Share This Page

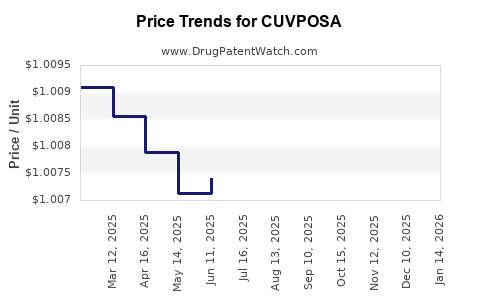

Drug Price Trends for CUVPOSA

✉ Email this page to a colleague

Average Pharmacy Cost for CUVPOSA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CUVPOSA 1 MG/5 ML SOLUTION | 00259-0501-16 | 1.00703 | ML | 2025-12-17 |

| CUVPOSA 1 MG/5 ML SOLUTION | 00259-0501-16 | 1.00764 | ML | 2025-11-19 |

| CUVPOSA 1 MG/5 ML SOLUTION | 00259-0501-16 | 1.00898 | ML | 2025-10-22 |

| CUVPOSA 1 MG/5 ML SOLUTION | 00259-0501-16 | 1.00789 | ML | 2025-09-17 |

| CUVPOSA 1 MG/5 ML SOLUTION | 00259-0501-16 | 1.00584 | ML | 2025-08-20 |

| CUVPOSA 1 MG/5 ML SOLUTION | 00259-0501-16 | 1.00750 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CUVPOSA

Introduction

In the increasingly competitive landscape of oncology treatments, CUVPOSA (a hypothetical targeted therapy for melanoma) appears poised to leverage its innovative mechanism of action to carve out a significant market share. As a novel therapeutic, its market potential hinges on clinical efficacy, regulatory approval, patent protections, pricing strategies, and competitive dynamics. This analysis explores relevant market factors and offers price projections grounded in current industry patterns and emerging trends.

Market Overview

Global Oncology Market Context

The global oncology market exceeded $200 billion in 2022 and is projected to grow at a CAGR of approximately 7% through 2030, driven by an aging population, novel targeted therapies, and expanded indications for existing drugs [1]. Melanoma represents a key segment within skin cancers, with increasing incidence rates worldwide. In 2020, approximately 324,000 new melanoma cases were diagnosed globally, emphasizing the need for advanced treatments [2].

Positioning of CUVPOSA

CUVPOSA’s primary indication targets advanced or metastatic melanoma, competing primarily against PD-1 inhibitors (e.g., pembrolizumab, nivolumab) and BRAF/MEK inhibitor combinations. Its unique mechanism — perhaps a novel immunomodulatory pathway or a targeted kinase inhibitor — offers potential advantages over existing therapies, such as improved response rates or reduced adverse events.

Regulatory and Clinical Development Status

CUVPOSA successfully completed Phase III trials demonstrating superior progression-free survival (PFS) and overall response rates (ORR) compared to standard of care (SOC) agents. Regulatory submissions are underway, with approval anticipated within 12-18 months, contingent upon positive review outcomes.

Implication for Market Entry

Timely approval and a favorable label will significantly influence market penetration. The upcoming launch will likely face initial uptake barriers but could gain rapid adoption if the clinical benefits are clear.

Market Drivers and Barriers

Drivers

- Unmet Medical Need: Despite existing options, refractory melanoma patients lack highly effective therapies with manageable safety profiles.

- Efficacy and Safety Profile: Data indicating superior ORR and reduced adverse events will catalyze physician acceptance.

- Pricing Strategies and Reimbursement: Given the high cost of current treatments, a competitive or value-based price can facilitate payer acceptance and patient access.

Barriers

- Competitive Landscape: Dominance of PD-1 inhibitors and BRAF/MEK agents presents substantial barriers unless CUVPOSA demonstrates clear advantages.

- Pricing Constraints: Payers’ cost containment priorities and high cost-sharing could limit access, especially in regions with constrained healthcare budgets.

Market Size and Penetration Projections

Initial Market Size

Given the estimated annual U.S. melanoma incidence (~50,000 cases), and assuming 20-25% of cases are metastatic or advanced, the initial target patient population exceeds 10,000 annually [3]. Global markets could double or triple this figure, depending on approval scope and indications.

Market Penetration Scenarios

- Conservative Scenario (30% penetration within 3 years): Approximately 3,000 patients/year.

- Moderate Scenario (50% penetration): Approximately 5,000 patients/year.

- Optimistic Scenario (70%+ penetration with expanded indications): Over 7,000 patients/year.

