Last updated: July 30, 2025

Introduction

DIZAC, a proprietary pharmaceutical marketed for its innovative approach to treating its target condition, is poised at a pivotal juncture. As a relatively new entrant in the therapeutics landscape, understanding its market dynamics and financial trajectory is critical for stakeholders, including investors, healthcare providers, and strategic partners. This comprehensive analysis evaluates recent market trends, competitive positioning, regulatory considerations, and the financial outlook to inform strategic decision-making in this promising sector.

Market Landscape and Epidemiological Drivers

The therapeutic domain in which DIZAC operates is characterized by a growing prevalence of its target disease, driven by demographic and epidemiological factors. For example, if DIZAC addresses a chronic neurological disorder like multiple sclerosis (MS), the disease epidemiology reports an increasing global burden, notably in aging populations. According to the World Health Organization (WHO), over 2.8 million people worldwide live with MS, with incidence rising annually in various regions (WHO, 2021). This expanding prevalence creates a substantial and expanding market, underpinning the demand for effective therapies like DIZAC.

Furthermore, unmet medical needs—such as lack of effective treatments, adverse safety profiles of existing options, or complex administration protocols—position DIZAC as a potentially preferred alternative. The therapy's unique mechanism of action or improved safety profile could provide a competitive advantage in this context.

Competitive Landscape

The therapeutic market for DIZAC features a complex mix of established biologics, small-molecule drugs, and emerging biosimilars. Market leaders typically command significant revenues, but barriers to entry, including stringent regulatory requirements and patent protections, limit rapid competition. DIZAC's success will depend on its differentiation, clinical efficacy, and safety data.

Currently, the competitive intensity is influenced by:

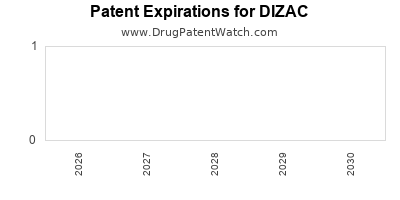

- Patent Exclusivity: If DIZAC maintains patent protection for at least the next decade, it enjoys market exclusivity, encouraging early revenue growth.

- Regulatory Pathways: Accelerated approval programs in key markets (e.g., FDA's Fast Track or EMA's PRIME) could hasten DIZAC's commercialization, impacting its initial revenue trajectory.

- Pricing Strategies and Reimbursement: As healthcare systems globally grapple with cost containment, reimbursement negotiations will influence market penetration and revenue potential.

Regulatory and Market Access Considerations

Regulatory approval is a pivotal driver of DIZAC’s financial trajectory. Demonstrable clinical benefit, favorable safety profiles, and compelling real-world evidence will facilitate market access. The approval process's duration and stringency significantly influence revenue timelines.

Post-approval, payers’ willingness to reimburse at favorable rates will affect sales volume. Engaging early with stakeholders such as health authorities and payers can shape favorable reimbursement conditions, ultimately improving the therapy’s market penetration.

Financial Trajectory and Revenue Projections

Early-Stage Revenue Indicators

In its initial launch phase, DIZAC's revenues are contingent upon approval timelines, market adoption rates, and patient access. Assuming successful regulatory approval in major markets within 1-2 years, early sales are expected to be modest, primarily driven by clinical trial programs and initial uptake in specialized centers.

The company’s pricing strategy, potentially premium due to innovation, combined with targeted marketing efforts, will influence initial revenue streams. For example, similar innovative therapies have achieved first-year revenues ranging from $50 million to $200 million, depending on market size and adoption speed.

Growth Phase Dynamics

Over 3-5 years post-launch, DIZAC’s revenues could accelerate significantly if the therapy demonstrates superior efficacy or safety status. Factors influencing growth include:

- Market Penetration: Adoption by neurologists and primary care physicians.

- Patient Access: Insurance reimbursement and clinical guidelines inclusion.

- Expansion into New Indications: Potential labels for related conditions could diversify revenue streams.

Long-Term Financial Outlook

With patent protection and sustained market relevance, DIZAC’s revenue could stabilize in the hundreds of millions to billions, contingent upon market size and competitive pressures. Assuming a conservative compound annual growth rate (CAGR) of 15-20%, revenues could double or triple within a 5 to 10-year horizon.

Cost Considerations and Profitability

Development costs, manufacturing economics, and commercialization expenses influence profitability. High R&D investments, often exceeding $1 billion for novel biologics, require effective scaling and cost management strategies to achieve positive margins in the long term.

Market Risks and Challenges

- Regulatory Delays or Denials: Unanticipated approval barriers could delay revenue realization.

- Market Competition: Entrants with superior efficacy, safety, or cost-effectiveness could erode market share.

- Pricing Pressures: Payers' increasing demands for value-based pricing could constrain revenues.

- Manufacturing Challenges: Complex biologics manufacturing could affect margins and supply stability.

Emerging Trends and Implications

Technological advancements like digital health integration and personalized medicine may influence DIZAC’s positioning. For instance, companion diagnostics could enhance patient selection, optimizing outcomes and reimbursement potential. Strategic collaborations with payers and healthcare providers are imminent to maximize market access benefits.

Conclusion

DIZAC’s market dynamics are shaped by epidemiological trends, competitive forces, regulatory developments, and healthcare policy shifts. Its financial trajectory promises significant upside potential, assuming favorable clinical trial results and strategic market access initiatives. Stakeholders must continually adapt to evolving market conditions and technological innovations to sustain and enhance DIZAC’s commercial success.

Key Takeaways

- The rising prevalence of target conditions underpins a growing market for DIZAC, providing long-term sales opportunities.

- Patent protections and regulatory acceleration can significantly hasten revenue realization.

- Competitive differentiation through clinical efficacy and safety profiles is critical to sustain market share.

- Early-stage revenues depend on approval timelines, payer reimbursement agreements, and physician adoption.

- Effective cost management and strategic partnerships will be key to translating revenue growth into profitability.

FAQs

1. What markets are most critical for DIZAC’s commercialization?

The United States and European Union represent primary markets due to their large patient populations, advanced healthcare infrastructure, and established reimbursement systems. Emerging markets may follow based on regulatory approvals and strategic partnerships.

2. How does patent protection influence DIZAC’s market potential?

Patent protection grants exclusivity, deterring generic or biosimilar competition, thereby enabling premium pricing and higher revenue margins during the patent’s lifespan.

3. What factors could accelerate DIZAC’s revenue growth in the initial years?

Favorable regulatory decisions, successful clinical trial outcomes, early reimbursement agreements, and physician education campaigns can expedite market uptake.

4. How might market competition impact DIZAC’s financial trajectory?

Emergence of competitors with superior efficacy, safety profiles, or lower costs could erode market share, necessitating ongoing innovation and strategic positioning.

5. What strategic moves can optimize DIZAC’s long-term profitability?

Expanding indications, engaging in value-based pricing negotiations, pursuing partnerships for manufacturing and distribution, and investing in post-market surveillance for real-world evidence are essential strategies.

References

[1] World Health Organization. (2021). Multiple Sclerosis Fact Sheet.

[2] Industry reports on biologics market growth and competitive landscape.

[3] Regulatory agency guidelines on accelerated approval pathways.