Last updated: July 29, 2025

Introduction

DEPAKOTE CP (divalproex sodium extended-release, enteric-coated tablets) has established itself as a pivotal medication primarily for managing bipolar disorder, epilepsy, and migraine prophylaxis. With its unique pharmacokinetic profile and recognized efficacy, its market dynamics are influenced by evolving clinical guidelines, competitive landscape, regulatory shifts, and global health trends. This analysis explores the current market environment, growth drivers, competitive positioning, and future financial trajectories of DEPAKOTE CP.

Market Overview and Positioning

Since its approval, DEPAKOTE CP has benefitted from its extended-release formulation, offering advantages in dosing convenience and improved tolerability over immediate-release variants. Its positioning within the broader anti-epileptic and mood-stabilizing drug markets positions it as both a first-line and adjunct therapy, particularly in North America and Europe. The drug’s long-standing history, combined with its regulatory approvals, underscores its role in standard treatment protocols.

The global epilepsy market is projected to reach approximately USD 10.4 billion by 2028, with mood disorder therapeutics expected to grow at a CAGR of 2.8% over this period [1]. DEPAKOTE CP, as a branded product with established efficacy, occupies a significant market share, especially in developed countries where prescription familiarity and insurance coverage reinforce its sales.

Market Dynamics

1. Clinical Adoption and Prescribing Trends

Clinical guidelines continue to endorse valproate derivatives like DEPAKOTE CP for specific patient populations. However, shifts towards personalized medicine have heightened scrutiny over teratogenicity and hepatotoxicity risks, impacting prescribing patterns—especially for women of childbearing age. These safety concerns have led to a cautious approach, favoring alternative therapies in certain demographics [2].

2. Regulatory Environment and Safety Monitoring

The U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) enforce strict warnings related to fetal risk and liver toxicity associated with valproate-based medications [3]. These regulations affect prescribing behaviors and may influence market penetration. Also, recent regulatory updates necessitate risk mitigation programs, which entail additional post-marketing commitments for manufacturers.

3. Competitive Landscape

DEPAKOTE CP faces competition primarily from generic formulations of valproate and alternative mood stabilizers like lamotrigine, carbamazepine, and newer agents such as lacosamide. The generic erosion is significant, especially in mature markets where patent expirations have intensified price competition. Consequently, revenue from branded DEPAKOTE CP faces downward pressure, although maintained through prescriber loyalty and differentiated formulation benefits.

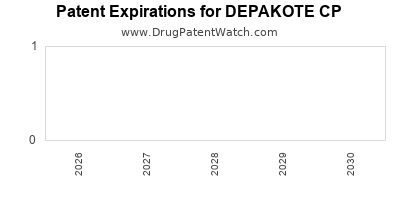

4. Patent and Exclusivity Status

The core patent protection for DEPAKOTE CP has expired or is nearing expiration in several jurisdictions; this trend is forecasted to persist over the next few years. However, formulation patents, method-of-use patents, and regulatory exclusivities can delay generic entry, offering revenue protection albeit temporarily.

5. Pricing and Reimbursement

Pricing strategies for DEPAKOTE CP reflect its branded status, clinical advantages, and safety profile. Reimbursement policies in healthcare systems heavily influence prescribing and dispensation. In regions with extensive insurance coverage, branded medication margins are maintained, while in cost-sensitive markets, generics dominate.

6. Global Market Penetration

Emerging markets offer growth potential, given increasing diagnoses of epilepsy and mood disorders, rising healthcare infrastructure, and expanding insurance coverage. Nevertheless, affordability and regulatory hurdles constrain rapid uptake. Market entry strategies in these regions hinge on licensing, partnerships, and local manufacturing.

Financial Trajectory Analysis

1. Revenue Projections

For the leading pharmaceutical companies with rights to DEPAKOTE CP, revenue projections depend on patent status, competitive pressures, and clinical acceptance. Historically, branded revenues for DEPAKOTE CP in North America and Europe have ranged between USD 400-700 million annually, with a declining trend anticipated as generics penetrate [4].

Projections suggest that without significant new formulations or indications, the drug's revenue will decline at an annualized rate of 3-5% over the next five years, aligning with patent expirations and generic competition. However, strategic marketing, additional indications, and lifecycle management could mitigate some revenue loss.

