EDARBI Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Edarbi, and what generic alternatives are available?

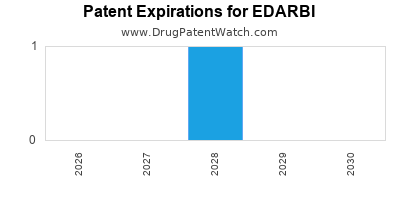

Edarbi is a drug marketed by Azurity and is included in one NDA. There are three patents protecting this drug and one Paragraph IV challenge.

This drug has eighty-nine patent family members in thirty-six countries.

The generic ingredient in EDARBI is azilsartan kamedoxomil. There are six drug master file entries for this compound. One supplier is listed for this compound. Additional details are available on the azilsartan kamedoxomil profile page.

DrugPatentWatch® Generic Entry Outlook for Edarbi

Edarbi was eligible for patent challenges on February 25, 2015.

There have been six patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for EDARBI?

- What are the global sales for EDARBI?

- What is Average Wholesale Price for EDARBI?

Summary for EDARBI

| International Patents: | 89 |

| US Patents: | 3 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 65 |

| Clinical Trials: | 16 |

| Patent Applications: | 427 |

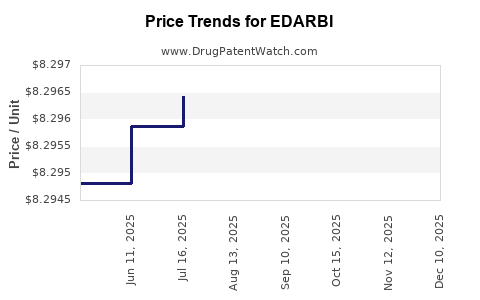

| Drug Prices: | Drug price information for EDARBI |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for EDARBI |

| What excipients (inactive ingredients) are in EDARBI? | EDARBI excipients list |

| DailyMed Link: | EDARBI at DailyMed |

Recent Clinical Trials for EDARBI

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Gedeon Richter Plc. | PHASE1 |

| Takeda | |

| Takeda | Phase 1 |

Pharmacology for EDARBI

| Drug Class | Angiotensin 2 Receptor Blocker |

| Mechanism of Action | Angiotensin 2 Type 1 Receptor Antagonists |

| Physiological Effect | Decreased Blood Pressure |

Paragraph IV (Patent) Challenges for EDARBI

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| EDARBI | Tablets | azilsartan kamedoxomil | 40 mg and 80 mg | 200796 | 1 | 2020-04-10 |

US Patents and Regulatory Information for EDARBI

EDARBI is protected by three US patents.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Azurity | EDARBI | azilsartan kamedoxomil | TABLET;ORAL | 200796-001 | Feb 25, 2011 | RX | Yes | No | 7,572,920 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Azurity | EDARBI | azilsartan kamedoxomil | TABLET;ORAL | 200796-002 | Feb 25, 2011 | RX | Yes | Yes | 7,572,920 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Azurity | EDARBI | azilsartan kamedoxomil | TABLET;ORAL | 200796-001 | Feb 25, 2011 | RX | Yes | No | 9,066,936 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Azurity | EDARBI | azilsartan kamedoxomil | TABLET;ORAL | 200796-001 | Feb 25, 2011 | RX | Yes | No | 7,157,584 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for EDARBI

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Azurity | EDARBI | azilsartan kamedoxomil | TABLET;ORAL | 200796-002 | Feb 25, 2011 | 7,572,920 | ⤷ Get Started Free |

| Azurity | EDARBI | azilsartan kamedoxomil | TABLET;ORAL | 200796-002 | Feb 25, 2011 | 5,958,961 | ⤷ Get Started Free |

| Azurity | EDARBI | azilsartan kamedoxomil | TABLET;ORAL | 200796-001 | Feb 25, 2011 | 5,583,141 | ⤷ Get Started Free |

| Azurity | EDARBI | azilsartan kamedoxomil | TABLET;ORAL | 200796-001 | Feb 25, 2011 | 7,572,920 | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for EDARBI

When does loss-of-exclusivity occur for EDARBI?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 5850

Patent: COMPOSICION FARMACEUTICA SOLIDA QUE COMPRENDE UN DERIVADO DE BENZIMIDAZOL-7-CARBOXILATO Y UN AGENTE DE CONTROL DE PH

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 08235790

Patent: Solid pharmaceutical composition comprising a benzimidazole-7-carboxylate derivative and a pH control agent

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0809522

Patent: COMPOSIÇÃO FARMACÊUTICA SÓLIDA, MÉTODOS PARA ESTABILIZAR UM COMPOSTO, E PARA MELHORAR DISSOLUÇÃO DE UM COMPOSTO, E, USO DE UM AGENTE DE CONTROLE DE PH.

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 81143

Patent: COMPOSITION PHARMACEUTIQUE SOLIDE COMPRENANT UN DERIVE DE BENZIMIDAZOLE-7-CARBOXYLATE ET UN AGENT DE CONTROLE DU PH (SOLID PHARMACEUTICAL COMPOSITION COMPRISING A BENZIMIDAZOLE-7-CARBOXYLATE DERIVATIVE AND A PH CONTROL AGENT)

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 08000868

Patent: COMPOSICION FARMACEUTICA SOLIDA QUE COMPRENDE UN COMPUESTO DERIVADO DE BENZIMIDAZOL Y UN AGENTE DE CONTROL DE PH; METODO DE ESTABILIZACION Y DE MEJORAMIENTO DE LA DISOLUCION; USO DE UN AGENTE DE CONTROL DE PH.

