Last updated: July 27, 2025

Introduction

Economazole nitrate, a broad-spectrum imidazole antifungal agent, holds a significant position within the dermatological pharmaceutical landscape. Primarily employed in topical formulations to treat fungal infections, its market trajectory is shaped by dynamic clinical, regulatory, and competitive factors. This comprehensive analysis explores current market dynamics, driving forces, competitive landscape, and forecasting considerations crucial for stakeholders assessing investment, partnership, or development strategies for econazole nitrate.

Overview of Econazole Nitrate

Econazole nitrate is a synthetic imidazole antifungal agent with a mechanism that disrupts fungal cell membrane synthesis by inhibiting ergosterol biosynthesis. It is predominantly formulated as creams, gels, and lotions for conditions like athlete’s foot, ringworm, pityriasis versicolor, and seborrheic dermatitis. Its high efficacy and minimal systemic absorption have established it as a mainstay in topical antifungal therapy.

Global Market Landscape

The global antifungal market, crucially including econazole nitrate, is projected to grow markedly, driven by increasing prevalence of fungal infections, expanding dermatology treatment markets, and rising awareness of skin health. According to industry reports, the antifungal segment was valued at approximately USD 15 billion in 2021, with a compound annual growth rate (CAGR) forecast of 6-8% over the next five years (1).

Econazole nitrate, which primarily occupies the topical antifungal niche, benefits from strong generic manufacturing presence in emerging markets, where affordability and accessibility are vital. In developed regions like North America and Europe, the pharmaceutical companies focus on brand extensions and combination therapies that include econazole nitrate.

Key Market Drivers

1. Rising Incidence of Fungal Infections:

The increasing incidence of superficial fungal infections, driven by factors such as climate change, urbanization, immunosuppressive therapies, and lifestyle factors, fuels demand. Particularly, rising cases of athlete’s foot and tinea infections, especially in tropical and subtropical regions, bolster the topical antifungal market (2).

2. Growing Dermatology Market:

With dermatology evolving as a specialty, there is heightened adoption of topical antifungal agents. Increasing skin health awareness, coupled with aging populations and rising dermatological conditions, enhances market potential.

3. Generic Production and Cost-Effectiveness:

Econazole nitrate’s presence as a generic product increases accessibility, especially in low-to-middle-income countries. Price sensitivity fosters widespread use, ensuring sustained demand.

4. Regulatory Approvals and Expanded Indications:

Regulatory agencies such as the FDA and EMA have approved econazole nitrate formulations, and ongoing research into broader applications (e.g., vulvovaginal candidiasis) could further expand its use.

Market Challenges

Despite positive drivers, several challenges influence the market dynamics:

-

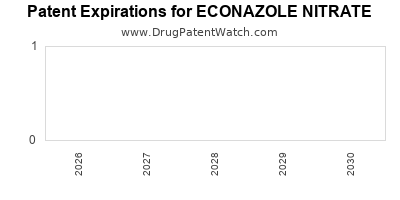

Limited Patent Exclusivity:

Econazole nitrate’s generic status in many markets limits profit margins for manufacturers, dampening R&D incentives for innovation (3).

-

Emergence of Resistance:

Though currently rare, reports of antifungal resistance pose future therapeutic challenges bolstering the need for alternative agents or combination approaches.

-

Competition from Newer Agents:

Alternatives like terbinafine, clotrimazole, and newer azole derivatives offer competitive efficacy and novel formulations, challenging econazole nitrate’s market share.

-

Formulation Limitations:

Topical therapies suffer from poor patient adherence due to inconvenience and application frequency. Development of more user-friendly formulations remains a crucial factor.

Regulatory and Patent Landscape

Econazole nitrate's patent landscape is largely characterized by expiration, facilitating generic proliferation. Regulatory pathways are streamlined in many jurisdictions due to established safety and efficacy profiles; however, newer formulations may seek label extensions or combination approvals to reinvigorate their market position. Regulatory agencies also emphasize environmental safety, especially regarding topical excipients and preservatives.

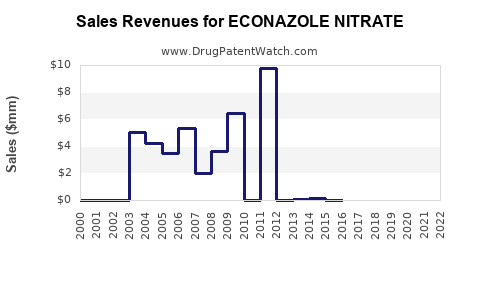

Financial Trajectory and Investment Outlook

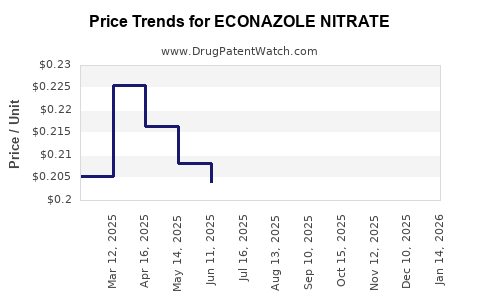

From a financial perspective, econazole nitrate’s market is characterized by stability rooted in its low-cost production and consistent demand in dermatology. However, high competitive pressure and patent expiries constrict margins, pushing companies to seek product differentiation through:

-

Novel Formulations:

Innovations such as nanotechnology-based delivery systems could improve bioavailability, efficacy, and adherence, translating into premium pricing strategies.