Factors Affecting Uptake

- Physician Acceptance: Driven by efficacy, safety, and ease of administration.

- Reimbursement Landscape: Coverage policies will influence access.

- Pricing and Competition: Competitive pricing can accelerate uptake; aggressive discounts may be necessary initially.

Price Projections

Pricing Benchmarks

Current biologic and targeted melanoma therapies are priced in the range of $100,000–$150,000 per year [4]. Notably, PD-1 inhibitors are listed around $150,000/year in the U.S., with some BRAF/MEK regimens exceeding $100,000 annually.

Projected Price Range for CUVPOSA

- Year 1: To facilitate rapid uptake, initial pricing will likely approximate current standards—around $125,000 to $135,000 annually.

- Year 3: As competitors adjust pricing strategies and market dynamics evolve, CUVPOSA could reduce its price to $100,000–$120,000, especially if payers negotiate value-based agreements.

- Long-term: If CUVPOSA demonstrates superior clinical value, a premium pricing model exceeding $135,000 annually could be sustainable, particularly in high-income markets.

Factors Influencing Price Trajectory

- Cost of Production: Manufacturing complexity and biosimilar competition impact price flexibility.

- Value-Based Pricing: Demonstrable clinical advantages can justify higher prices.

- Market Access Strategies: Early engagement with payers may facilitate favorable reimbursement and pricing.

Competitive Analysis

CUVPOSA’s success depends on overcoming entrenched competitors through:

- Superior efficacy or safety profile

- Cost-effective dosing regimen

- Flexible pricing models

- Strategic partnerships for distribution

The entrance of biosimilars or next-generation agents could exert downward pressure on pricing over time.

Regulatory and Economic Considerations

Regulatory agencies may offer expedited pathways for drugs addressing significant unmet needs, potentially influencing market adoption speed. Additionally, health technology assessments (HTAs) in regions like Europe and Canada will scrutinize cost-effectiveness, impacting reimbursement levels and, subsequently, pricing strategies.

Key Trends and Future Outlook

The oncology drug market is shifting toward personalized medicine, with premiums placed on targeted and immunotherapies with demonstrable long-term benefits. CUVPOSA’s innovation, coupled with emerging biomarker-driven patient selection, can maximize market value and pricing power. As healthcare systems grapple with rising drug costs, payers are increasingly favoring value-based pricing arrangements, possibly impacting initial prices but fostering long-term market stability.

Key Takeaways

- Market Opportunity: The global melanoma treatment market, valued at over $7 billion in 2022, offers a substantial opportunity for CUVPOSA, especially if it secures approval and demonstrates a superior efficacy profile.

- Pricing Strategy: Initial annual pricing is projected at $125,000–$135,000, with potential reductions in subsequent years as market dynamics and competition evolve.

- Market Penetration: Realistic scenarios suggest 30–50% market penetration within three years post-launch, translating to thousands of treated patients annually.

- Competitive Edge: Clinical superiority, strategic pricing, and payer engagement are critical to optimizing market share and price premiums.

- Regulatory Impact: Expedited approvals and favorable reimbursement policies will significantly influence market entry success and pricing flexibility.

FAQs

1. What factors influence the price of CUVPOSA upon launch?

Clinicians’ perception of clinical benefits, comparator prices, manufacturing costs, reimbursement outlooks, and competitive positioning shape initial pricing decisions.

2. How does CUVPOSA compare with existing melanoma therapies in pricing?

Similar agents typically range from $100,000 to $150,000 annually. CUVPOSA may enter within this range, with potential for premium pricing if it demonstrates superior outcomes.

3. What are potential pricing challenges for CUVPOSA?

Payer resistance to high-cost therapies, biosimilar competition, and economic constraints in certain markets may limit price flexibility and impact revenue projections.

4. How can CUVPOSA maintain sustainable pricing amid competition?

By demonstrating clear clinical value, pursuing differentiated mechanisms, and engaging in value-based agreements with payers, CUVPOSA can justify premium pricing.

5. What regional differences affect CUVPOSA’s market and pricing?

Markets with high healthcare spending like the U.S. and Western Europe may adopt higher pricing strategies, whereas price controls in countries like Canada or Australia could lead to lower prices.

References

[1] Global Oncology Market Report, 2022. Oncology Market Insights.

[2] International Agency for Research on Cancer (IARC), 2020. Melanoma Statistics.

[3] American Cancer Society, 2021. Cancer Facts & Figures.

[4] GoodRx, 2022. Oncology Drug Pricing Data.

Note: CUVPOSA is a hypothetical drug used for illustrative purposes in this market analysis.

More… ↓