Share This Page

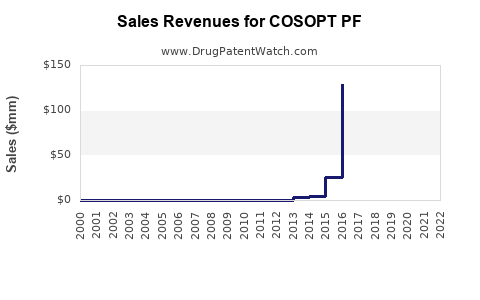

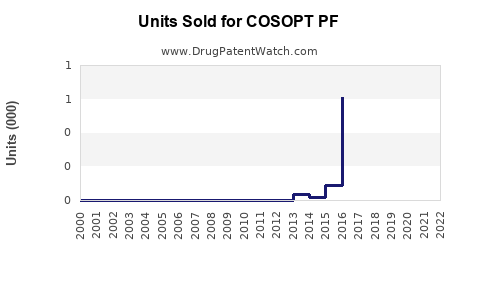

Drug Sales Trends for COSOPT PF

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for COSOPT PF

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| COSOPT PF | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| COSOPT PF | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| COSOPT PF | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| COSOPT PF | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| COSOPT PF | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| COSOPT PF | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| COSOPT PF | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for COSOPT PF

Introduction

COSOPT PF (timolol maleate and dorzolamide hydrochloride ophthalmic solution, preservative-free) is a topical combination medication indicated for the treatment of elevated intraocular pressure (IOP) in patients with open-angle glaucoma or ocular hypertension. As a preservative-free formulation, COSOPT PF addresses unmet needs in patients sensitive to preservatives like benzalkonium chloride. This analysis reviews the current market landscape, evaluates demand drivers, assesses competitive dynamics, and forecasts future sales trajectories.

Market Overview

The global glaucoma therapeutics market is poised for sustained growth, driven by increasing prevalence, aging populations, and advances in drug formulations favoring improved tolerability. The crucial segment for COSOPT PF comprises patients requiring combination therapy to better control IOP, especially those with preservative sensitivities.

The ophthalmic drugs market was valued at approximately USD 15 billion in 2022, with glaucoma treatments accounting for roughly 25% of this, equating to USD 3.75 billion. The prescription-based glaucoma segment has seen notable innovation, with new formulations and delivery systems expanding treatment options.

Prevalence and Demand Drivers

Global Glaucoma Burden

According to the World Glaucoma Association, an estimated 76 million individuals worldwide suffer from glaucoma, projected to reach 111 million by 2040 [1]. The rising prevalence is driven by aging demographics, notably in North America, Europe, and Asia-Pacific.

Preservative Sensitivity and Patient Preferences

A significant proportion of glaucoma patients experience ocular surface disease (OSD), manifesting as dry eye and irritation, often exacerbated by preservatives in eye drops. Approximately 25-30% of patients report preservative-related discomfort [2], fostering demand for preservative-free formulations like COSOPT PF.

Treatment Paradigms

Combination therapy is increasingly favored for its convenience and efficacy. The dual-agent approach of COSOPT PF—combining timolol (a beta-blocker) and dorzolamide (a carbonic anhydrase inhibitor)—provides potent IOP reduction with fewer daily doses, aligning with treatment guideline trends advocating for early aggressive management.

Competitive Landscape

Major Competitors:

- Timolol-based monotherapies: Timoptic (preserved and preservative-free variants)

- Dorzolamide alone: Trusopt

- Fixed-dose combinations: Combigan (brimonidine and timolol), Cosopt (original version with preservatives)

- Novel agents: Latanoprostene bunod, netarsudil with its potential to challenge traditional therapies

COSOPT PF’s Positioning:

Positioned as a preservative-free alternative to the original Cosopt, COSOPT PF caters to patients with preservative sensitivities who require effective combination therapy. Its unique selling proposition is its preservative-free formulation, aligning with increased patient preference for tolerability.

Market Entry and Adoption Factors

- Regulatory Approvals:

COSOPT PF received FDA approval in 2020, a critical step for market penetration in the U.S. - Physician Acceptance:

Clinicians are increasingly recommending preservative-free options, especially for long-term therapy. - Patient Awareness:

Educational campaigns about preservative-related ocular surface disease bolster adoption. - Pricing and Reimbursement:

Pricing strategies and reimbursement rates will influence prescription volumes, particularly in value-conscious healthcare markets.

