Share This Page

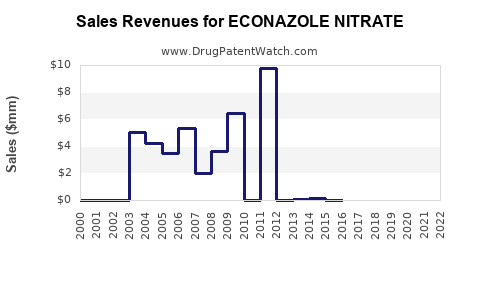

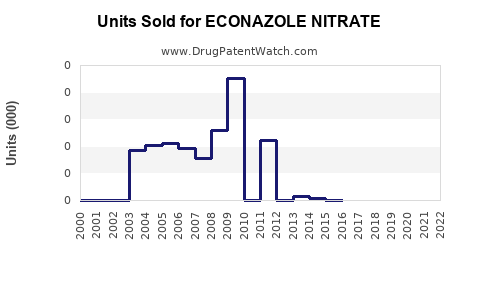

Drug Sales Trends for ECONAZOLE NITRATE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ECONAZOLE NITRATE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ECONAZOLE NITRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ECONAZOLE NITRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ECONAZOLE NITRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Econazole Nitrate

Introduction

Econazole nitrate, a broad-spectrum imidazole antifungal agent, is primarily indicated for the topical treatment of superficial fungal infections such as dermatophyte, Candida, and Malassezia-related conditions. Recognized for its efficacy and safety profile, econazole nitrate’s market dynamics are driven by increasing prevalence of dermatological fungal infections, evolving treatment paradigms, and rising global healthcare expenditures. This analysis explores the current market landscape, competitive environment, regulatory considerations, and forecasts sales trajectories for econazole nitrate over the next five years.

Market Overview

Global Market Size and Growth Drivers

The global antifungal market, valued at approximately USD 18 billion in 2022, is projected to grow at a CAGR of approximately 4-6% through 2027. A significant segment within this comprises topical antifungal agents like econazole nitrate, owing to their widespread use in dermatology. The increasing incidence of fungal skin infections — exacerbated by climate change, immunosuppressive therapies, and lifestyle factors — underpins steady demand. Asia-Pacific, North America, and Europe dominate markets for topical antifungals, driven by high healthcare spending, urbanization, and heightened awareness.

Key Therapeutic Indications

Econazole nitrate finds widespread application in treating:

- Tinea corporis, cruris, pedis

- Candidiasis of skin and mucous membranes

- Pityriasis versicolor

The rising prevalence of these conditions, especially in tropical and subtropical regions, sustains demand. Moreover, economic factors favor topical over systemic antifungals, bolstering econazole nitrate’s utilization.

Market Segmentation

The market can be segmented as follows:

- Formulation: Creams, gels, solutions, suppositories

- Distribution Channels: Hospitals, retail pharmacies, online pharmacies

- Geography: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Innovation in topical formulations, such as combination creams and improved delivery systems, enhances patient compliance and expands market reach.

Competitive Landscape

Major Players

Several pharmaceutical firms manufacture econazole nitrate formulations, including:

- BASF (the original patent holder, with formulations under various brand names)

- Sartorius

- Perrigo

- Mundipharma

- Generic manufacturers across emerging markets

The market is notably characterized by a high degree of generic competition, influencing pricing strategies and profit margins.

Market Entry Barriers

Patent expirations, regulatory approvals, and manufacturing scale define competitive entry. Since econazole nitrate formulations are often off-patent, new entrants focus on formulation improvements and regional distribution networks.

Regulatory Environment

Global regulatory agencies (FDA, EMA, PMDA) regulate econazole nitrate products, emphasizing quality, safety, and efficacy. Many formulations are marketed as OTC products in developed countries, easing accessibility but intensifying competition. Emerging markets often have less stringent requirements, allowing rapid commercialization of generics.

Sales Projections (2023-2028)

Assumptions

- Continued high prevalence of superficial fungal infections.

- Incremental adoption of econazole nitrate over older agents like clotrimazole or miconazole.

- Growing awareness and healthcare access in developing regions.

- Entry of combination formulations to capture unmet needs.

- Generic competition constrains pricing but sustains volume sales.

