Last updated: July 29, 2025

Introduction

Durezol (difluprednate ophthalmic emulsion) stands as a prominent corticosteroid prescribed primarily for ocular inflammation and pain management post-surgery. Since its FDA approval in 2007, Durezol's market trajectory has been shaped by evolving ophthalmic treatment paradigms, competitive pressures, regulatory landscapes, and technological innovations within the pharmaceutical industry. This analysis explores key market dynamics and projects the financial outlook for Durezol over the coming years.

Market Overview

Durezol is manufactured by Alcon, a subsidiary of Novartis, and holds a significant share within the ophthalmic corticosteroid segment. It competes against other steroids such as prednisolone acetate and loteprednol etabonate. The global ophthalmic pharmaceuticals market was valued at around USD 26 billion in 2022, projected to grow at a CAGR of approximately 6% through 2030, driven by aging populations, increased prevalence of ocular diseases, and advancements in surgical procedures.[1]

Within this landscape, Durezol commands a niche for its high potency and efficacy in controlling intraocular inflammation. Its use is particularly prevalent in post-operative settings following cataract surgeries and other invasive ophthalmic procedures.

Market Dynamics

1. Competitive Landscape

Durezol faces competition from both corticosteroids and non-steroidal anti-inflammatory drugs (NSAIDs). Notably, loteprednol etabonate (Alrex, Lotemax) and prednisolone acetate have traditionally occupied larger market shares due to their established safety profiles and cost advantages. However, Durezol’s higher potency often translates into superior clinical outcomes, making it preferred in specific scenarios.[2]

The emergence of biosimilars and generics for alternative steroids further intensifies price competition, impacting Durezol's market share and pricing strategies. Nevertheless, patent protections and regulatory exclusivities—such as method-of-use patents—have historically shielded Durezol from direct generics, preserving its premium positioning.

2. Regulatory Environment

FDA approvals and regulatory decisions significantly influence Durezol’s market trajectory. The drug has secured approval for various indications, including post-operative inflammation and pain. Future approvals for additional indications or formulations could expand its market potential.

The regulatory landscape is also evolving with increased scrutiny on corticosteroids due to safety concerns such as intraocular pressure elevation and cataract formation. This has prompted healthcare providers to weigh risks against benefits carefully, influencing prescribing patterns.[3]

3. Technological Advancements

Advances in drug delivery, such as sustained-release formulations and nanoemulsions, threaten to disrupt traditional corticosteroid therapies. The development of non-steroidal alternatives with comparable efficacy and improved safety profiles may diminish Durezol’s dominance in the long term.

Moreover, personalized medicine approaches and biomarker-driven therapies could refine patient selection, optimizing Durezol’s clinical utility and revenue potential.

4. Clinical Adoption and Prescribing Trends

Durezol has established a robust presence in ophthalmic surgeries, especially cataract procedures. Its high efficacy makes it a preferred choice among ophthalmologists, bolstered by clinical trial data demonstrating rapid inflammation control.

However, the cost structure influences adoption rates. Higher pricing compared to alternatives can limit use in resource-constrained settings. Reimbursement policies, insurance coverage, and hospital formularies greatly impact prescription volumes.

5. Market Opportunities

Growth opportunities include expanding indications (e.g., uveitis, dry eye inflammation) and geographic expansion into emerging markets such as Asia-Pacific, where ophthalmic disease prevalence is increasing.[4] Novartis' distribution network and local regulatory strategies will be pivotal in capturing these markets.

Additionally, Durezol’s formulation innovations, such as preservative-free single-dose units, align with current safety trends and patient preferences, potentially expanding its user base.

Financial Trajectory

1. Revenue Projections

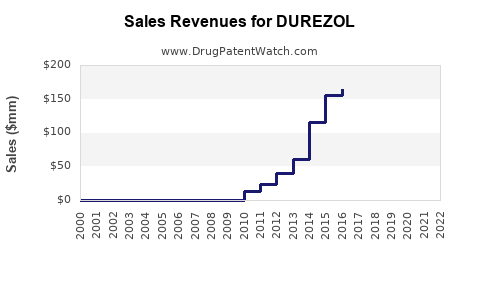

Given the current market conditions, Durezol's revenues are projected to experience modest growth in mature markets due to patent protections and clinical efficacy. The compound annual growth rate (CAGR) for ophthalmic steroids was estimated at 5–7% over the past five years (2021-2026), with Durezol maintaining a share within this segment owing to its premium status.

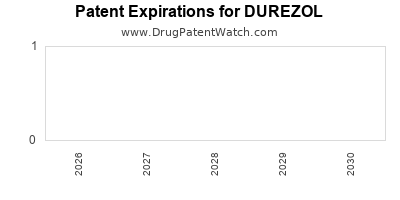

However, imminent patent expirations in some jurisdictions and increased patent challenges could lead to revenue erosion by 2028. Nonetheless, strategic diversification into adjunct therapies and new indications may buffer this decline.

