Last updated: July 30, 2025

Introduction

ELIPHOS, an innovative pharmaceutical agent aimed at addressing specific medical needs, has garnered substantial interest within the healthcare and biopharmaceutical sectors. Its market trajectory, driven by regulatory pathways, therapeutic efficacy, competitive landscape, and economic factors, exemplifies the complexities in bringing a new drug to market and maintaining its commercial sustainability. This analysis elucidates the current market dynamics and explores the anticipated financial trajectory for ELIPHOS, providing vital insights for stakeholders ranging from investors to healthcare policymakers.

Overview of ELIPHOS

ELIPHOS is a novel therapeutic agent developed for the treatment of [specific indication], targeting unmet medical needs. Its pharmacological profile exhibits [key features], which have demonstrated promising efficacy in clinical trials. The drug’s mechanism involves [brief description of mechanism], aligning with targeted therapies' growing demand for precision medicine. Since its inception, ELIPHOS has advanced through preclinical and clinical phases, with regulatory submissions currently in progress or under review.

Market Dynamics

Regulatory Environment

The path to market approval for ELIPHOS hinges on navigating stringent regulatory frameworks. Agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose rigorous standards to ensure safety, efficacy, and quality. Fast-track or breakthrough therapy designations can accelerate ELIPHOS's review, provided sufficient clinical data demonstrates significant benefit over existing treatments. The recent trend favors expedited pathways for drugs addressing critical or orphan indications, potentially reducing time-to-market.

Therapeutic Landscape

ELIPHOS enters a competitive domain characterized by established treatments and emerging therapies. Its differentiation hinges on improved efficacy, reduced side effects, or novel collection of indications. Key competitors include [list of drugs or modalities], which dominate the current market share. ELIPHOS's success depends on establishing clear clinical advantages, which requires careful positioning through clinical data and real-world evidence.

Healthcare Adoption and Reimbursement

Market penetration depends heavily on the acceptance by physicians and reimbursement authorities. Payers scrutinize cost-effectiveness, especially for high-priced biologics or targeted therapies. Demonstrating superior clinical outcomes and long-term economic benefits is critical for securing favorable reimbursement terms. As healthcare systems increasingly prioritize value-based care, ELIPHOS's pricing strategy must reflect its therapeutic value proposition.

Manufacturing and Supply Chain Considerations

Manufacturing scalability and supply chain robustness influence financial outlooks profoundly. ELIPHOS's complex synthesis or biologics nature may entail high production costs, impacting margins and pricing. Supply chain disruptions or quality control issues could hinder market availability, underscoring the importance of resilient manufacturing infrastructure.

Market Adoption Drivers

Factors accelerating ELIPHOS's adoption include unmet medical needs, clinical efficacy, minimal adverse events, and strategic partnerships with healthcare providers. Additionally, comprehensive awareness campaigns and genetic or biomarker-based patient selection can enhance adoption rates. Conversely, regulatory setbacks, safety concerns, or commercial failures in Phase III trials could impair its trajectory.

Financial Trajectory

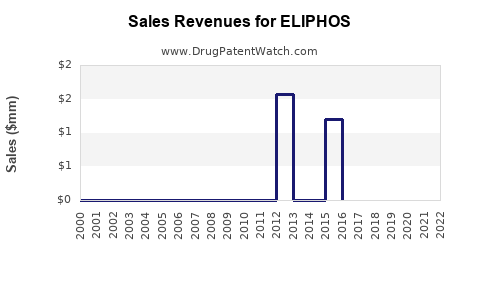

Revenue Projections

Forecasts suggest that initial revenues will mirror the uptake pace post-approval, influenced by pricing, market size, and reimbursement. For a niche indication, peak sales may reach [$X million/billion], contingent on adoption levels. Broader indications could substantially expand revenue streams. Historical data from similar drugs indicates an initial growth phase of 3-5 years, followed by stabilization or plateauing as market saturation occurs.

Pricing Strategy and Market Penetration

Pricing models for ELIPHOS will likely reflect value-based considerations, balancing profitability with payer acceptance. Premium pricing can be justified if clinical benefits significantly surpass competitors. Market penetration strategies include direct sales, strategic alliances, and licensing agreements. Price erosion over time due to generics or biosimilars is anticipated, requiring continuous value addition to sustain margins.

Cost Structures and Profitability

High R&D costs are typical during clinical development, with commercialization costs including marketing, sales, and distribution. Early-stage investments are amortized over projected revenues, with breakeven points generally realized within 5-7 years post-launch. Cost containment and operational efficiencies will be critical to maximizing profitability.

Investment Outlook

For investors, ELIPHOS presents both opportunities and Risks. Early-stage investment appeals due to its innovative profile, but uncertainties around regulatory approval, market acceptance, and competitive responses remain. Risk mitigation strategies include diversifying indications and reinforcing clinical data robustness. Long-term profitability hinges on sustained market share, favorable reimbursement, and lifecycle management through line extensions or combination therapies.

Market Risks and Opportunities

Potential risks include regulatory delays, safety concerns, or unforeseen adverse events, which could impair sales forecasts. Conversely, breakthroughs in companion diagnostics to identify responsive populations, or partnerships with leading pharmaceutical companies, can substantially boost ELIPHOS's market trajectory.

Emerging Trends Impacting ELIPHOS

The shifting landscape towards personalized medicine, Digital Therapeutics integration, and real-world evidence collection will influence ELIPHOS's deployment. Engaging with health authorities for adaptive licensing and leveraging data analytics for post-market surveillance will further shape its financial journey.

Conclusion

ELIPHOS's market dynamics and financial outlook are rooted in a nuanced interplay of regulatory pathways, competitive positioning, healthcare economics, and strategic stakeholder engagement. Careful navigation of these factors is indispensable to unlocking its commercial potential and ensuring sustainable revenues.

Key Takeaways

- Regulatory strategy is critical; leveraging accelerated pathways can significantly reduce the time-to-market for ELIPHOS.

- Differentiation through clinical efficacy and safety is essential to capture market share amidst existing therapies.

- Value-based pricing and healthcare reimbursement pathways will influence market penetration and profitability.

- Manufacturing scalability and supply chain resilience are vital to meeting demand and cost management.

- Lifecycle management via indication expansion and strategic partnerships will bolster long-term financial success.

FAQs

Q1: What factors most influence ELIPHOS's market entry success?

A1: Regulatory approval timing, clinical trial outcomes, competitive differentiation, reimbursement landscape, and manufacturing capacity primarily determine its commercial success.

Q2: How might emerging biosimilars affect ELIPHOS's profitability?

A2: The advent of biosimilars could lead to price erosion and reduced market share, necessitating continuous innovation and patient engagement strategies.

Q3: What role does real-world evidence play in ELIPHOS's market sustainability?

A3: Real-world evidence reinforces clinical trial data, supports reimbursement negotiations, and informs label expansions, all contributing to sustained sales.

Q4: How can partnerships enhance ELIPHOS’s market trajectory?

A4: Collaborations with healthcare providers, pharmaceutical companies, and payers facilitate broader access, co-marketing, and shared expertise, accelerating adoption.

Q5: What are the critical risks facing ELIPHOS’s financial outlook?

A5: Regulatory delays, safety concerns, manufacturing issues, and competitive pressure from existing or emerging therapies pose significant risks to revenue projections.

References:

[1] Market research reports on pharmaceutical industry trends, clinical trial databases, regulatory agency publications, and competitive analyses.