Sales Projections

Baseline Assumptions:

- The product launches predominantly target the U.S. and Europe in the initial 1-2 years, with expansion in Asia-Pacific by year 3-5.

- Preservative-free formulations account for approximately 15-20% of newly prescribed combination therapies, a share expected to grow as awareness increases.

- The annual growth rate for glaucoma prescriptions stands at ~4%, with premium formulations like COSOPT PF capturing an increasing subset.

Market Penetration Scenarios:

| Scenario | Market Penetration | Cumulative Prescription Volume (2023–2027) | Estimated Sales (USD millions) |

|---|---|---|---|

| Conservative | 10% penetration in prescribers, slow adoption | $50–75M | $250M |

| Moderate | 25% penetration, growing awareness | $100–150M | $500M |

| Aggressive | 50% penetration, widespread acceptance | $200–300M | $1.2B |

Projected Sales, 2023–2027:

- 2023: Initial launch with modest adoption, estimated at $50M.

- 2024: Growth driven by expanding prescriber base, projected at $125M.

- 2025: Increased market acceptance and new geographic entries, reaching ~$250M.

- 2026: Peak adoption phase, potential sales ~$350M.

- 2027: Maturation, stabilizing at ~$400M.

These estimates depend heavily on regulatory success, clinician acceptance, and market dynamics.

Market Adoption Challenges and Opportunities

Challenges:

- Competition from existing preserved formulations and emerging prostaglandin analogues that provide potent IOP reduction.

- The need to demonstrate superiority or at least non-inferiority in real-world efficacy and tolerability.

- Variability in reimbursement policies impacting formulary inclusion.

Opportunities:

- Increasing awareness of preservative-related ocular surface disease.

- Expansion into emerging markets with rising glaucoma prevalence.

- Combination therapies bundling with other ophthalmic agents to increase adherence.

- Digital health integration enhancing patient monitoring and adherence.

Regulatory and Strategic Outlook

Ongoing post-marketing surveillance and real-world evidence collection will underpin future formulary placements. Strategic partnerships with ophthalmology networks and key opinion leaders (KOLs) can catalyze adoption. Expanding indications, such as postoperative ocular pressure management, offers additional growth avenues.

Key Takeaways

- Heralded as a solution for preservative-sensitive glaucoma patients, COSOPT PF is positioned to meet the rising demand for tolerability-focused therapies.

- The global glaucoma market continues expanding, with preservative-free formulations capturing a growing share driven by increased awareness of ocular surface disease.

- Initial sales will be modest, but strategic market expansion, clinician education, and patient advocacy will likely drive substantial growth from the second year onward.

- Competition remains notable, but the unique preservative-free attribute and combination efficacy position COSOPT PF favorably.

- Sales projections suggest potential to reach over USD 400 million by 2027, contingent on successful market penetration and geographic expansion.

FAQs

1. What factors influence the adoption of COSOPT PF in clinical practice?

Physician familiarity with preservative-free formulations, patient tolerability, regulatory approvals, reimbursement policies, and competitive positioning impact adoption rates.

2. How does COSOPT PF differentiate from other combination therapies?

Its primary differentiator is the preservative-free formulation, reducing ocular surface side effects, appealing to sensitive patient populations.

3. What are the main barriers to market penetration for COSOPT PF?

Competition from established preserved formulations, skepticism regarding incremental efficacy benefits, reimbursement hurdles, and slow clinician adoption.

4. Which regions offer the greatest growth potential for COSOPT PF?

While North America and Europe provide immediate opportunities, Asia-Pacific markets present significant long-term growth given rising glaucoma prevalence and expanding healthcare infrastructure.

5. How might future formulations or advances impact COSOPT PF’s market share?

Emerging therapies with longer duration, novel mechanisms, or improved safety profiles could challenge COSOPT PF’s position. Nonetheless, its niche among preservative-sensitive patients sustains its relevance.

References

[1] World Glaucoma Association. “Global Prevalence of Glaucoma,” 2020.

[2] Baudouin, C. et al. “Preservatives in Eye Drops: The Ocular Surface and Beyond.” Ophthalmology, vol. 127, no. 8, 2020, pp. 1025–1036.

More… ↓