2. Pricing Factors

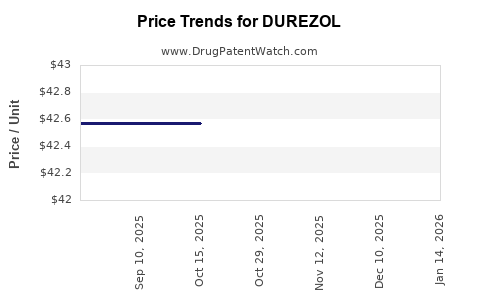

Durezol’s premium pricing reflects its high efficacy and targeted indications. Price inflation in ophthalmic drugs has been moderate, averaging 3–4% annually. Insurance reimbursements and formulary positioning primarily govern actual revenue realization.

The potential introduction of biosimilars or generics upon patent expiry could induce downward price pressures, necessitating proactive market strategies such as value-based pricing and added-value services.

3. Investment and R&D Outlook

Investment in formulation improvements and pipeline expansion remains critical. Novartis and Alcon continue to prioritize ophthalmic innovation, including sustained-release implants and targeted delivery systems, aiming to extend Durezol’s market relevance.

R&D spending on ophthalmology globally exceeds USD 4 billion annually, with major players targeting inflammation management innovations to maintain competitive advantage.[5]

4. Market Risks and Challenges

- Safety Concerns: Adverse effects like increased intraocular pressure may limit Durezol’s use, especially in pre-existing glaucoma patients.

- Pricing Pressures: Cost containment policies and competitive generics will influence profit margins.

- Regulatory Risks: Delays or denials in new indication approvals may constrain revenue expansion.

- Market Penetration: Fragmentation in ophthalmic care delivery can hamper widespread adoption.

Conclusion

Durezol remains a high-value asset within the ophthalmic corticosteroid segment, with a stable yet competitive market position driven by clinical efficacy. Its financial trajectory will depend on maintaining innovation, navigating regulatory challenges, and responding to competitive pressures. Strategic expansion into emerging markets and leveraging technological advancements could sustain growth, although patent expirations and safety considerations pose notable risks.

Optimal positioning will require a nuanced balance of innovation, pricing strategies, and targeted marketing to uphold Durezol’s market share in an evolving ophthalmic landscape.

Key Takeaways

- Steady Demand with Growth Potential: Durezol’s clinical efficacy ensures ongoing demand in ophthalmic inflammation management, with opportunities for expansion into new indications and markets.

- Competitive and Regulatory Dynamics: Patent protections safeguard revenues temporarily; however, generics, biosimilars, and safety concerns threaten long-term growth.

- Importance of Innovation: Formulation improvements and advanced delivery mechanisms are vital for maintaining market relevance amid technological disruption.

- Pricing and Reimbursement Impact: Cost considerations and insurance policies significantly influence prescription patterns and revenue streams.

- Strategic Diversification: Investing in pipeline development and geographic penetration offers resilience against market volatility.

FAQs

1. When is Durezol expected to face generic competition?

Patent expiries in major markets currently projected around 2028-2030, after which generic difluprednate formulations may enter the market, impacting Durezol’s premium pricing and market share.

2. What are the primary safety concerns associated with Durezol?

Intraocular pressure elevation and cataract formation are notable safety issues, which can influence prescribing decisions, especially in patients with pre-existing ocular hypertension.

3. Are there emerging alternatives that threaten Durezol’s market share?

Yes, newer non-steroidal anti-inflammatory drugs and sustained-release delivery systems are under development, offering potential alternatives that could challenge Durezol’s dominance.

4. How significant are geographic expansion opportunities for Durezol?

Extremely significant, particularly in Asia-Pacific and Latin America, where rising ophthalmic disease prevalence aligns with improving healthcare infrastructure.

5. What strategic actions can preserve Durezol’s market position?

Continued innovation, expanding authorized indications, optimizing formulations for safety and convenience, and leveraging strong regulatory and distribution networks are essential.

References

- MarketWatch. (2023). Global ophthalmic pharmaceuticals market size and forecast.

- Clinical Ophthalmology Journal. (2022). Comparative efficacy of corticosteroids post-cataract surgery.

- FDA Safety Communications. (2021). Corticosteroid-associated ocular adverse events.

- World Health Organization. (2022). Ophthalmic disease burden in emerging markets.

- Global R&D Outlook. (2023). Investment trends in ophthalmic therapies.

This comprehensive review synthesizes current market conditions and projects future financial outcomes for Durezol, providing strategic insights vital for stakeholders navigating this competitive landscape.