DELSTRIGO Drug Patent Profile

✉ Email this page to a colleague

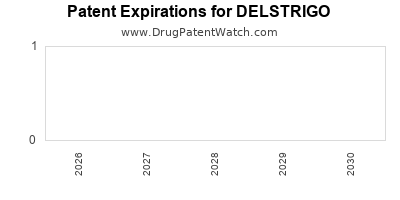

When do Delstrigo patents expire, and when can generic versions of Delstrigo launch?

Delstrigo is a drug marketed by Msd Merck Co and is included in one NDA. There are three patents protecting this drug and one Paragraph IV challenge.

This drug has one hundred and one patent family members in forty-six countries.

The generic ingredient in DELSTRIGO is doravirine; lamivudine; tenofovir disoproxil fumarate. One supplier is listed for this compound. Additional details are available on the doravirine; lamivudine; tenofovir disoproxil fumarate profile page.

DrugPatentWatch® Generic Entry Outlook for Delstrigo

Delstrigo was eligible for patent challenges on August 30, 2022.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be August 30, 2032. This may change due to patent challenges or generic licensing.

There is one Paragraph IV patent challenge for this drug. This may lead to patent invalidation or a license for generic production.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for DELSTRIGO?

- What are the global sales for DELSTRIGO?

- What is Average Wholesale Price for DELSTRIGO?

Summary for DELSTRIGO

| International Patents: | 101 |

| US Patents: | 3 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Clinical Trials: | 11 |

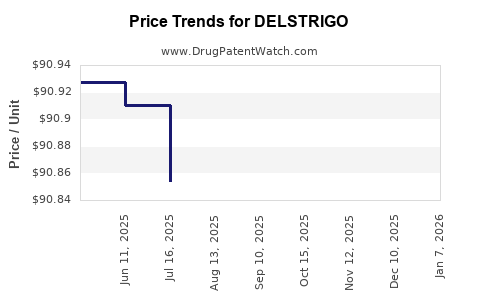

| Drug Prices: | Drug price information for DELSTRIGO |

| What excipients (inactive ingredients) are in DELSTRIGO? | DELSTRIGO excipients list |

| DailyMed Link: | DELSTRIGO at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for DELSTRIGO

Generic Entry Date for DELSTRIGO*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for DELSTRIGO

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Africa Health Research Institute | Phase 3 |

| Liverpool School of Tropical Medicine | Phase 4 |

| Desmond Tutu Health Foundation | Phase 4 |

Pharmacology for DELSTRIGO

Paragraph IV (Patent) Challenges for DELSTRIGO

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| DELSTRIGO | Tablets | doravirine; lamivudine; tenofovir disoproxil fumarate | 100 mg/300 mg/ 300 mg | 210807 | 1 | 2022-08-30 |

US Patents and Regulatory Information for DELSTRIGO

DELSTRIGO is protected by five US patents and one FDA Regulatory Exclusivity.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of DELSTRIGO is ⤷ Get Started Free.

This potential generic entry date is based on patent 8,486,975.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

International Patents for DELSTRIGO

When does loss-of-exclusivity occur for DELSTRIGO?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 0859