2. Development of Biosimilars and Generics

The expiry of key patents opens opportunities for generic manufacturers. Price erosion could accelerate as multiple entrants enter the market, potentially reducing the drug's price by 50% or more in some markets [5].

3. Lifecycle and Pipeline

To offset revenue declines, pharmaceutical companies are exploring new formulations, extended indications, or combination therapies involving DEPAKOTE CP. For example, investigational studies on its efficacy in neuropathic pain or off-label uses could provide ancillary revenue streams.

4. Impact of Regulatory and Safety Concerns

Ongoing safety concerns may lead to formulary restrictions, dosage guidelines alterations, or even market withdrawal in extreme cases. These factors could adversely impact sales or necessitate significant investments in risk mitigation.

5. Pricing Strategies and Market Expansion

Premium pricing in North America remains feasible due to clinical familiarity, but price pressures in emerging markets, coupled with affordability issues, favor generics. Strategic alliances, licensing deals, and technological innovations could improve the drug’s financial outlook in diverse markets.

Future Outlook and Strategic Considerations

Market Outlook

The future landscape indicates a gradual decline in DEPAKOTE CP’s branded sales, driven chiefly by patent expirations and safety concerns. Nonetheless, its entrenched position in treatment guidelines, coupled with ongoing safety monitoring, supports a continued, albeit diminishing, market presence.

Strategic Focus Areas

- Lifecycle Management: Developing new formulations, fixed-dose combinations, or extended indications to prolong market relevance.

- Market Diversification: Expanding into emerging markets with tailored pricing and access strategies.

- Regulatory Engagement: Addressing safety concerns proactively to prevent restrictive policies.

- Innovation Pipeline: Investing in research to find safer alternatives or adjuncts that complement DEPAKOTE’s pharmacology.

Investment Implications

Pharmaceutical firms holding rights to DEPAKOTE CP should prepare for revenue erosion due to patent expirations and competitive pressures. Prioritizing lifecycle management and pipeline innovation is critical for sustaining financial viability. For investors, exposure to this asset necessitates cautious evaluation of patent status, pipeline health, and safety regulatory developments.

Key Takeaways

- Market Positioning: DEPAKOTE CP's leadership in epilepsy and bipolar disorder management is challenged by patent expirations, generic competition, and safety concerns.

- Revenue Outlook: Expected to decline at 3-5% annually over the coming five years due to patent cliffs and market saturation.

- Strategic Opportunities: Lifecycle extensions through new formulations, expanding indications, and entering emerging markets can mitigate revenue loss.

- Regulatory and Safety Impact: Increasing safety warnings may restrict prescribing, underscoring the importance of proactive risk management.

- Competitive Landscape: The rise of generics and alternative therapies necessitates differentiation strategies to preserve market share.

FAQs

1. What are the primary indications for DEPAKOTE CP?

DEPAKOTE CP is indicated for epilepsy, bipolar disorder (manic episodes), and migraine prophylaxis. It acts as a mood stabilizer and anticonvulsant with extended-release formulation benefits.

2. How do patent expirations affect DEPAKOTE CP's market?

Patent expirations open the market to generics, significantly reducing prices and branded revenues. This trend erodes market share unless mitigated by lifecycle strategies or new indications.

3. What safety concerns influence DEPAKOTE CP’s market dynamics?

Risks include teratogenicity and hepatotoxicity, leading to strict warnings, risk management protocols, and potential prescribing restrictions, especially for women of childbearing age.

4. Are there ongoing efforts to extend DEPAKOTE CP’s market viability?

Yes, companies are exploring new formulations, fixed-dose combinations, expanded indications, and geographic expansion in emerging markets to prolong its lifecycle.

5. What is the outlook for generic competition?

Generics are expected to dominate due to patent expirations. Price competition will intensify, potentially reducing overall market revenues for branded DEPAKOTE CP over time.

References

[1] Global Market Insights. (2022). Epilepsy Therapeutics Market Size & Share.

[2] U.S. FDA. (2021). Valproate-containing products: Boxed Warning and Contraindications.

[3] European Medicines Agency. (2020). Valproate: Circumstances of Use and Risks.

[4] IQVIA. (2022). Prescription Data and Market Shares.

[5] EvaluatePharma. (2022). Generic Drug Industry Reports.