Forecast Summary

| Year | Estimated Global Sales (USD Million) | CAGR | Key Factors |

|---|---|---|---|

| 2023 | 250 | — | Steady demand; mature market |

| 2024 | 270 | 8% | Increased awareness; new formulations |

| 2025 | 290 | 7.4% | Expansion in APAC and Latin America |

| 2026 | 310 | 6.9% | Market saturation; price competition |

| 2027 | 330 | 6.5% | Broadened indications, regional growth |

| 2028 | 355 | 7.6% | Emerging market penetration, patents off |

Note: The projections assume moderate growth driven by regional expansion and innovation, with pricing pressures due to generics.

Key Market Trends

Increasing Adoption of Generic Formulations

The expiration of patents and absence of proprietary barriers propel the proliferation of generics, contributing approximately 60-70% of market sales by volume. This pattern enhances affordability but may compress profit margins.

Shift Towards Combination Products

Clinicians increasingly prefer combination topical therapies (e.g., econazole + corticosteroids), accelerating sales volumes. Such formulations address inflammatory components more effectively, augmenting patient outcomes.

Digital Distribution and Telemedicine

Catalyzed by recent healthcare reforms and pandemic responses, online pharmacies and telehealth platforms facilitate wider product dissemination, especially in remote regions.

Regional Growth Opportunities

Developing markets in Asia-Pacific, Latin America, and Africa exhibit robust growth, owing to rising dermatological disease burden, increasing healthcare investments, and expanding generic manufacturing.

Risks and Challenges

- Pricing pressure from generics could inhibit margins.

- Regulatory hurdles in certain jurisdictions delay product launches.

- Competition from other antifungal agents (e.g., sertaconazole, terbinafine) may divert market share.

- Patient adherence issues related to topical administration may impact real-world efficacy.

Strategic Expansion Opportunities

- Formulation innovation to enhance bioavailability, stability, and patient compliance.

- Geographic expansion into underserved markets.

- Partnerships with regional manufacturers for distribution.

- Marketing campaigns emphasizing efficacy and safety profiles.

Conclusion

The econazole nitrate market is mature but poised for steady growth, primarily driven by increasing superficial fungal infections and expanding regional markets. Competitive dynamics favor generic penetration, with real growth potential arising from formulation innovations and regional expansion. Companies that strategically leverage these trends can optimize sales and secure market positioning in this evolving landscape.

Key Takeaways

- Market Size & Growth: Expected to reach approximately USD 355 million by 2028, with a CAGR of around 6-8%.

- Competitive Environment: Dominated by generics, with potential for niche formulations and combination products.

- Geographic Focus: High growth opportunities in Asia-Pacific, Latin America, and Africa.

- Innovation & Differentiation: Critical for maintaining market share amidst price competition.

- Regulatory Navigation: Essential for timely market access, especially in emerging markets.

FAQs

1. How does econazole nitrate compare to other topical antifungals?

Econazole nitrate offers broad-spectrum activity with a favorable safety profile. While agents like clotrimazole and miconazole are similar, econazole is often preferred for its potency and reduced resistance profiles. Combination formulations with corticosteroids also expand its use.

2. What are the main market challenges for econazole nitrate?

The primary challenges include high generic competition, pricing pressures, regulatory disparities across regions, and competition from emerging antifungal agents.

3. Which regions present the most promising opportunities?

Asia-Pacific and Latin America are significant growth regions due to high disease prevalence, increasing healthcare investment, and expanding access to affordable antifungal therapies.

4. How might formulations evolve to capture more market share?

Innovations such as gel-based formulations, combination creams, sustained-release topical systems, and patient-friendly delivery mechanisms can improve adherence and efficacy, fostering higher sales.

5. What are key factors influencing sales projections?

Factors include growing incidence of fungal infections, regional market expansion, patent expiration timelines, healthcare infrastructure development, and strategic marketing efforts.

References

[1] MarketsandMarkets, "Antifungal Drugs Market," 2022.

[2] Allied Market Research, "Global Topical Antifungals Market," 2022.

[3] World Health Organization, "Prevalence of Fungal Skin Infections," 2022.

[4] US Food and Drug Administration, "Regulatory Guidelines for Topical Antifungal Drugs," 2021.

More… ↓