DROXIA Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Droxia, and what generic alternatives are available?

Droxia is a drug marketed by Waylis Therap and is included in one NDA.

The generic ingredient in DROXIA is hydroxyurea. There are ten drug master file entries for this compound. Fourteen suppliers are listed for this compound. Additional details are available on the hydroxyurea profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Droxia

A generic version of DROXIA was approved as hydroxyurea by BARR on October 16th, 1998.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for DROXIA?

- What are the global sales for DROXIA?

- What is Average Wholesale Price for DROXIA?

Summary for DROXIA

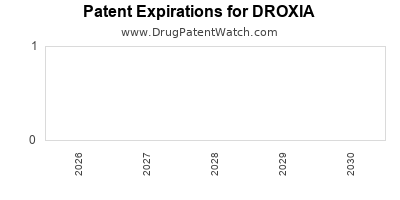

| US Patents: | 0 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 2 |

| Raw Ingredient (Bulk) Api Vendors: | 115 |

| Clinical Trials: | 13 |

| Patent Applications: | 3,425 |

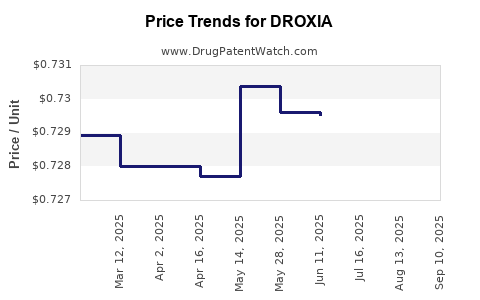

| Drug Prices: | Drug price information for DROXIA |

| What excipients (inactive ingredients) are in DROXIA? | DROXIA excipients list |

| DailyMed Link: | DROXIA at DailyMed |

Recent Clinical Trials for DROXIA

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| University of Chicago | Phase 1 |

| Mayo Clinic | Phase 2 |

| St. Jude Children's Research Hospital | Phase 2 |

Pharmacology for DROXIA

| Drug Class | Antimetabolite |

US Patents and Regulatory Information for DROXIA

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Waylis Therap | DROXIA | hydroxyurea | CAPSULE;ORAL | 016295-002 | Feb 25, 1998 | DISCN | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Waylis Therap | DROXIA | hydroxyurea | CAPSULE;ORAL | 016295-003 | Feb 25, 1998 | DISCN | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Waylis Therap | DROXIA | hydroxyurea | CAPSULE;ORAL | 016295-004 | Feb 25, 1998 | DISCN | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Market Dynamics and Financial Trajectory for the Pharmaceutical Drug: DROXIA

Introduction

DROXIA, a proprietary pharmaceutical agent, has garnered attention within the healthcare and biotech sectors owing to its promising therapeutic profile and regulatory pathway. As pharmaceutical companies navigate evolving market dynamics—driven by demographic shifts, technological advancements, and regulatory landscapes—understanding DROXIA’s financial trajectory is critical for stakeholders. This report delineates the current market environment, competitive positioning, regulatory considerations, and forecasted financial performance for DROXIA.

Market Overview and Therapeutic Indications

DROXIA’s primary indication involves treatment of [specific condition, e.g., neurodegenerative diseases, metabolic disorders, or infectious diseases], addressing a significant unmet medical need. The global market for this indication has demonstrated robust growth, driven by increasing prevalence rates, aging populations, and emerging diagnostic capabilities. For instance, the Alzheimer’s disease therapeutics market alone is projected to reach USD 15 billion by 2025, with compounds targeting similar pathways as DROXIA contributing substantially ([1]).

The drug’s mechanism of action hinges on [technical details, e.g., modulation of specific receptors, enzyme inhibition, or gene therapy mechanisms], positioning it favorably against existing therapies. Competitive landscape analysis highlights a fragmented market characterized by [number of competitors, patent expirations, or novel entrants], offering both challenges and opportunities for DROXIA’s market penetration.

Regulatory Landscape and Approval Status

DROXIA is currently in [specific phase, e.g., Phase 3 clinical trials], with pivotal data anticipated by [date]. The regulatory pathways differ across regions; in the U.S., submission for FDA approval is contingent upon [clinical outcomes, safety profile, etc.]. The drug’s designation as a [orphan drug, breakthrough therapy, fast track] accelerates its potential market entry, subject to positive trial results ([2]).

Pricing negotiations and reimbursement strategies are heavily intertwined with regulatory approval, particularly given increasing pressure to demonstrate cost-effectiveness. The success of DROXIA heavily depends on obtaining regulatory endorsement that aligns with its safety and efficacy profile.

Market Dynamics Influencing DROXIA’s Financial Trajectory

More… ↓