Last updated: July 28, 2025

Overview of DIURIL

DIURIL (chlorothiazide) is a thiazide diuretic primarily indicated for the treatment of hypertension and edema-related conditions. First approved by the FDA in 1958, DIURIL remains a widely prescribed medication in the antihypertensive class, owing to its proven efficacy, affordability, and established safety profile. As a staple in cardiovascular management, DIURIL's market position reflects its historical significance and ongoing therapeutic relevance.

Market Dynamics

1. Therapeutic Landscape and Competitor Profile

The antihypertensive market landscape has evolved significantly, driven by innovations such as ACE inhibitors, ARBs, calcium channel blockers, and novel combination therapies. While thiazide diuretics like DIURIL maintain foundational roles, shifts towards personalized medicine and combination regimens have influenced prescribing trends.

Key competitors include:

- Hydrochlorothiazide (HCTZ): The most widely prescribed thiazide diuretic, often favored for its availability in combination pills.

- Indapamide and Metolazone: Offer longer durations of action and are used for specific indications.

- Newer classes: ACE inhibitors (e.g., enalapril), ARBs (e.g., losartan), and calcium channel blockers (e.g., amlodipine), which have gained prominence due to better side effect profiles in some patient populations.

Despite competitive pressures, DIURIL’s low cost and longstanding clinical evidence sustain its usage, especially in resource-constrained settings.

2. Regulatory and Patent Landscape

DIURIL is classified as a branded generic with no current patent protections, which encourages generic manufacturing and price competition. The expiration of any potential patents facilitates entry of generics, increasing affordability but exerting downward pricing pressure on revenue streams.

3. Prescribing Trends and Demographics

Globally, hypertension prevalence continues to rise, with projected increases in low- and middle-income countries (LMICs), where affordable treatments like DIURIL are vital. In high-income countries, however, newer medications often supplant traditional diuretics due to concerns about metabolic side effects.

Prescribing data indicates steady usage in:

- Elderly populations, where diuretics remain first-line therapy in certain guidelines.

- Patients with edema, heart failure, or specific comorbid conditions.

4. Market Drivers

Key drivers shaping DIURIL's market include:

- Global hypertension burden: The WHO estimates over 1.2 billion affected individuals, emphasizing the ongoing demand for antihypertensives.

- Cost-effectiveness: Its generics appeal to healthcare systems emphasizing affordability.

- Clinical guidelines: European and American guidelines endorse diuretics like DIURIL as first-line agents under certain circumstances.

5. Market Challenges

Challenges confronting DIURIL include:

- Adverse metabolic effects: Electrolyte imbalances, glucose intolerance, and lipid alterations may limit suitability.

- Emerging combination therapies: Fixed-dose combinations with other antihypertensives reduce pill burden but may favor newer agents.

- Pharmacogenomics: Variability in response necessitates personalized therapy, sometimes relegating DIURIL to second-line use.

Financial Trajectory

1. Revenue Trends

Historically, DIURIL has enjoyed consistent, albeit modest, revenue streams driven by its low manufacturing costs and widespread use. Global revenue estimates for diuretics projected at billions annually, with DIURIL contributing a significant share due to its legacy status.

In mature markets, revenue growth is plateauing or declining:

- United States: Prescription volumes have stabilized amid declining use in favor of newer agents.

- Emerging markets: Demand remains robust, driven by affordability and disease burden.

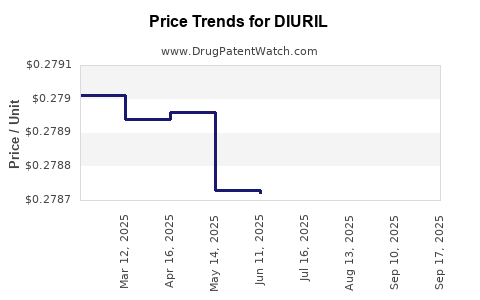

2. Market Penetration and Pricing Strategy

The commoditized nature of DIURIL results in limited pricing power. Generics dominate, with prices significantly lower than branded counterparts. This dynamic favors volume over margins, focusing on maintaining market share.

