Last updated: July 29, 2025

Introduction

DUREZOL (fluorometholone ophthalmic suspension) is a corticosteroid eye drop primarily indicated for the treatment of post-operative inflammation, postoperative allergic conjunctivitis, and other ocular inflammatory conditions. As a branded ophthalmic corticosteroid, DUREZOL occupies a niche within the multifunctional and highly competitive ophthalmic drugs market. Analyzing its current market standing and forecasting its future pricing dynamics demands an understanding of regulatory landscapes, competitive positioning, prescribing trends, and market demand.

Market Overview

The global ophthalmic drugs market is experiencing sustained growth driven by an aging population, increasing prevalence of ocular diseases, and technological advancements in drug delivery systems. The corticosteroid segment, including DUREZOL, contributes significantly to this growth due to its efficacy in managing inflammatory ocular conditions.

DUREZOL's primary therapeutic niche involves postoperative care in ophthalmic surgeries such as cataract and LASIK procedures. The rise in surgical procedures globally amplifies demand for effective anti-inflammatory therapies. According to data from Market Research Future, the global ophthalmic drugs market is projected to grow at a compound annual growth rate (CAGR) of approximately 4.2% from 2022 to 2028, with corticosteroids expected to retain substantial market share [1].

Competitive Landscape

DUREZOL competes with a range of corticosteroid eye drops including generic fluormetholone formulations, other branded drugs like prednisolone acetate (e.g., Omnipred), loteprednol (e.g., Lotemax), and difluprednate (e.g., Durezol) (note: “Durezol” is a similar-sounding but differently branded drug; avoid confusion). The market’s shift toward generic formulations offers price competition, though branded formulations like DUREZOL maintain premium pricing due to reputation and formulation specifics.

Key competitors' strategic positioning includes:

- Generics: Offer cost-effective alternatives, pressuring DUREZOL’s market share in regions with price-sensitive healthcare systems.

- Newer corticosteroids: Drugs like loteprednol tend to have better safety profiles, influencing prescribing trends.

- Postoperative protocols: Increasing adoption of combination therapies may influence DUREZOL’s standalone sales.

Regulatory and Prescribing Trends

Regulatory approvals and shifts in clinical guidelines significantly influence DUREZOL's market. The FDA approved DUREZOL in 2009 for ophthalmic inflammation [2], establishing it firmly within the postoperative care standard. However, newer corticosteroids with improved safety profiles and lower intraocular pressure (IOP) elevation risks are gaining preference, subtly impacting DUREZOL’s market share.

Prescribing behavior increasingly favors agents with ease of use, favorable dosing schedules, and minimized adverse effects. DUREZOL’s once-daily dosing appeals to clinicians but faces stiff competition from agents with similar or more advantageous profiles.

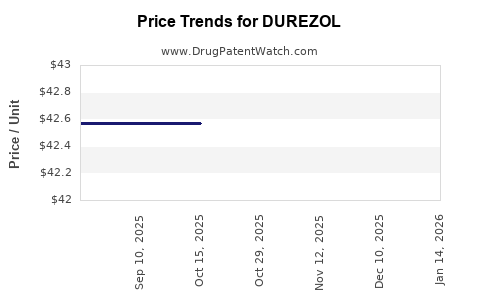

Pricing Analysis

The pricing of DUREZOL remains relatively stable but varies by region, formulation strength, and packaging. In the U.S., the average retail price for a 5 mL bottle hovers around $150–$180, reflecting a branded premium. Insurance coverage, patient copay assistance programs, and regional market dynamics influence out-of-pocket costs.

In comparison, generic fluormetholone formulations are priced significantly lower, often below $50 per bottle. This pricing differential drives a segment of clinicians and patients toward generics where formulary restrictions allow.

Emerging market economies exhibit more pronounced price disparities, with DUREZOL priced higher due to import tariffs, less generic competition, and differing healthcare reimbursement structures.

