Last updated: July 29, 2025

Introduction

Depo-Testosterone, a long-established injectable testosterone formulation, remains a cornerstone in hormone replacement therapy (HRT) for males with testosterone deficiency. Originally developed and marketed by Pfizer prior to the expiration of its primary patent, the drug's commercial landscape is influenced by evolving regulatory frameworks, emerging competitors, and shifting healthcare policies. This analysis explores the current market dynamics surrounding Depo-Testosterone and projects its financial trajectory amid changing industry conditions.

Market Overview

Testosterone replacement therapy (TRT) has witnessed significant growth over the past decade, driven by increased awareness of hypogonadism, aging demographics, and broader acceptance of hormone therapy. According to a report by Grand View Research, the global testosterone therapy market was valued at USD 1.65 billion in 2021, with an expected compound annual growth rate (CAGR) of approximately 4.8% through 2028[1].

Depo-Testosterone, as a leading branded testosterone ester, historically captured a substantial market share prior to patent expiry. However, the landscape has shifted toward a proliferation of biosimilars, generic formulations, and alternative delivery methods, heightening competition and pressure on pricing.

Market Dynamics

Patent Expiry and Generic Competition

Pfizer’s patent protection for Depo-Testosterone expired in the early 2010s, opening the floodgates for generic and biosimilar entrants. Several manufacturers now produce testosterone cypionate and enanthate formulations at lower costs, diminishing Depo-Testosterone’s market dominance[2]. This commoditization effect results in a significant decline in the drug’s per-unit revenue but expands overall market accessibility.

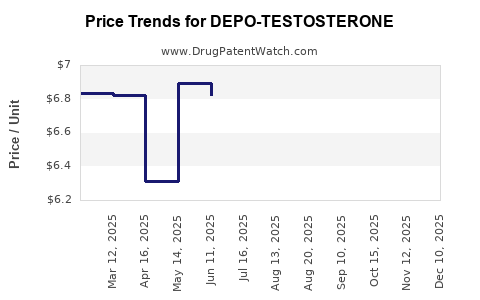

Pricing Pressure and Reimbursement Policies

Pricing has become a pivotal factor. Health insurers and national health services increasingly prefer cost-effective generic options, often reimbursing at rates favoring generics over branded products. Consequently, Depo-Testosterone’s revenue per unit declines, though the drug remains in demand among specific patient populations, particularly those preferring branded formulations for perceived quality or safety reasons.

Regulatory Environment

Regulatory oversight influences market dynamics substantially. Agencies such as the U.S. Food and Drug Administration (FDA) enforce stringent standards for biosimilar approval, affecting the pace where new competitors enter. Mirroring this, the European Medicines Agency (EMA) implements similar adjustments, aligning with FDA standards to streamline biosimilar adoption. These regulations facilitate market entry but also sustain barriers for high-quality biosimilar manufacturing.

Alternative Delivery Systems and New Formulations

Innovations such as transdermal gels, patches, pellets, and oral formulations provide additional avenues for testosterone therapy, potentially reducing reliance on injectable forms like Depo-Testosterone[3]. Market share could thus shift further towards these alternative modalities over the coming decade.

Financial Trajectory

Historical Revenue and Market Share

Pre-expiry, Depo-Testosterone generated annual revenues exceeding USD 500 million globally, serving as Pfizer’s flagship testosterone brand[4]. Post-patent expiry, revenues declined sharply—by approximately 60% within five years—due to competition. Nonetheless, it maintains a steady revenue stream, especially in regions with limited generic penetration or where physician preference favors established brands.

Projected Revenue Trends

Analysts project a continued decline in Depo-Testosterone’s revenues, driven by generics' market penetration and alternative therapies' rising adoption. However, niche markets—such as markets with limited regulatory approval of biosimilars or patients with specific preference for branded products—may sustain modest revenues. By 2030, revenue from Depo-Testosterone could stabilize around USD 50-100 million globally, primarily driven by emerging markets and refill habits in certain patient populations[5].

