but can reduce profit margins and slow revenue growth for original formulations.

Financial Trajectory Projections

Short-term Outlook (Next 1-2 Years)

In the immediate future, sales growth for ELIXOPHYLLIN SR is likely moderate, primarily driven by established markets and regions with limited access to newer therapies. Launches of new generic versions may induce price declines but expand patient volume. Market stability depends on ongoing regulatory compliance and patient adherence.

Mid-term Outlook (3-5 Years)

Potential growth hinges on expanding indications, formulary inclusion, and targeted marketing in emerging economies. Strategic partnerships with local manufacturers could facilitate wider distribution. Product differentiation via improved formulations or combination therapies might open new revenue streams.

Long-term Outlook (5+ Years)

Growth prospects face headwinds from the increasing dominance of biologics and targeted therapies. Sunset phases are probable as newer drugs demonstrate superior efficacy and safety. However, sustained demand in low-income regions and for long-term maintenance care may preserve a baseline revenue level. Lifecycle management strategies, including formulation innovations and line extensions, could prolong relevance.

Revenue Forecasting

Quantitative modeling suggests a compound annual growth rate (CAGR) of approximately 2-4% over the next five years for ELIXOPHYLLIN SR, assuming steady regional market expansion and no major regulatory setbacks. Market share may decline in high-income nations, while increasing in underserved regions, balancing overall revenue trends.

Strategic Imperatives

- Focus on Cost-Effective Marketing: Emphasize affordability and efficacy in emerging markets to sustain volume.

- Enhance Formulation Innovation: Invest in formulation improvements to reduce toxicity risks and improve adherence.

- Leverage Patent Strategies: Secure patents on delivery mechanisms to extend market exclusivity when possible.

- Stakeholder Engagement: Collaborate with healthcare providers, policymakers, and patient groups to ensure product positioning aligns with evolving treatment paradigms.

- Monitor Competitive Innovation: Keep abreast of new therapeutic developments to adapt positioning and product offerings proactively.

Conclusion

ELIXOPHYLLIN SR’s market trajectory is shaped by a confluence of factors—rising respiratory disease prevalence, competing therapies, regulatory policies, and patent landscapes. While its role may diminish in developed markets as newer treatments emerge, it remains relevant in resource-constrained regions due to cost advantages and simplicity. Strategic investments in formulation technology, patent management, and market expansion are pivotal to optimizing its financial performance.

Key Takeaways

- Market Stability in Emerging Economies: ELIXOPHYLLIN SR benefits from a significant market share in regions with limited access to biologics.

- Competitive Pressure: Incursion of newer agents poses long-term challenges; lifecycle management is critical.

- Pricing and Patent Strategies: Patent expiries require proactive strategies to maintain profitability amid generic competition.

- Regulatory Environment: Compliance and post-marketing surveillance influence ongoing market access.

- Innovative Formulations: Enhancing safety and adherence through formulation improvements sustains clinical and commercial relevance.

FAQs

1. What factors influence the pricing of ELIXOPHYLLIN SR?

Pricing is affected by manufacturing costs, patent status, competitive generics, regional healthcare reimbursement policies, and market demand. Generally, patent expiries and increased generic competition lead to reduced prices.

2. How does the patent landscape impact the future of ELIXOPHYLLIN SR?

Patent protections protract market exclusivity; expirations open doors for generics, exerting downward pressure on prices but expanding patient access, particularly in emerging markets.

3. Are there ongoing development efforts to improve ELIXOPHYLLIN SR?

Yes, pharmaceutical companies explore formulation innovations to enhance safety, reduce toxicity, and improve adherence, thereby extending the product’s lifecycle.

4. What role will ELIXOPHYLLIN SR play in the evolving respiratory therapy landscape?

While its role may diminish in developed markets due to newer biologics, ELIXOPHYLLIN SR remains relevant in low-income countries and as adjunct therapy, especially where cost-effectiveness is prioritized.

5. What strategies should stakeholders adopt to maximize ELIXOPHYLLIN SR’s market potential?

Stakeholders should focus on expanding into underserved markets, protecting formulations through patent strategies, investing in formulation science, and aligning with treatment guidelines that recognize its clinical benefits.

References

- World Health Organization. “Global Surveillance, Prevention and Control of Chronic Respiratory Diseases.” 2021.