Future Price Projection Factors

Numerous factors will shape DUREZOL’s pricing trajectory:

-

Generic Competition: Continued emergence of generic fluormetholone options could erode DUREZOL’s premium pricing. Price erosion is anticipated at approximately 10–15% annually in highly competitive markets over the next 5 years [3].

-

Regulatory Approvals and NewIndications: Expansion into new therapeutic indications or formulations (e.g., preservative-free version) could sustain or elevate pricing due to added value.

-

Market Penetration: Growth in surgical volumes, particularly if DUREZOL is included in standardized postoperative protocols, would stabilize or increase demand, supporting premium pricing.

-

Supply Chain Dynamics: Manufacturing costs, procurement strategies, and global supply chain stability could influence pricing adjustments.

-

Reimbursement Policies: Changes in healthcare reimbursement strategies, especially in the U.S. and Europe, may either restrict or facilitate premium pricing models.

-

Emerging Technologies: Advances such as sustained-release implants or eye drops with improved safety profiles could impact DUREZOL’s price attractiveness.

Based on these factors, a conservative projection suggests that DUREZOL’s average price may decline approximately 8–12% annually over the next five years, primarily driven by generic competition, unless augmented by new indications or formulations that command premium pricing.

Market Penetration and Volume Forecasts

The increasing adoption of minimally invasive ocular surgeries and enhanced postoperative care standards support demand stability. In North America and Europe, where branded drugs maintain strong footholds, sales volume is expected to grow modestly at CAGR of 3–4%, with revenue growth contingent upon price stability or moderate declines.

In emerging markets, rapid surgical expansion and limited presence of generics could sustain higher prices longer-term; however, intense price competition is likely to lead to a faster decline in substitution rates once generics become fully available.

Strategic Implications for Stakeholders

- Pharmaceutical Manufacturers: Innovating with preservative-free or sustained-release formulations may justify premium pricing and sustain revenue streams.

- Healthcare Providers: Prescribing behaviors favoring newer corticosteroids with better safety profiles could reduce DUREZOL’s market share.

- Payers and Policymakers: Favoring cost-effective, generic options will likely exert downward pressure on DUREZOL pricing.

Key Takeaways

- The global ophthalmic corticosteroid market is growing steadily, with demand driven by increased ocular surgeries and aging populations.

- DUREZOL’s revenue and price stability are increasingly challenged by generic competition and evolving clinical preferences.

- Price projections indicate a decline rate of approximately 8–12% annually over five years, barring novel formulations or expanded indications.

- Market expansion hinges on surgical volume growth and formulary positioning, particularly in emerging markets.

- Stakeholders should focus on product differentiation through innovation and clinical guidelines alignment to maintain competitive advantage.

FAQs

1. How does DUREZOL compare to generic fluormetholone formulations in terms of efficacy and safety?

DUREZOL offers a proven efficacy profile with a well-established safety record, particularly in reducing intraocular pressure elevation relative to some earlier corticosteroids. Generics match its efficacy but may lack the same formulation stability or preservative profile, influencing clinician preference.

2. What factors could hinder DUREZOL’s market growth in the coming years?

Emerging safer corticosteroids, increased availability of generics, and shifts in prescribing toward drugs with lower IOP risk could diminish DUREZOL’s market share.

3. Are there any upcoming regulatory hurdles for DUREZOL?

Ongoing evaluations of safety and efficacy, alongside patent protections in various regions, may influence market access and pricing strategies. No major regulatory hurdles are currently reported.

4. What role do reimbursement policies play in DUREZOL’s pricing?

Payer reimbursement policies directly impact out-of-pocket costs for patients and thus influence prescribing patterns, which can indirectly affect pricing and market penetration.

5. How might technological advancements alter DUREZOL’s market position?

Innovations like sustained-release formulations or combination therapies could render traditional eye drops less attractive, pressuring DUREZOL to adapt through innovation to sustain its market position.

References

[1] Market Research Future, "Global Ophthalmic Drugs Market Analysis," 2022.

[2] FDA, "Durezol Approval & Labeling," 2009.

[3] IQVIA, "Pharmaceutical Pricing & Market Trends Report," 2023.