Share This Page

Drug Price Trends for DELSTRIGO

✉ Email this page to a colleague

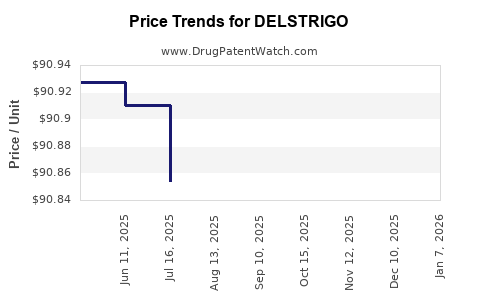

Average Pharmacy Cost for DELSTRIGO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DELSTRIGO 100-300-300 MG TAB | 00006-5007-01 | 90.65162 | EACH | 2025-12-17 |

| DELSTRIGO 100-300-300 MG TAB | 00006-5007-01 | 90.71467 | EACH | 2025-11-19 |

| DELSTRIGO 100-300-300 MG TAB | 00006-5007-01 | 90.68881 | EACH | 2025-10-22 |

| DELSTRIGO 100-300-300 MG TAB | 00006-5007-01 | 90.68086 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DELSTRIGO

Introduction

DELSTRIGO (doravirine, lamivudine, and tenofovir disoproxil fumarate) is a fixed-dose combination antiviral medication approved by the U.S. Food and Drug Administration (FDA) for the treatment of HIV-1 infection. Launched by Merck & Co. in August 2018, DELSTRIGO targets a significant segment within the antiretroviral therapy (ART) market, riding on the increasing global HIV prevalence and the demand for simplified treatment regimens. This analysis examines current market dynamics, competitive landscape, pricing trends, and future price projections for DELSTRIGO, providing strategic insights for stakeholders aiming to navigate this niche effectively.

Market Overview

Global HIV/AIDS Treatment Market Context

The global HIV/AIDS treatment market is projected to reach approximately $22 billion by 2027, driven by expanding access to ART, improved patient adherence, and the development of novel therapies [1]. The increasing prevalence of HIV, especially in sub-Saharan Africa, alongside rising awareness and governmental initiatives to combat HIV/AIDS, sustains demand for effective ART formulations.

FDA Approval and Market Penetration

Since its August 2018 approval, DELSTRIGO has positioned itself competitively within the nucleoside reverse transcriptase inhibitors (NRTIs) and non-nucleoside reverse transcriptase inhibitors (NNRTIs) segment. Its fixed-dose combination simplifies HIV management, improving adherence and reducing pill burden—a vital feature in treatment protocols.

Current market penetration remains moderate, constrained by competitive alternatives like Biktarvy (Gilead), Juluca (Gilead), and Stribild (Gilead). Yet, DELSTRIGO appeals particularly to patients seeking a well-tolerated, single-tablet regimen with a favorable safety profile.

Competitive Landscape Analysis

Several key players control significant market share in ART:

- Gilead Sciences: Dominates with Biktarvy, Descovy, and Tivicay.

- ViiV Healthcare: Offers Triumeq and Juluca.

- Merck & Co.: Markets DELSTRIGO and Isentress.

Competitive Advantages of DELSTRIGO:

- Once-daily dosing simplifies adherence.

- Favorable tolerability profile.

- Absence of certain side effects (e.g., weight gain associated with some alternatives).

Limitations:

- Slightly higher cost compared to older regimens.

- Market preference for integrase strand transfer inhibitor (INSTI)-based regimens like Biktarvy.

- Patent and exclusivity periods influencing generic accessibility.

Pricing Strategies and Trends

Current Price Benchmarks

According to retail pharmacy data, the list price of DELSTRIGO hovers around $3,000 to $3,500 per month in the United States (as of 2023). Insurance coverage and government programs significantly influence actual patient out-of-pocket costs, often reducing price disparities through negotiated rebates and discounts.

Reimbursement Dynamics

In high-income markets like the U.S., private insurers and Medicaid programs negotiate substantial discounts, with average net prices potentially reduced by 30-50%. Conversely, in lower-income regions, especially within sub-Saharan Africa, the drug is provided through global aid programs at subsidized or zero-cost arrangements.

Market Access and Pricing Considerations

Regulatory exclusivity, patent protections, and pricing regulations shape market access, with emerging markets poised for price adjustments following patent expirations or licensing agreements. Merck’s pricing policy emphasizes maintaining premium positioning while balancing affordability in diverse markets.

