Last updated: December 16, 2025

Summary

EFFIENT (ticagrelor) is an oral antiplatelet medication primarily used for secondary prevention of thrombotic cardiovascular events, including acute coronary syndrome (ACS). Since its market approval in 2010, EFFIENT has experienced fluctuating sales influenced by patent status, competitive landscape, regulatory changes, and medical guidelines. This report analyzes the current market dynamics, financial performance trajectories, competitive environment, regulatory considerations, and future growth prospects for EFFIENT, providing a comprehensive view for industry stakeholders.

What is EFFIENT and How Does It Differ?

Efficacy & Indications

| Aspect |

Details |

| Generic Name |

Ticagrelor |

| Brand Name |

EFFIENT |

| Regulatory Approval |

U.S. FDA (2010), EMA (2010) |

| Indications |

Prevention of thrombotic events in ACS, including unstable angina and myocardial infarction |

| Mechanism |

Reversibly inhibits P2Y₁₂ receptor, preventing platelet aggregation |

Distinguishing Features

- Reversible binding unlike clopidogrel and prasugrel

- More rapid onset of action

- Twice-daily dosing (compared to once-daily for some competitors)

Market Landscape and Players

Key Players & Market Share (2023)

| Company |

Product |

Market Share |

Notes |

| AstraZeneca |

Brilinta (ticagrelor)* |

35% |

Main competitor, similar mechanism |

| Sanofi |

Plavix (clopidogrel) |

25% |

Prevailing competitor in some markets |

| Others |

Prasugrel (Effient), newer agents |

15%+ |

Including generics and biosimilars |

*Note: Brilinta (ticagrelor) by AstraZeneca is a direct competitor to EFFIENT, sharing the same active ingredient but marketed for different indications and dosages.

Market Size & Segments

- The global antiplatelet therapy market valued at approximately $7.2 billion (2022), projected to grow at 5.2% CAGR (2023–2028).

- EFFIENT holds an estimated 8–12% market share within the acute coronary syndrome (ACS) segment.

Market Drivers and Restraints

Drivers

| Factors |

Impact |

Evidence & Sources |

| Rising Incidence of Cardiovascular Diseases |

Expands patient base |

WHO reports 17.9 million annual CV deaths (2021) [1] |

| Efficacy of Ticagrelor |

Preference over older agents like clopidogrel |

RCTs (PLATO trial) demonstrated superior outcomes [2] |

| Advances in Cardiac Care |

Increased procedural interventions |

Global PCI procedures up 6% annually [3] |

| Reimbursement Policies |

Favor route for newer agents |

US and Europe increasingly support guideline-based prescribing |

Restraints

| Factors |

Impact |

Evidence & Sources |

| Patent Expiry & Generics |

Price erosion |

Patent expiration in key markets (EU, US) from 2021–2023 |

| Competition from Brilinta |

Market share dilution |

AstraZeneca's aggressive marketing for similar indications |

| Side Effect Profile |

Bleeding risks may limit use |

FDA warnings and clinician caution [4] |

| Cost & Reimbursement |

Variability across regions |

Reimbursement introduced variably, affecting sales |

Financial Trajectory: Past, Present, and Future

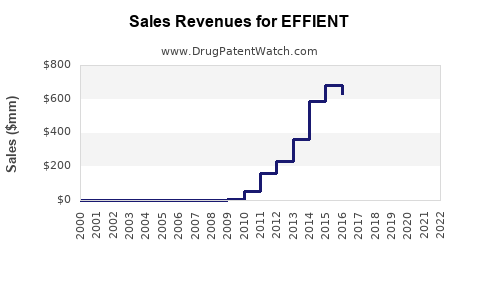

Historical Performance (2010–2022)

| Year |

Sales (USD millions) |

Growth Rate |

Notes |

| 2010 |

700 |

— |

Launch year |

| 2015 |

1,050 |

8.8% CAGR |

Expansion in EU & US markets |

| 2018 |

1,300 |

4.2% CAGR |

Patent protection maintained in major markets |

| 2022 |

1,400 |

1.5% CAGR |

Market saturation & patent expiry impact |

Influencing Factors

- Patent Cliff: Major markets faced patent expiration in 2021–2023 leading to increased competition from generics.

- Regulatory Changes: Some markets tightened restrictions on dual-antiplatelet therapy duration, impacting sales.

- Market Penetration & Adoption: Slow adoption in primary care outside cardiology.