Pharmaceutical companies leveraging DIURIL often employ strategic approaches such as:

- Geographic expansion: Targeting LMICs with high hypertension prevalence.

- Formulation innovations: Developing controlled-release or combination formulations to extend lifecycle and differentiate products.

3. Impact of Patent Expiry and Generics

Patent expirations have historically led to revenue erosion. Manufacturers adapt by:

- Introducing improved formulations.

- Entering emerging markets with aggressive pricing.

- Diversifying portfolios with newer antihypertensives.

4. Regulatory and Reimbursement Factors

Reimbursement policies influence profitability. Countries with universal healthcare systems tend to favor cost-effective drugs like DIURIL. Conversely, healthcare systems emphasizing newer, patented medications may see reduced DIURIL prescriptions, impacting revenue.

5. Future Revenue Projections

Projections indicate a slow decline in developed nations' markets due to saturation and emerging preferences for newer drugs. Conversely, in LMICs, demand remains high, supported by governments emphasizing affordable medications. The global market for diuretics is expected to grow modestly, with compound annual growth rates (CAGR) of approximately 2-4% over the next five years, primarily fueled by the expansion in emerging markets.

6. Emerging Opportunities

Innovative formulations, such as combination therapies integrating DIURIL with agents like ACE inhibitors, may revitalized demand. Additionally, the increasing focus on medication adherence can create demand for fixed-dose combinations containing DIURIL.

Conclusion

The market dynamics of DIURIL are characterized by its longstanding role and the pressures of evolving therapeutic standards. While global demand persists—particularly in resource-limited settings—the trend toward newer antihypertensive agents challenges its growth trajectory. Financially, DIURIL’s prospects hinge on geographic expansion, formulation innovation, and strategic positioning within the competitive landscape.

Key Takeaways

- Steady Demand in Emerging Markets: DIURIL remains crucial in LMICs due to affordability and the high prevalence of hypertension.

- Market Saturation in Developed Countries: Usage stabilizes or declines in high-income nations, influenced by newer antihypertensives.

- Pricing and Generic Competition: Limited pricing power constrains revenue growth; volume sales sustain profitability.

- Innovation Opportunities: Fixed-dose combinations and sustained-release formulations can extend product lifecycle.

- Impact of Regulatory Policies: Reimbursement schemes and clinical guidelines significantly shape DIURIL’s market trajectory.

FAQs

Q1: What are the main factors affecting DIURIL’s market share?

A1: Factors include competition from newer antihypertensive drugs, rising preference for combination therapies, safety profile considerations, and pricing dynamics, especially with generic competition.

Q2: How does market expansion in developing countries influence DIURIL’s financial prospects?

A2: Growing hypertension prevalence and government initiatives favoring affordable medications sustain demand, offering growth opportunities despite mature markets’ saturation.

Q3: Are there any regulatory hurdles impacting DIURIL’s market?

A3: Patent expirations facilitate generic entries, reducing prices but potentially impacting margins. Regulatory approval for new formulations or combinations can extend product relevance.

Q4: Can innovation in formulation improve DIURIL’s market outlook?

A4: Yes, sustained-release formulations and fixed-dose combinations can enhance adherence, differentiate products, and potentially revive declining sales.

Q5: What is the long-term outlook for DIURIL’s revenue?

A5: Revenue is expected to decline slowly in developed markets due to saturation and preference shifts but will remain stable or grow marginally in emerging markets, driven by affordability and rising disease burden.

References

[1] World Health Organization. (2021). Hypertension Fact Sheet.

[2] U.S. Food and Drug Administration. (2022). Drug Approvals and Labeling.

[3] MarketWatch. (2023). Global Diuretics Market Analysis.

[4] GlobalData. (2022). Hypertension Treatment Market Trends.

[5] European Society of Cardiology Guidelines. (2018). Hypertension Management.