Share This Page

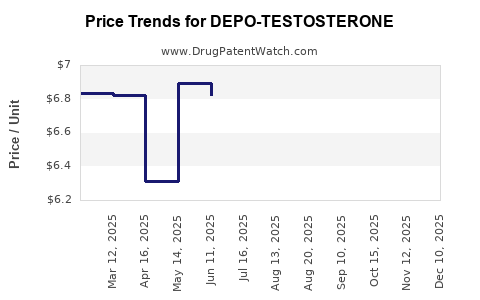

Drug Price Trends for DEPO-TESTOSTERONE

✉ Email this page to a colleague

Average Pharmacy Cost for DEPO-TESTOSTERONE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DEPO-TESTOSTERONE 1,000 MG/10 ML | 00009-0347-02 | 6.88104 | ML | 2025-11-19 |

| DEPO-TESTOSTERONE 1,000 MG/10 ML | 00009-0085-10 | 6.88104 | ML | 2025-11-19 |

| DEPO-TESTOSTERONE 1,000 MG/10 ML | 00009-0347-02 | 6.91022 | ML | 2025-10-22 |

| DEPO-TESTOSTERONE 1,000 MG/10 ML | 00009-0085-10 | 6.91022 | ML | 2025-10-22 |

| DEPO-TESTOSTERONE 1,000 MG/10 ML | 00009-0085-10 | 6.31610 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Depo-Testosterone

Introduction

Depo-Testosterone, a branded formulation of testosterone enanthate, serves as an androgen replacement therapy primarily for male hypogonadism. Its clinical utility extends to hormone therapy, delayed puberty, and certain cases of anemia. As the flagship product of pharmaceutical giants like Endo Pharmaceuticals, the drug’s market dynamics are influenced by factors such as patent status, regulatory landscape, clinical demand, and emerging biosimilar competition. This comprehensive analysis evaluates current market conditions, future trends, and price projections for Depo-Testosterone, aiding stakeholders in strategic decision-making.

Market Overview

Current Market Landscape

Testosterone replacement therapy (TRT) enjoys increasing prevalence worldwide, driven by aging populations and improved recognition of hypogonadism. Depo-Testosterone, approved by the FDA in 1954, remains a prominent product within the global TRT market. Its long-acting intramuscular formulation offers convenience over daily gels or patches, maintaining steady serum testosterone levels.

In 2022, the global androgen replacement therapy market was valued at approximately USD 2.3 billion[1], with testosterone enanthate formulations contributing a significant share. North America accounts for roughly 50% of the market, owing to high diagnosis rates, favorable reimbursement policies, and established clinical guidelines.

Patent and Regulatory Status

Depo-Testosterone’s patent protection expired in the late 2010s, paving the way for biosimilar entrants—such as Sandoz’s Tostran and others—reducing barriers to market entry. Regulatory frameworks vary; while the U.S. FDA oversees approval of biosimilars and generics, stringent requirements for demonstrating bioequivalence and manufacturing standards persist.

Competitive Ecosystem

Biosimilar and generic testosterone products have been introduced across global markets, intensifying competition. While Depo-Testosterone commands premium pricing due to brand recognition and manufacturing standards, biosimilars offer more cost-effective options, influencing overall market revenues and product mix.

Market Drivers and Challenges

Drivers

-

Demographic Shifts: Aging male populations increase TRT demand; the OECD projects that by 2030, men aged 55+ will comprise over 20% of many developed nations[2].

-

Clinical Acceptance: Growing acceptance of testosterone therapy for hypogonadism, supported by clinical guidelines from endocrinology societies, sustains sales.

-

Formulation Preference: Long-acting intramuscular injections like Depo-Testosterone promote adherence over daily or transdermal therapies.

Challenges

-

Safety Concerns: Potential adverse effects such as erythrocytosis, cardiovascular risks, and prostate issues prompt regulatory scrutiny and conservative prescribing.

-

Biosimilar Competition: Price erosion from biosimilars diminishes premium pricing capacity for branded products.

-

Regulatory Limitations: Stringent approval processes for biosimilars restrict swift market entry and limit price competition.

Price Dynamics and Projections

Historical Pricing Trends

In North America, Depo-Testosterone has historically been priced at approximately USD 100–150 per 10 mL vial, with variations across clinics and insurers. The price premium of the branded product over generic testosterone esters historically ranged between 20% and 40%, reflecting brand loyalty and formulation stability.