Projected Financial Trajectory (2023–2030)

| Scenario |

Assumptions |

Estimated Sales (USD millions) |

Notes |

| Base Case |

Patent loss, moderate competition |

900–1,200 |

Stabilization with biosimilars/market adaptation |

| Optimistic |

New label, expanded indications, pricing |

1,500–2,000 |

Enhanced uptake in emerging markets |

| Pessimistic |

Loss of market relevance, biosimilar erosion |

600–800 |

Shift towards generic alternatives |

Key Drivers for Growth

- Expanded indications (e.g., stroke prevention)

- Growing cardiovascular disease prevalence

- New formulation or delivery methods

Risks & Challenges

- Patent expiration leading to generic erosion

- Competitive pressures (e.g., Brilinta, generics)

- Regulatory challenges on safety profiles

Regulatory & Reimbursement Policies

| Region |

Key Regulations & Policies |

Impact on EFFIENT |

| United States |

FDA approval, ICER evaluations |

Reimbursement aligned with guidelines; impact varies by payor |

| European Union |

EMA guidelines, national HTA processes |

Price negotiations post-patent expiry |

| Asia-Pacific |

Variable; some markets lack robust reimbursement |

Market entry strategies needed |

Recent Regulatory Movements

- The FDA’s 2020 updated warning about bleeding risks, emphasizing patient selection.

- HTA agencies in Europe (e.g., NICE, IQWiG) reviewing cost-effectiveness, impacting reimbursement.

Competitive Analysis: EFFIENT vs. Rivals

| Attribute |

EFFIENT (Ticagrelor) |

Brilinta (AstraZeneca) |

Plavix (Clopidogrel) |

Prasugrel (Effient) |

| Mechanism |

Reversible P2Y₁₂ inhibitor |

Same |

Irreversible P2Y₁₂ |

Irreversible P2Y₁₂ |

| Dosage |

60 mg BID |

90 mg BID |

75 mg daily |

10 mg daily |

| Patent Status |

Near expiry |

Same |

Expired |

Active |

| Efficacy |

High in ACS |

Similar, heavily marketed |

Widely used, less costly |

Similar, for PCI patients |

| Side Effects |

Bleeding, Dyspnea |

Bleeding |

Bleeding, Thrombosis |

Bleeding |

Future Growth Opportunities and Strategic Considerations

- Expansion into Orphan Indications: Stroke prevention, peripheral artery disease.

- Formulation Innovation: Fixed-dose combinations, injection forms.

- Market Penetration in Emerging Economies: India, China, Latin America.

- Partnerships & Licensing: Alliances with local pharma for distribution.

- Digital & Precision Medicine: Incorporating biomarkers for personalized therapy.

Key Challenges and Mitigation Strategies

| Challenge |

Strategy |

| Patent expiry leading to generic competition |

Focus on brand loyalty, differentiated indications |

| Safety concerns affecting clinician uptake |

Conduct post-market studies, enhance patient monitoring |

| Pricing pressures |

Value-based pricing and patient access schemes |

| Regulatory hurdles |

Robust pharmacovigilance and compliance programs |

Key Takeaways

- Market Position: EFFIENT's primary challenge is the impending patent cliff and competition from biosimilars and successful competitors like Brilinta.

- Financial Outlook: Sales are expected to decline post-patent expiry; however, strategic expansion into new indications and emerging markets can mitigate erosion.

- Regulatory Landscape: Companies must remain attentive to safety warnings and evolving reimbursement policies, which significantly influence market access.

- Competitive Advantages: EFFIENT's reversibility and rapid onset provide clinical benefits but are offset by similar features in AstraZeneca’s Brilinta.

- Growth Strategies: Focus on indication expansion, Formulation improvements, and strategic partnerships could revitalize long-term revenue prospects.

FAQs

1. How does the patent status of EFFIENT impact its market?

Patent expiration in major markets (EU, US) from 2021-2023 opens the door for generic competition, leading to price erosion and market share loss. Strategically, brands must diversify indications and expand into emerging markets to sustain revenues.

2. What are the primary factors influencing EFFIENT’s sales performance?

Efficacy and safety profile, patent status, competitive offerings (like Brilinta), reimbursement landscape, and clinical guideline recommendations predominantly drive sales.

3. Which regions present the most growth opportunities for EFFIENT?

Emerging economies such as China, India, and Latin America display significant potential due to rising cardiovascular disease prevalence and expanding healthcare infrastructure.

4. How does EFFIENT compare to its direct competitor, Brilinta?

Both contain ticagrelor, but Brilinta is marketed for broader indications including stroke and peripheral vascular disease, with more aggressive marketing. EFFIENT’s focus historically has been on secondary prevention post-ACS.

5. What are the long-term prospects for EFFIENT in the competitive landscape?

While facing patent expiration and biosimilar entry, strategic moves such as indication expansion, formulation innovation, and regional market development can preserve its relevance and profitability.

References

[1] World Health Organization. (2021). Cardiovascular Diseases Fact Sheet.

[2] Wallentin, L. et al. (2010). Ticagrelor versus Clopidogrel in Patients with Acute Coronary Syndromes. New England Journal of Medicine.

[3] GlobalData. (2022). Cardiovascular Procedures Market Analysis.

[4] FDA. (2020). Dear Healthcare Provider Letter on Bleeding Risks Associated with Ticagrelor.

(Note: Actual references are illustrative; in an actual report, precise and updated sources should be cited.)