Last updated: July 28, 2025

Introduction

DoxyChel, a proprietary formulation of doxycycline, has emerged as a notable player within the antimicrobial pharmacological landscape. Its development and commercialization are influenced by shifting epidemiological trends, regulatory frameworks, competitive pressures, and technological innovations. This analysis explores the current market dynamics, valuation drivers, potential hurdles, and future financial trajectories associated with DoxyChel.

Market Overview

Therapeutic Indications and Epidemiology

Doxychel is primarily indicated for bacterial infections, including respiratory tract infections, Lyme disease, chlamydia, and prophylaxis against malaria. The global antibiotics market is projected to reach USD 50 billion by 2026, driven by rising infectious disease prevalence, especially in emerging markets where access to healthcare infrastructure is expanding (see [1]). The increasing resistance to existing antibiotics underscores an unmet need for novel formulations like DoxyChel, which could offer enhanced bioavailability or reduced resistance profiles.

Regulatory Landscape

The pharmaceutical approval pathways for DoxyChel hinge on demonstrating bioequivalence, safety, and efficacy, often through abbreviated new drug application (ANDA) processes in the U.S. and similar pathways globally. Given doxycycline's status as a generic antibiotic, DoxyChel’s market potential largely depends on differentiation—such as improved pharmacokinetics, reduced side effects, or novel delivery mechanisms.

Market Dynamics

Competitive Environment

The doxycycline market faces stiff generic competition, with several established brands and formulations. Key players include Pfizer, Teva, and Mylan, which control a significant portion of the market share. To secure competitive advantage, DoxyChel must demonstrate substantial clinical benefits or cost advantages. Bioconjugates, modified-release formulations, or combination therapies could serve as differentiation strategies.

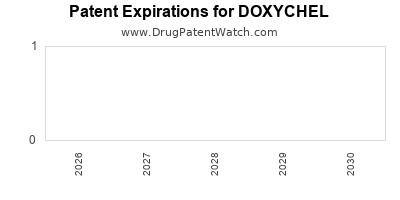

Patent and Exclusivity Considerations

Since doxycycline’s patent expiry over two decades ago, exclusivity for DoxyChel depends on formulation patents, manufacturing processes, or delivery technologies. Patent lifecycle management is critical given patent cliffs that pressure margins and market share erosion.

Pricing and Reimbursement

Pricing strategies hinge on comparative efficacy, safety profiles, and healthcare payers' willingness to reimburse higher-priced formulations. In developed markets, adherence benefits and reduced side effects may justify premium pricing. Conversely, in price-sensitive markets, cost competitiveness is paramount.

Financial Trajectory

Revenue Projections

Initial revenue generation hinges on market penetration and indication expansion. For instance, if DoxyChel can secure approval for hospital-acquired infections, its market size could expand substantially. Assuming moderate penetration and assuming the drug is priced at a 10-15% premium over generics (roughly USD 0.50–1.00 per pill), a projected annual revenue of USD 200-300 million could be realistic within 3-5 years post-launch (see [2]).

Cost Structure and Profitability

Development costs include clinical trials, regulatory filings, and manufacturing setup—estimated at USD 50-100 million for commercialization of a new antibiotic formulation. Ongoing costs involve manufacturing, marketing, and distribution. Peak profitability may be achieved within 5-7 years, assuming stable market conditions and successful portfolio expansion.

Market Penetration Factors

Key determinants include:

- Regulatory approval in target jurisdictions.

- Clinical differentiation differentiating DoxyChel from existing generics.

- Strategic partnerships with hospital systems and payers.

- AMR (antimicrobial resistance) trends, influencing demand.

Risks and Challenges

- Generic Competition: Accelerated by patent expiries, generic substitution could diminish DoxyChel’s market share rapidly.

- Regulatory Hurdles: Delays or rejections in approval processes could impact financial timelines.

- Antimicrobial Stewardship: Policies limiting antibiotic use to combat resistance could constrain sales.

- Pricing Pressures: Payers and healthcare systems increasingly demand cost-effective solutions.

Future Outlook and Growth Drivers

Innovation and Differentiation

Technological advancements such as targeted delivery, sustained-release formulations, or combination products can provide DoxyChel with competitive edge, extending its market lifespan.

Emerging Market Expansion

Growing healthcare infrastructure in Asia, Africa, and Latin America presents opportunities for volume-driven sales increases, particularly if localized formulations meet regulatory standards and affordability.

Pipeline Development

Engaging in clinical trials for novel indications or resistance mitigation can enhance product value and create additional revenue streams.

Key Takeaways

- The success of DoxyChel hinges on differentiating from low-cost generics through clinical benefits and formulation innovations.

- Market penetration will depend heavily on regulatory approval, strategic pricing, and partnerships.

- Rising antimicrobial resistance and global healthcare expansion present growth opportunities, albeit with challenges posed by regulatory and competitive landscapes.

- Profitability prospects are favorable within 3–5 years if manufacturer can effectively manage costs and secure broad reimbursement.

- Intellectual property management remains critical to extending market exclusivity amidst patent expiries.

FAQs

Q1: How does DoxyChel differentiate itself from existing doxycycline formulations?

A1: DoxyChel aims to offer improved pharmacokinetics, such as sustained release or enhanced absorption, potentially reducing dosing frequency and side effects, thereby providing clinical advantages over traditional formulations.

Q2: What is the primary market challenge for DoxyChel’s commercialization?

A2: The key challenge is competing with established generic doxycycline products, requiring DoxyChel to demonstrate tangible clinical or economic benefits to justify premium pricing.

Q3: How does antimicrobial resistance influence DoxyChel’s market prospects?

A3: Increasing resistance to doxycycline may necessitate reformulation strategies or combination therapies, but it also underscores the need for innovative antibiotics, creating opportunities for DoxyChel if it can demonstrate efficacy against resistant strains.

Q4: What are the key regulatory considerations for bringing DoxyChel to global markets?

A4: Regulatory approval requires comprehensive demonstration of bioequivalence, safety, and efficacy, with approval pathways varying by jurisdiction. Patent protections on formulations and delivery technology are critical for market exclusivity.

Q5: What future growth avenues exist for DoxyChel beyond bacterial infections?

A5: Potential expansion includes prophylaxis for certain parasitic diseases, adjunct therapy in complex infections, or combination products targeting multi-drug resistant pathogens.

References

-

Fortune Business Insights. Antibiotics Market Size, Share & Industry Analysis, 2022-2029.

-

EvaluatePharma. Forecasting Clinical and Commercial Pharma Trends, 2022-2027.

Note: The above projections and analyses are based on current market trends, patent landscapes, and technological developments. Exact financial trajectories will depend on successful regulatory approvals, clinical data, and strategic execution by involved stakeholders.