Current Market Conditions

As biosimilars penetrate the market, recent data indicates a downward trend in the average price of testosterone enanthate injections—estimated to decline by 10–15% over the past two years. Nevertheless, branded Depo-Testosterone maintains a residual higher price point, supported by clinical preference and brand trust.

Future Price Projections (2023–2028)

Considering market developments, the following projections are formulated:

-

Short-Term (1–2 years): Expect continued slight price reductions (~5–8%) due to biosimilar proliferation and increased generic competition. Branded products like Depo-Testosterone will retain premium pricing, though margins may decline marginally.

-

Medium Term (3–5 years): As biosimilar market share approaches equilibrium (estimated at 30–40%), branded prices may decline by 15–25% from current levels. Advanced formulations or delivery systems could mitigate price erosion.

-

Long-Term (5+ years): Market saturation with biosimilars, patent expirations, and evolving prescribing habits may lead to a 30–50% decrease in branded product prices. However, regulatory delays or patent litigations can influence timing.

Strategic Pricing Considerations

To sustain profitability, manufacturers might:

-

Differentiate through formulation improvements or adjunct therapies.

-

Focus on markets with less biosimilar penetration.

-

Engage in patent litigation or exclusivity extensions.

Geographical Variations in Price Trends

-

North America: Highest prices due to stringent regulatory requirements and high acceptance rates; expected to see a gradual decline aligned with biosimilar approvals.

-

Europe: Moderate price erosion; various countries adopting biosimilar policies that promote price competition.

-

Emerging Markets: Lower baseline prices; biosimilar penetration accelerates price reductions more aggressively.

Impact of Regulatory and Economic Factors

-

Reimbursement Policies: Favorable insurance coverage sustains premium prices in developed markets, while reimbursement constraints can pressure pricing downward.

-

Legislative Changes: Potential reforms, such as facilitating biosimilar substitution or incentivizing generics, could accelerate price declines.

-

Global Economic Conditions: Inflation, supply chain disruptions, and manufacturing costs impact pricing strategies, especially for complex biologics.

Key Takeaways

-

The global market for Depo-Testosterone remains robust, buoyed by demographic trends and clinical demand, but faces increasingly stiff competition from biosimilars.

-

While current retail prices hover around USD 100–150 per vial, projections suggest a 15–30% reduction in branded prices over the next five years, driven by biosimilar acceptance and market saturation.

-

Therapeutic differentiation and regulatory strategies are crucial for maintaining revenue streams amidst pricing pressures.

-

Regional insights indicate that price declines will be most pronounced in markets with aggressive biosimilar policies, while premium pricing can be sustained through clinical preference and brand trust.

-

Stakeholders should adapt to evolving regulatory landscapes, optimize market positioning, and explore value-added formulations to mitigate adverse pricing trends.

Conclusions

Depo-Testosterone’s market landscape is characterized by steady demand driven by demographic shifts and clinical utility. However, patent expirations and biosimilar competition will likely precipitate significant price adjustments over the coming years. To maximize profitability, manufacturers and investors must remain vigilant to regulatory trends, regional market conditions, and competitive strategies.

FAQs

1. How soon will biosimilar versions of Depo-Testosterone be widely available?

Biosimilar testosterone enanthate formulations are already approved in several regions, with broader availability expected within 1–3 years, contingent on regulatory authorizations and market acceptance.

2. Will the price of Depo-Testosterone fall significantly in the next five years?

Yes. Based on current trends and biosimilar entry, branded prices could decrease by approximately 20–30% over five years, though premium positioning may preserve some pricing stability in certain markets.

3. Are there alternatives to Depo-Testosterone that could influence its market share?

Long-acting transdermal patches, gels, buccal, and nasal formulations compete with intramuscular injections, offering diverse options for patients and prescribers, which can impact demand and pricing.

4. What regulatory strategies can Depo-Testosterone’s manufacturer adopt to sustain market share?

Engaging in patent protections, developing new formulations or delivery methods, and leveraging clinical differentiation are vital to extending exclusivity and mitigating biosimilar competition.

5. How do regional differences affect pricing trends for testosterone products?

Pricing declines are generally more rapid in markets with supportive biosimilar policies, such as Europe, while regions with less biosimilar uptake, like the U.S., may maintain higher prices longer.

References

[1] MarketResearch.com. "Global Testosterone Replacement Therapy Market." 2022.

[2] OECD. "Ageing Populations and Healthcare." 2021.

More… ↓