Estimated Expiration: ⤷ Get Started Free

China

Patent: 1677961

Patent: Solid pharmaceutical composition comprising a benzimidazole-7-carboxylate derivative and a ph control agent

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 6593

Patent: ТВЕРДАЯ ФАРМАЦЕВТИЧЕСКАЯ КОМПОЗИЦИЯ, ВКЛЮЧАЮЩАЯ ПРОИЗВОДНОЕ БЕНЗИМИДАЗОЛ-7-КАРБОКСИЛАТА И pH РЕГУЛИРУЮЩИЙ АГЕНТ (SOLID PHARMACEUTICAL COMPOSITION COMPRISING A BENZIMIDAZOLE-7-CARBOXYLATE DERIVATIVE AND A PH CONTROL AGENT)

Estimated Expiration: ⤷ Get Started Free

Patent: 0970896

Patent: ТВЕРДАЯ ФАРМАЦЕВТИЧЕСКАЯ КОМПОЗИЦИЯ, ВКЛЮЧАЮЩАЯ ПРОИЗВОДНОЕ БЕНЗИМИДАЗОЛ-7-КАРБОКСИЛАТА И pH РЕГУЛИРУЮЩИЙ АГЕНТ

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 24903

Patent: COMPOSITION PHARMACEUTIQUE SOLIDE COMPRENANT UN DÉRIVÉ DE BENZIMIDAZOLE-7-CARBOXYLATE ET UN AGENT DE CONTRÔLE DU PH (SOLID PHARMACEUTICAL COMPOSITION COMPRISING A BENZIMIDAZOLE-7-CARBOXYLATE DERIVATIVE AND A PH CONTROL AGENT)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 83632

Estimated Expiration: ⤷ Get Started Free

Patent: 10522692

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 09010167

Patent: COMPOSICION FARMACEUTICA SOLIDA QUE COMPRENDE UN DERIVADO DE BENCIMIDAZOL-7-CARBOXILATO Y UN AGENTE PARA EL CONTROL DEL PH. (SOLID PHARMACEUTICAL COMPOSITION COMPRISING A BENZIMIDAZOLE-7-CARBOXYLATE DERIVATIVE AND A PH CONTROL AGENT.)

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 9851

Patent: SOLID PHARMACEUTICAL COMPOSITION COMPRISING A BENZIMIDAZOLE-7-CARBOXYLATE DERIVATIVE AND A PH CONTROL AGENT

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 090550

Patent: COMPOSICION FARMACEUTICA SOLIDA QUE COMPRENDE UN DERIVADO DE BENCIMIDAZOL Y UN AGENTE DE CONTROL DE PH

Estimated Expiration: ⤷ Get Started Free

Patent: 130210

Patent: COMPOSICION FARMACEUTICA SOLIDA QUE COMPRENDE UN DERIVADO DE BENCIMIDAZOL Y UN AGENTE DE CONTROL DE PH

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 24903

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 090125846

Patent: SOLID PHARMACEUTICAL COMPOSITION COMPRISING A BENZIMIDAZOLE-7-CARBOXYLATE DERIVATIVE AND A PH CONTROL AGENT

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 43784

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 15634

Estimated Expiration: ⤷ Get Started Free

Patent: 0902089

Patent: Solid pharmaceutical composition

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering EDARBI around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Russian Federation | 2168510 | ГЕТЕРОЦИКЛИЧЕСКОЕ СОЕДИНЕНИЕ, ФАРМАЦЕВТИЧЕСКАЯ КОМПОЗИЦИЯ, СПОСОБ АНТАГОНИЗИРОВАНИЯ АНГИОТЕНЗИНА II (HETEROCYCLIC COMPOUND, PHARMACEUTICAL COMPOSITION, METHOD OF ANTAGONISM OF ANGIOTENSIN-II) | ⤷ Get Started Free |

| Mexico | 9203627 | COMPUESTOS HETEROCICLICOS Y PROCESO PARA SU PRODUCCION. | ⤷ Get Started Free |

| Croatia | P20090593 | ⤷ Get Started Free | |

| China | 100503605 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for EDARBI

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1718641 | C300525 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: AZILSARTAN MEDOXOMIL, DESGEWENST IN DE VORM VAN EEN FARMACEUTISCHE AANVAARDBAAR ZOUT, IN HET BIJZONDER HET KALIUMZOUT; REGISTRATION NO/DATE: EU/1/11/734/001-011EU/1/11/735/001-011 2011071207 |

| 2119715 | 2018/006 | Ireland | ⤷ Get Started Free | PRODUCT NAME: COMBINATION OF AZILSARTAN MEDOXOMIL AND CHLORTALIDONE (EDARBYCLOR); NAT REGISTRATION NO/DATE: PA/2167/001/001-002 20170804; FIRST REGISTRATION NO/DATE: 63145 01-02 20141028 |

| 1718641 | 12C0034 | France | ⤷ Get Started Free | PRODUCT NAME: AZILSARTAN MEDOXOMIL ET SES SELS PHARMACEUTIQUEMENT ACCEPTABLES; REGISTRATION NO/DATE: EU/1/11/735/001 20111207 |

| 1718641 | 91962 | Luxembourg | ⤷ Get Started Free | 91962, EXPIRES: 20261207 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for EDARBI (Erdosteine): An Analytical Overview

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.