-

Combination Therapies:

Combining econazole nitrate with corticosteroids or antibacterials enhances clinical outcomes and creates new market segments.

-

Geographical Expansion:

Emerging economies present lucrative growth opportunities, where regulatory barriers are lower, and infection burdens are higher.

Future revenues hinge on product lifecycle management strategies, regional regulatory frameworks, and acceptance of innovative formulations. Market analysts project a moderate CAGR of 4-6% for econazole nitrate’s segment, reflecting its steady demand juxtaposed with competitive pressures (4).

Competitive Landscape

Major players in the econazole nitrate market include pharmaceutical giants like GlaxoSmithKline, Janssen, and generic manufacturers across Asia, Europe, and North America. Market share distribution is heavily influenced by generics, with branded formulations maintaining niche segments through marketing and formulation improvements. Several key strategies include:

- Expansion into combination therapies.

- Licensing agreements for regional distribution.

- Investment in formulation technology to improve patient compliance.

The environmental and regulatory compliance landscape influences market entry and sustainability. Companies with robust R&D capabilities and extensive supply chain networks have a competitive advantage.

Future Outlook and Market Trends

Innovation in Formulation Technologies:

Sustained investment in nanoformulations, sustained-release topical patches, and coated formulations to improve penetration and durability are anticipated trends.

Personalized Dermatology:

Developing tailored antifungal regimens based on genetic and microbiome insights could redefine econazole nitrate’s positioning in skin infection management.

Regulatory Incentives and Sustainability:

Adapting formulations to meet environmental sustainability standards and leveraging regulatory incentives for formulations targeting specific populations (e.g., pediatric) will influence future growth.

Market Consolidation:

We can expect mergers and acquisitions to optimize manufacturing capacity and expand regional footprints, especially in underserved markets.

Conclusion

Econazole nitrate remains a resilient and essential asset in the topical antifungal market, driven by persistent demand for effective, affordable fungal infection treatments. While patent expiries and competitive alternatives present challenges, innovation in formulation and strategic regional expansion are anticipated to sustain its financial trajectory. Stakeholders should monitor technological advances, resistance trends, and regulatory changes to optimize positioning and capitalize on emerging opportunities.

Key Takeaways

- The global antifungal market, with econazole nitrate as a staple, is poised for steady growth driven by rising superficial fungal infections.

- Patent expiries and generic manufacturing underpin affordability but limit high-margin innovations; diversification into combination therapies and advanced formulations present growth avenues.

- Competitive pressures necessitate continuous innovation, especially in patient-friendly delivery systems.

- Emerging markets offer substantial expansion prospects due to high fungal infection prevalence and cost sensitivity.

- Future success depends on integrating formulation innovation, regional regulatory navigation, and strategic collaborations to extend product lifecycle.

FAQs

Q1: How does econazole nitrate compare to other topical antifungals like clotrimazole?

A: Econazole nitrate generally exhibits comparable efficacy to clotrimazole; however, differences in formulation, patient tolerability, and resistance profiles may influence clinician choice. Econazole’s broader spectrum and potential for fewer resistance issues make it a preferred option in certain settings.

Q2: What are the primary regions driving econazole nitrate market growth?

A: Emerging markets in Asia-Pacific and Latin America are key growth drivers due to high fungal infection rates, increasing dermatological awareness, and the availability of affordable generics.

Q3: Are there any notable resistance concerns associated with econazole nitrate?

A: Resistance remains relatively rare but has been reported in certain fungal strains. Ongoing surveillance and combination therapies are strategies to mitigate resistance development.

Q4: What innovations could extend econazole nitrate’s market lifespan?

A: Advanced nanotechnology-based formulations, combination therapies, and targeted treatments tailored for specific demographics can revitalise market interest and improve clinical outcomes.

Q5: How do regulatory trends influence econazole nitrate’s market prospects?

A: Regulatory approvals, patent expiries, and environmental standards shape market entry strategies. Streamlined approval processes for new formulations and indications can accelerate market penetration and profitability.

References

- Grand View Research. Antifungal Market Size, Share & Trends Analysis Report. 2022.

- World Health Organization. Global Atlas on Fungal Infections. 2017.

- IMS Health. Pharmaceutical Patent Landscape. 2021.

- MarketsandMarkets. Topical Antifungal Market Forecast. 2022.