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 11235568

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2012024691

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 94377

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 12002744

Estimated Expiration: ⤷ Get Started Free

China

Patent: 2971308

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 30126

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 120503

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0150427

Estimated Expiration: ⤷ Get Started Free

Patent: 0161680

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 16437

Estimated Expiration: ⤷ Get Started Free

Patent: 18774

Estimated Expiration: ⤷ Get Started Free

Patent: 19025

Estimated Expiration: ⤷ Get Started Free

Patent: 19026

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 52902

Estimated Expiration: ⤷ Get Started Free

Patent: 24034

Estimated Expiration: ⤷ Get Started Free

Dominican Republic

Patent: 012000256

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 12012201

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 4804

Estimated Expiration: ⤷ Get Started Free

Patent: 1290976

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 52902

Estimated Expiration: ⤷ Get Started Free

Patent: 24034

Estimated Expiration: ⤷ Get Started Free

Finland

Patent: 0190020

Estimated Expiration: ⤷ Get Started Free

Patent: 0190021

Estimated Expiration: ⤷ Get Started Free

Georgia, Republic of

Patent: 0156368

Estimated Expiration: ⤷ Get Started Free

Honduras

Patent: 12002039

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 75471

Estimated Expiration: ⤷ Get Started Free

Patent: 09121

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 25336

Estimated Expiration: ⤷ Get Started Free

Patent: 31785

Estimated Expiration: ⤷ Get Started Free

Patent: 900021

Estimated Expiration: ⤷ Get Started Free

Patent: 900022

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 2030

Estimated Expiration: ⤷ Get Started Free

Patent: 3334

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 81718

Estimated Expiration: ⤷ Get Started Free

Patent: 86790

Estimated Expiration: ⤷ Get Started Free

Patent: 13209405

Estimated Expiration: ⤷ Get Started Free

Patent: 13510800

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 552902

Estimated Expiration: ⤷ Get Started Free

Patent: 924034

Estimated Expiration: ⤷ Get Started Free

Patent: 2019506

Estimated Expiration: ⤷ Get Started Free

Patent: 2019507

Estimated Expiration: ⤷ Get Started Free

Patent: 24034

Estimated Expiration: ⤷ Get Started Free

Luxembourg

Patent: 0113

Estimated Expiration: ⤷ Get Started Free

Patent: 0114

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 3979

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 12011379

Estimated Expiration: ⤷ Get Started Free

Montenegro

Patent: 181

Estimated Expiration: ⤷ Get Started Free

Patent: 570

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 170

Estimated Expiration: ⤷ Get Started Free

Netherlands

Patent: 0980

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 2670

Patent: Non-nucleoside reverse transcriptase inhibitors

Estimated Expiration: ⤷ Get Started Free

Nicaragua

Patent: 1200146

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 19018

Estimated Expiration: ⤷ Get Started Free

Patent: 19019

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 130158

Patent: INHIBIDORES NO NUCLEOSIDICOS DE LA TRANSCRIPTASA INVERSA

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 012501923

Patent: NON-NUCLEOSIDE REVERSE TRANSCRIPTASE INHIBITORS

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 52902

Estimated Expiration: ⤷ Get Started Free

Patent: 24034

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 52902

Estimated Expiration: ⤷ Get Started Free

Patent: 24034

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 017

Patent: NE-NUKLEOZIDNI INHIBITORI REVERZNE TRANSKRIPTAZE (NON-NUCLEOSIDE REVERSE TRANSCRIPTASE INHIBITORS)

Estimated Expiration: ⤷ Get Started Free

Patent: 505

Patent: FARMACEUTSKA KOMPOZICIJA KOJA SADRŽI NE-NUKLEOZIDNI INHIBITOR REVERZNE TRANSKRIPTAZE (PHARMACEUTICAL COMPOSITION COMPRISING A NON-NUCLEOSIDE REVERSE TRANSCRIPTASE INHIBITOR)

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 4347

Patent: NON-NUCLEOSIDE REVERSE TRANSCRIPTASE INHIBITORS

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 52902

Estimated Expiration: ⤷ Get Started Free

Patent: 24034

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1421861

Estimated Expiration: ⤷ Get Started Free

Patent: 120128703

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 36295

Estimated Expiration: ⤷ Get Started Free

Patent: 09636

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 58719

Estimated Expiration: ⤷ Get Started Free

Patent: 1139409

Patent: Non-nucleoside reverse transcriptase inhibitors

Estimated Expiration: ⤷ Get Started Free

Tunisia

Patent: 12000455

Patent: NON-NUCLEOSIDE REVERSE TRANSCRIPTASE INHIBITORS

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 8495

Patent: НЕНУКЛЕОЗИДНІ ІНГІБІТОРИ ЗВОРОТНОЇ ТРАНСКРИПТАЗИ (REVERSE TRANSCRIPTASE NUCLEOSIDE INHIBITORS)

