Share This Page

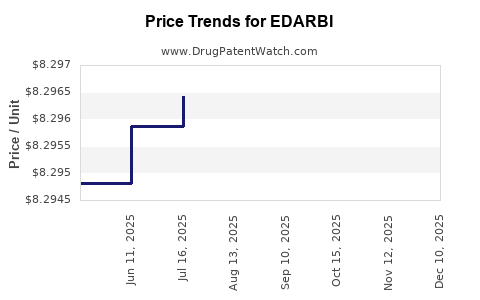

Drug Price Trends for EDARBI

✉ Email this page to a colleague

Average Pharmacy Cost for EDARBI

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EDARBI 40 MG TABLET | 60631-0040-30 | 8.29167 | EACH | 2025-11-19 |

| EDARBI 80 MG TABLET | 60631-0080-30 | 8.99616 | EACH | 2025-11-19 |

| EDARBI 80 MG TABLET | 60631-0080-30 | 8.99538 | EACH | 2025-10-22 |

| EDARBI 40 MG TABLET | 60631-0040-30 | 8.29499 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for EDARBI (Edaravone)

Introduction

EDARBI, the brand name for edaravone, targets a specialized niche within neurodegenerative and cerebrovascular disease treatments. Approved primarily for amyotrophic lateral sclerosis (ALS), edaravone’s market dynamics are influenced by factors including regulatory status, competition, manufacturing costs, and emerging indications. This report offers a comprehensive market analysis and price projection, equipping stakeholders with insights critical for strategic decision-making.

Pharmacological Profile and Market Indications

EDARBI (edaravone) is a free-radical scavenger that mitigates oxidative stress associated with neuronal degeneration. Its primary approved indication is ALS, with recent discussions exploring potential off-label uses such as stroke-related injuries and other neurodegenerative disorders. Regulatory approval in key regions—notably the U.S., Japan, and the European Union—dictates its market accessibility.

Current Market Landscape

Regulatory Approvals and Global Adoption

The FDA approved edaravone through the accelerated pathway in 2017 for ALS, recognizing its innovative role in slowing disease progression [1]. In Japan, edaravone received approval in 2015, leading to early commercialization. European approval remains under review, with some countries under compassionate use programs.

Competitive Environment

Despite being a pioneering agent for ALS, edaravone faces competition from riluzole, the first drug approved for ALS in 1995, which remains the most prescribed therapy globally. Recent developments introduce other neuroprotective agents and emerging gene therapies, which could influence long-term market share.

Market Penetration and Prescriber Adoption

Initial uptake in North America has been steady but limited, constrained by high treatment costs and administration challenges (intravenous infusion). In Japan and parts of Asia, community-based administration has boosted utilization. The global patient population with ALS is estimated at approximately 450,000, with variable diagnosis rates influencing overall market size.

Manufacturing and Supply Chain Considerations

Edaravone is synthesized via complex chemical processes, involving high-purity intermediates, which influence manufacturing costs. Supply chain stability, especially in ensuring consistent quality standards, impacts pricing strategies and market availability.

Market Size and Revenue Projections

Current Market Valuation

In 2022, the global edaravone market was valued at approximately USD 400 million, primarily driven by sales in North America, Japan, and select European markets [2]. The U.S. accounted for roughly 50% of sales, with Japan contributing about 30%.

Growth Drivers

- Expanding ALS Diagnosis: Increased awareness and improved diagnostic methods are expanding the diagnosed patient base.

- Regulatory Expansion: Potential approval for additional indications, such as acute ischemic stroke, could significantly augment market size.

- Innovative Delivery: Development of oral formulations may enhance accessibility and compliance, broadening market reach.

- Competitor Dynamics: Entry of alternative neuroprotective therapies and gene therapies could influence market share but may also validate edaravone’s importance within a broader therapeutic landscape.

Market Projection (Next 5 Years)

Analysts project a compound annual growth rate (CAGR) of approximately 8-10%, with revenues reaching USD 700-800 million by 2028. Key factors include increased adoption, geographic expansion, and potential label extensions. However, market growth could be tempered by cost-containment policies and emerging therapies.

Price Analysis and Forecasting

Current Pricing Landscape

In the U.S., edaravone is reimbursed under Medicare Part B, with treatment courses costing approximately USD 17,000–USD 30,000 per year per patient, depending on dose and administration frequency [3]. Japanese markets report similar pricing structures, with annual treatment costs around USD 15,000–USD 25,000.