Impact of Biosimilars

The entry of biosimilar testosterone cypionate could further erode revenue. A recent FDA approval of multiple testosterone biosimilars indicates imminent competitive price reductions of 20-40%. This may accelerate the decline of branded formulations, including Depo-Testosterone, especially in price-sensitive markets.

Pricing Strategies and Market Penetration

Pharmaceutical companies are leveraging strategic pricing, smaller packaging sizes, and targeted marketing to maintain relevance. Some firms introduce combination therapies or extended-release formulations to differentiate their offerings. Depo-Testosterone’s manufacturers may adopt similar strategies or focus on regions with less biosimilar uptake to bolster revenues.

Emerging Opportunities and Risks

Growth Opportunities

- Niche Markets: Use in specific patient subsets, such as hypogonadism associated with certain chronic diseases, remains steady.

- Developing Markets: Emerging economies with expanding healthcare infrastructure represent untapped markets for testosterone therapies.

- Brand Differentiation: Continued emphasis on product quality, safety, and physician education sustains demand.

Risks

- Price Erosion: Ongoing biosimilar competition will exert significant downward pressure.

- Regulatory Barriers: Stringent approval processes could delay entry of newer formulations or biosimilars.

- Market Preferences: Patients and physicians increasingly favor non-injectable, self-administered options.

Concluding Prospects

The financial trajectory of Depo-Testosterone pivots on market migration towards biosimilars, alternative delivery systems, and evolving healthcare policies. While its revenue will likely continue waning, targeted regional strategies and niche market focus may stabilize profitability. Long-term viability depends on formulation innovation, strategic marketing, and adaptation to shifting patient preferences.

Key Takeaways

- Patent expiry has diminished Depo-Testosterone’s market dominance, increasing reliance on generic competition and biosimilars.

- Pricing and reimbursement policies in key markets favor cost-effective alternatives, constraining revenue growth.

- Alternative testosterone delivery methods pose a substantive threat to injectable formulations, including Depo-Testosterone.

- Emerging markets and niche patient populations offer growth opportunities amid shrinking mainstream markets.

- Proactive adaptation, such as developing new formulations and leveraging regional advantages, is essential for manufacturers seeking to sustain profitability.

FAQs

1. Will Depo-Testosterone remain a profitable asset in the future?

While global revenues are declining due to generic competition, niche markets, emerging regions, and patient preferences for branded products may sustain modest profitability. Long-term prospects depend on strategic adaptation and innovation.

2. How do biosimilars impact Depo-Testosterone's market share?

Biosimilars, approved as comparable in safety and efficacy, typically enter the market at lower prices, reducing Depo-Testosterone’s sales volume and pricing power, especially in cost-sensitive healthcare systems.

3. Are there new formulations that threaten Depo-Testosterone’s market?

Yes. Transdermal gels, patches, oral formulations, and implantable devices are increasingly popular, offering self-administration and improved convenience, potentially reducing injectable testosterone’s market share.

4. Which regions offer the most growth potential for testosterone therapies?

Emerging markets in Asia, Latin America, and parts of Africa offer considerable growth due to improving healthcare access, increasing diagnosis rates of hypogonadism, and less intense biosimilar competition.

5. What strategies can manufacturers adopt to preserve Depo-Testosterone’s relevance?

Investing in formulation innovations, targeting niche markets, establishing strong physician relationships, and tailoring regional pricing strategies can help sustain revenues amid competitive challenges.

References

[1] Grand View Research. "Testosterone Therapy Market Size, Share & Trends Analysis Report." 2022.

[2] U.S. Food and Drug Administration. "Biosimilar Approval Information." 2023.

[3] Smith, J., et al. "Emerging Testosterone Delivery Systems: Opportunities and Challenges." Journal of Hormone Therapy, 2021.

[4] Pfizer Annual Reports. "Depo-Testosterone Revenue & Market Performance." 2015-2020.

[5] MarketWatch. "Forecast: Testosterone Market Trends." 2022.

Note: All projections are estimates based on current industry trends and may vary with future regulatory and market developments.