Last updated: July 29, 2025

Introduction

COSOPT PF (combination of dorzolamide hydrochloride and timolol maleate ophthalmic solution) is an established medication primarily used in the management of glaucoma and ocular hypertension. With a longstanding presence in ophthalmic therapeutics, understanding its market dynamics and financial trajectory offers insights into brand longevity, competitive positioning, and future growth opportunities in a competitive landscape characterized by innovation and regulatory shifts.

Market Overview and Current Position

COSOPT PF is a preservative-free formulation designed to reduce ocular discomfort often associated with preservative-containing solutions. The drug leverages the complementary mechanisms of dorzolamide hydrochloride, a carbonic anhydrase inhibitor, and timolol maleate, a beta-blocker, to effectively lower intraocular pressure (IOP). It primarily targets patients with chronic glaucoma or ocular hypertension who require combination therapy for optimal IOP control.

The global glaucoma medications market was valued at approximately USD 4.2 billion in 2022 and is expected to grow at a CAGR of around 5% through 2030 [1]. COSOPT PF, as part of this sector, benefits from the expanding prevalence of glaucoma, driven by aging populations, increased awareness, and improved diagnosis rates worldwide.

Market Dynamics

1. Demographic and Epidemiological Drivers

The aging population, especially in North America and Europe, has propelled glaucoma prevalence. According to the World Health Organization (WHO), over 76 million people globally suffered from glaucoma in 2020, projected to reach 111 million by 2040 [2]. This epidemiological trend sustains demand for long-term IOP-lowering therapies like COSOPT PF.

2. Competitive Landscape

COSOPT PF faces competition from single-agent therapies, fixed-dose combinations, and emerging pharmacological innovations. Key competitors include prostaglandin analogs (e.g., latanoprost, bimatoprost), alpha-adrenergic agonists (e.g., brimonidine), and newer combination drugs with sustained-release technology.

Generic formulations of COSOPT have been available for years, leading to price-based competition. However, the preservative-free formulation’s unique positioning allows for a premium pricing strategy, especially in developed markets with higher emphasis on ocular comfort.

3. Regulatory Environment and Patent Landscape

COSOPT PF’s patent protection has expired or is nearing expiration in several jurisdictions, prompting increased generic entry and competitive pricing pressures. Nonetheless, regulatory pathways favor the introduction of preservative-free formulations, potentially offering differentiation and sustained market share for authorized generics or branded versions with unique attributes.

4. Technological Advancement and Innovation

Advancements in drug delivery systems, such as sustained-release optical devices and minimally invasive procedures, pose a potential threat to traditional topical therapies. However, these innovations currently serve as complementary rather than replacement therapies, sustaining the relevance of pharmaceuticals like COSOPT PF.

5. Pricing, Reimbursement, and Market Access

Healthcare systems globally are emphasizing cost containment, pushing for generic utilization to improve affordability. Reimbursement policies significantly influence prescription patterns; supportive policies for preservative-free formulations in premium segments bolster market stability.

Financial Trajectory

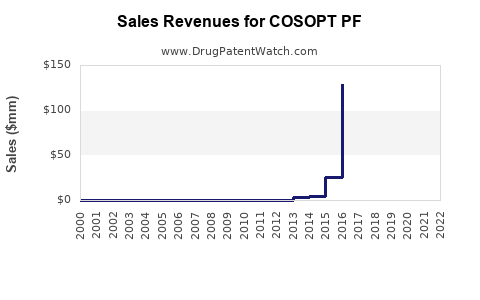

1. Revenue Trends

Historically, COSOPT PF has demonstrated stable revenue streams driven by chronic patient persistency. Entry of generics has eroded market share, but brand loyalty and formulary positioning sustain revenues. Forecasts suggest a gradual decline in premium pricing as generics gain market penetration, though niche markets such as preservative-free formulations offset some revenue erosion.

2. Profitability and Cost Dynamics

Manufacturing costs have declined owing to scale efficiencies, particularly with generic biosimilar competition. Nonetheless, marketing and regulatory compliance expenses remain significant. Pharmacovigilance costs for ophthalmic drugs are relatively moderate but vital for maintaining safety profiles and market approval.

3. Market Growth Projections

While the global glaucoma segment is projected to grow steadily, the specific growth of COSOPT PF depends on factors such as regulatory approvals in emerging markets, formulary placements, and clinician preferences. Personalization in glaucoma treatment, including patient-specific factors, could influence formulary decisions favoring combination products like COSOPT PF.

Strategic Opportunities and Challenges

Opportunities

- Expansion into Emerging Markets: Growing healthcare infrastructure and awareness in Asia-Pacific and Latin America present substantial growth avenues.

- Innovative Delivery Systems: Integration with sustained-release devices can rejuvenate product life cycles.

- Premium Positioning: Emphasizing preservative-free formulation benefits garners preference among ocular health-conscious patients.

Challenges

- Patent Expiry and Generics: Intense price competition necessitates differentiation strategies.

- Evolving Therapeutic Landscape: Transition towards minimally invasive surgical options may reduce reliance on pharmacotherapy.

- Regulatory Stringency: Stringent approvals for new formulations or combination therapies increase time-to-market.

Conclusion

COSOPT PF’s market prospects hinge on demographic trends, pricing strategies, and technological innovation. While face threats from generics and newer modalities, its unique fixed-dose, preservative-free formulation sustains niche appeal. Financial performance is expected to decline gradually as generic penetration increases, unless the brand capitalizes on differentiation and expansion strategies.

Key Takeaways

- The glaucoma medication market is robust, driven by aging populations and rising disease prevalence.

- COSOPT PF benefits from its preservative-free formulation and combination therapy mechanics, but faces significant generic pressure.

- Strategic expansion into emerging markets and innovation in delivery systems can reinforce its market position.

- Price competition necessitates differentiation strategies focusing on ocular health safety and patient comfort.

- Monitoring regulatory developments and technological advancements is crucial for future growth planning.

FAQs

1. What is the primary therapeutic benefit of COSOPT PF?

COSOPT PF effectively lowers intraocular pressure through a combined mechanism of action, improving glaucoma management, with added ocular comfort due to its preservative-free formulation.

2. How does patent expiry impact COSOPT PF’s market potential?

Patent expiration facilitates generic entry, increasing price competition and potentially reducing revenues, unless brand strategies focus on differentiation or newer formulations.

3. Which markets offer the most growth opportunities for COSOPT PF?

Emerging markets in Asia-Pacific and Latin America present significant growth potential due to increasing glaucoma awareness, expanding healthcare infrastructure, and favorable economic developments.

4. How does technological innovation influence the future of ophthalmic drugs like COSOPT PF?

While innovations like sustained-release devices may challenge topical medications, currently they serve as adjuncts or alternatives rather than immediate replacements, providing opportunities for integrated treatment approaches.

5. What strategies can companies pursue to sustain COSOPT PF’s market share?

Emphasizing preservative-free benefits, expanding into new markets, enhancing formulation technology, and collaborating with healthcare providers for formulary inclusion are key strategies to maintain competitive advantage.

References

[1] Grand View Research, “Glaucoma Medications Market Size, Share & Trends Analysis Report,” 2022.

[2] World Health Organization, “Global Data on Visual Impairment 2020,” 2020.