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering DELSTRIGO around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Japan | 2018535991 | ドラビリン、テノホビルジソプロキシルフマル酸塩およびラミブジンを含有する医薬組成物 | ⤷ Get Started Free |

| Hungary | E056978 | ⤷ Get Started Free | |

| Denmark | 2924034 | ⤷ Get Started Free | |

| Croatia | P20211687 | ⤷ Get Started Free | |

| Lithuania | C2552902 | ⤷ Get Started Free | |

| Spain | 2895951 | ⤷ Get Started Free | |

| Chile | 2012002744 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for DELSTRIGO

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2924034 | C201930027 | Spain | ⤷ Get Started Free | PRODUCT NAME: DORAVIRINA O UNA SAL FARMACEUTICAMENTE ACEPTABLE DE LA MISMA EN COMBINACION CON LAMIVUDINA Y TENOFOVIR DISOPROXILO FUMARATO; NATIONAL AUTHORISATION NUMBER: EU/1/18/1333; DATE OF AUTHORISATION: 20181122; NUMBER OF FIRST AUTHORISATION IN EUROPEAN ECONOMIC AREA (EEA): EU/1/18/1333; DATE OF FIRST AUTHORISATION IN EEA: 20181122 |

| 2552902 | 2019019 | Norway | ⤷ Get Started Free | PRODUCT NAME: DORAVIRIN ELLER ET FARMASOEYTISK AKSEPTABELT SALT DERAV; REG. NO/DATE: EU/1/18/1332/001-2 20181213 |

| 2552902 | C201930026 | Spain | ⤷ Get Started Free | PRODUCT NAME: DORAVIRINA O UNA SAL FARMACEUTICAMENTE ACEPTABLE DE LA MISMA; NATIONAL AUTHORISATION NUMBER: EU/1/18/1333; DATE OF AUTHORISATION: 20181122; NUMBER OF FIRST AUTHORISATION IN EUROPEAN ECONOMIC AREA (EEA): EU/1/18/1333; DATE OF FIRST AUTHORISATION IN EEA: 20181122 |

| 2924034 | 132019000000062 | Italy | ⤷ Get Started Free | PRODUCT NAME: DORAVIRINA O UN SUO SALE FARMACEUTICAMENTE ACCETTABILE IN COMBINAZIONE CON LAMIVUDINA O UN SUO SALE FARMACEUTICAMENTE ACCETTABILE IN COMBINAZIONE CON TENOFOVIR O UN SUO ESTERE, IN PARTICOLARE UN ESTERE DI DISOPROXIL O UN SUO SALE FARMACEUTICAMENTE ACCETTABILE, IN PARTICOLARE UN SALE FUMARATO(DELSTRIGO); AUTHORISATION NUMBER(S) AND DATE(S): EU/1/18/1333/001-002, 20181127 |

| 2924034 | CR 2019 00024 | Denmark | ⤷ Get Started Free | PRODUCT NAME: DORAVIRINE OR A PHARMACEUTICALLY ACCEPTABLE SALT THEREOF IN COMBINATION WITH LAMIVUDINE AND IN COMBINATION WITH TENOFOVIR DISOPROXIL FUMARATE; REG. NO/DATE: EU/1/18/1333 20181126 |

| 2924034 | LUC00114 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: DORAVIRINE OU UN SEL PHARMACEUTIQUEMENT ACCEPTABLE DE CELLE-CI EN COMBINAISON AVEC LA LAMIVUDINE OU UN SEL PHARMACEUTIQUEMENT ACCEPTABLE DE CELLE-CI EN COMBINAISON AVEC DU TENOFOVIR OU UN DE SES ESTERS, EN PARTICULIER UN ESTER DE DISOPROXIL OU UN DE SES SELS PHARMACEUTIQUEMENT ACCEPTABLES, EN PARTICULIER UN SEL DE FUMARATE; AUTHORISATION NUMBER AND DATE: EU/1/18/1333 20181126 |

| 2924034 | C02924034/01 | Switzerland | ⤷ Get Started Free | PRODUCT NAME: DORAVIRIN, LAMIVUDIN UND TENOFOVIRDISOPROXIL; REGISTRATION NO/DATE: SWISSMEDIC-ZULASSUNG 67066 17.12.2019 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for DELSTRIGO: An In-Depth Analysis

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.