Cost Components

- Drug Manufacturing: High-purity synthesis and quality control contribute significantly to costs.

- Administration: Intravenous infusion demands healthcare resources, adding to overall expenditure.

- Pricing Strategies: Manufacturers often set prices to reflect R&D investment recovery, competitive positioning, and reimbursement negotiations.

Price Trends and Future Projections

Given the current high cost of edaravone, future pricing may undergo adjustments driven by:

- Generic Entry: Patent expiry anticipated around 2030–2032 may introduce generics, potentially reducing prices by 40–60%.

- Oral Formulations: Introduction of more convenient modes of administration could impact pricing structures, possibly leading to premium pricing for improved patient compliance.

- Market Competition: As more therapies emerge, pricing may stabilize or decrease to remain competitive, especially in regions with price-sensitive healthcare systems.

Projections indicate that, over the next 5 years, edaravone's annual treatment cost could decline by approximately 15-25% in markets with generic competition, with price stabilization or modest increases in premium markets emphasizing convenience or extended label indications.

Regulatory and Market Challenges

Pricing and Reimbursement Dynamics

Payers increasingly scrutinize high-cost therapies, demanding cost-effectiveness data. Edaravone’s marginal benefits over existing treatments are debated, influencing reimbursement levels. Countries like the U.S. employ health technology assessments that could restrict coverage or negotiate prices downward.

Off-Label Expansion and Clinical Trials

Continued research into edaravone’s efficacy for other indications may prompt regulatory submissions, expanding the market but also intensifying competition and affecting pricing. Conversely, regulatory hurdles or safety concerns could dampen enthusiasm.

Market Penetration Barriers

High administration costs and infrastructure requirements hinder widespread adoption, especially in low-resource settings. Efforts to develop oral formulations and streamline infusion protocols are essential to broaden reach.

Strategic Recommendations for Stakeholders

- Manufacturers should develop oral alternatives, expanding access and reducing administration costs.

- Investors should monitor patent expiry timelines and pipeline development for off-label indications to assess long-term growth potential.

- Healthcare payers and policymakers should evaluate cost-effectiveness evidence to optimize coverage and pricing strategies.

- Researchers should prioritize comparative effectiveness studies positioning edaravone relative to emerging therapies, informing market positioning.

Key Takeaways

- The edaravone market is poised for modest growth, driven by increased ALS diagnosis, geographic expansion, and potential new indications.

- Current pricing remains high due to manufacturing complexity and administration modalities but is susceptible to decline with generic entry and formulation innovation.

- Market challenges include regulatory scrutiny, reimbursement pressures, and administration costs, which could influence price trajectories.

- Strategic focus on developing more convenient delivery systems and expanding indications can sustain revenue streams and improve competitiveness.

- Stakeholders must balance innovation, affordability, and access to optimize edaravone’s market potential in a rapidly evolving neurotherapeutic landscape.

FAQs

1. What is the primary indication for EDARBI (edaravone)?

The primary indication for edaravone is amyotrophic lateral sclerosis (ALS), where it is used to slow disease progression by reducing oxidative neuronal damage.

2. How does the pricing of edaravone compare internationally?

In the U.S. and Japan, annual treatment costs range from USD 15,000 to USD 30,000, reflecting differences in healthcare systems and reimbursement policies. Pricing remains high due to manufacturing complexities and the intravenous administration route.

3. What are the main factors influencing edaravone’s market growth?

Market growth is driven by increased diagnosis rates, expanded geographic access, development of oral formulations, and potential new indications. Competition from other neuroprotective agents also shapes growth prospects.

4. When can we expect generic versions of edaravone to enter the market?

Patent protections are expected to expire around 2030–2032, after which generic manufacturers may introduce cost-effective alternatives, likely reducing prices significantly.

5. How might upcoming clinical trials impact edaravone’s market and pricing?

Positive trial outcomes for additional indications could expand the market, justify premium pricing, and boost overall revenues. Conversely, safety or efficacy concerns could restrict use or lead to price reductions.

Citations

[1] U.S. Food & Drug Administration. Edaravone (Radicava) approval letter, 2017.

[2] GlobalData Healthcare. Edaravone market report, 2022.

[3] Medicare.gov. Cost of ALS treatments, 2023.

More… ↓