Price Projections and Future Trends

Short-Term (Next 1-2 Years)

- Stable Pricing: Given the drug's relatively recent entry and moderate market penetration, prices are unlikely to significantly fluctuate in the immediate term.

- Negotiated Discounts: Payers will continue to secure substantial rebates, marginally reducing net prices.

- Market Competition: The aggressive launch of similar regimens, particularly integrase-based therapies, could pressure sticker prices.

Medium to Long-Term (3-5 Years)

- Patent Expiry Impact: With patent protection likely to last until late 2026, generic or biosimilar versions may emerge, prompting significant price reductions—potentially up to 40-60%—in affected markets.

- Introduction of Next-Generation Formulations: As newer, more potent, and better-tolerated therapies come to market, DELSTRIGO’s pricing may decline to maintain competitiveness.

- Global Expansion: In low-income countries, prices are expected to decline further due to international aid, licensing agreements, and public health initiatives.

Projected Price Range 2023-2028:

| Year | Estimated Price (USD/month) | Remarks |

|---|---|---|

| 2023 | $3,000 – $3,500 | Stable, with rebates influencing net cost |

| 2024 | $2,700 – $3,200 | Slight downward pressure from competition |

| 2025 | $2,500 – $2,900 | Anticipated patent expiry for some markets |

| 2026 | $2,000 – $2,500 | Biosimilar introductions in select markets |

| 2027 | $1,500 – $2,000 | Greater biosimilar/multiple generic access |

Implications for Stakeholders

- Pharmaceutical Companies: For emerging companies, biosimilar entry post-patent expiry presents revenue opportunities, but current prices sustain high margins.

- Healthcare Providers: Should weigh the cost-benefit balance between DELSTRIGO and competitors, considering efficacy, tolerability, and affordability.

- Payers and Governments: Strategic negotiations and procurement policies will significantly impact net prices, especially in resource-limited settings.

- Investors: As the patent clock ticks, valuation hinges on the lifecycle management of DELSTRIGO and adjacent pipeline developments.

Regulatory and Market Entry Risks

- Patent Challenges: Patent litigation or voluntariness could accelerate generic entry.

- Market Penetration Barriers: Existing dominance of competitors could hinder rapid uptake.

- Pricing Regulations: Governments impose price caps in many regions, constraining premium pricing models.

- Side Effect Profiles: Emerging safety concerns could diminish demand.

Key Takeaways

- Current Market Position: DELSTRIGO occupies a niche within the HIV-1 treatment market, competing primarily with other fixed-dose combinations offering similar or enhanced profiles.

- Pricing Stability: Despite competitive pressures, current list prices are unlikely to decline significantly before patent expiry.

- Future Price Decline: A potential 40-60% reduction could occur within 2–3 years post-patent expiration, as generic formulations enter markets.

- Market Expansion: Emerging markets will see lower prices driven by international health initiatives, creating new revenue avenues.

- Strategic Outlook: Stakeholders should monitor patent timelines, competitive launches, and regulatory changes to optimize market positioning and pricing strategies.

FAQs

1. When is DELSTRIGO's patent expected to expire?

Merck's patent for DELSTRIGO is projected to expire around late 2026, after which biosimilar versions may enter the market, prompting price reductions.

2. How does DELSTRIGO compare cost-wise with competitors?

Current list prices are similar to other once-daily combinations, generally ranging from $3,000 to $3,500 per month in the U.S. market, with net prices influenced by rebates and insurance negotiations.

3. Is DELSTRIGO suitable for all HIV patients?

While effective for many, treatment suitability depends on individual patient factors, including resistance profiles and comorbidities. Physicians evaluate these factors before prescribing.

4. Are there any plans for formulation improvements or new indications?

Currently, DELSTRIGO's formulation remains stable; ongoing research focuses on newer regimens with enhanced efficacy, safety, and tolerability, which may influence its long-term market relevance.

5. How do global health initiatives impact DELSTRIGO’s pricing?

In low-income regions, international agencies and governments subsidize or procure DELSTRIGO at significantly reduced prices, expanding access but decreasing revenue per unit in these markets.

References

[1] Global HIV & AIDS Treatment Market Report, 2020-2027.

[2] U.S. Food and Drug Administration (FDA). DELSTRIGO Approval Letter, 2018.

[3] IQVIA Institute. The Subscription Economy and Impact on HIV Drugs, 2022.

[4] International AIDS Society. Treatment Market Dynamics, 2021.

More… ↓