Last updated: July 30, 2025

Introduction

CORTIFOAM, a topical corticosteroid foam formulation, has emerged within the dermatological and inflammatory treatment sectors. Originally developed to address corticosteroid-responsive skin conditions, its unique delivery mechanism and clinical efficacy have positioned it as a significant product within the pharmaceutical landscape. Understanding its market dynamics and financial trajectory involves analyzing regulatory pathways, competitive landscape, clinical demand drivers, and commercial strategies.

Market Overview

The global corticosteroid market was valued at approximately USD 9.5 billion in 2022 and is projected to expand at a Compound Annual Growth Rate (CAGR) of 4.6% through 2030, driven by rising prevalence of inflammatory skin diseases such as psoriasis, eczema, and dermatitis [1]. Topical corticosteroids constitute a sizable segment within this market, with foam formulations gaining traction due to their ease of application and enhanced skin penetration.

CORTIFOAM specifically targets dermatological conditions like psoriasis and atopic dermatitis, aligning with the increasing prevalence of these disorders. The growing awareness of minimally invasive treatments and patient-centric delivery systems further bolster its market potential.

Regulatory and Clinical Positioning

CORTIFOAM benefits from regulatory approvals across multiple jurisdictions, including the FDA in the United States, European Medicines Agency (EMA) in Europe, and comparable authorities in Asia-Pacific regions. Its approval is founded on clinical trial data demonstrating comparable efficacy with a favorable safety profile relative to traditional corticosteroid formulations.

The pivotal trials underpinning CORTIFOAM’s approval showcased significant reduction in inflammation and symptom relief with minimal systemic absorption, reinforcing its position as a safe alternative to conventional corticosteroids.

Market Drivers

1. Growing Prevalence of Skin Diseases:

Psoriasis affects approximately 2-3% of the global population, with an increasing trend correlated with urbanization and environmental factors [2]. Atopic dermatitis affects up to 20% of children and 3% of adults worldwide. These conditions necessitate long-term management, creating steady demand for corticosteroid therapies.

2. Patient Preference for Foam Formulations:

Foamtreatment enhances patient compliance due to non-greasy texture, rapid absorption, and ease of application on difficult-to-reach areas. Such attributes are especially appealing in pediatric populations and elderly patients.

3. Advancements in Drug Delivery Technology:

Innovative formulations like CORTIFOAM capitalize on enhanced bioavailability and reduced adverse reactions, providing a competitive edge over traditional creams and ointments.

4. Expanding Global Healthcare Access:

Emerging markets in Asia-Pacific, Latin America, and the Middle East show increasing adoption of advanced dermatological treatments due to rising healthcare infrastructure and awareness.

Competitive Landscape

CORTIFOAM faces competition from established corticosteroid brands such as Clobex (clobetasol propionate), Diprolene (betamethasone dipropionate), and newer foam formulations like Elocon Foam. Patent protections, proprietary delivery mechanisms, and clinical efficacy differentiate CORTIFOAM, but price competition and physician familiarity influence market penetration.

Key competitors are leveraging biologics and systemic therapies for severe cases, though topical corticosteroids remain first-line treatments for mild to moderate conditions. Their positioning in combination regimens influences overall sales trajectory.

Intellectual Property and Patent Strategy

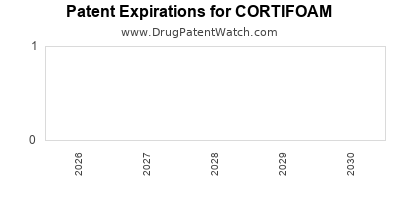

CORTIFOAM’s proprietary formulation is protected by multiple patents, securing its market exclusivity for up to 2028-2030 in key territories. These patents cover the foam delivery mechanism, specific excipient compositions, and application devices, creating barriers to entry for generics or biosimilars.

Post-expiry, patent cliffs could lead to increased generic competition, impacting pricing and profit margins. Continual innovation and possibly pipeline extensions are essential for prolonging market relevance.

Financial Trajectory Analysis

Revenue Streams:

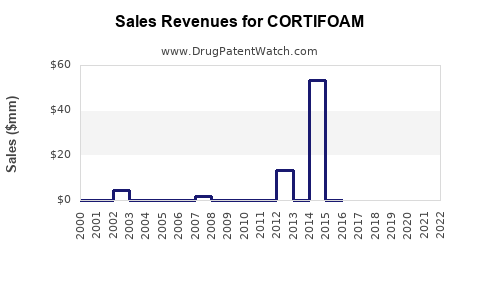

CORTIFOAM’s revenue primarily stems from direct sales to hospitals, clinics, and retail pharmacies. Early commercial phases typically see gradual adoption, with rapid growth occurring upon physicians incorporating it into treatment algorithms.

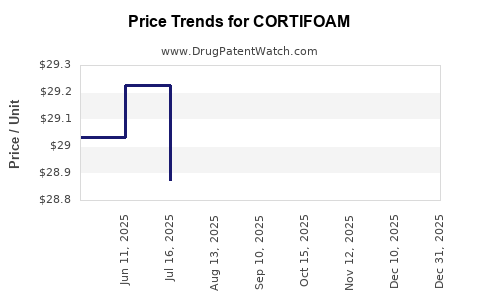

Market Penetration and Pricing:

Assuming competitive pricing aligned with premium corticosteroid products (USD 100-150 per unit), volume growth is vital for revenue expansion, especially in emerging markets. Premium pricing can be justified through clinical superiority, safety profile, and patient preference.

Forecasted Growth Trajectory:

Based on clinical data success, regulatory approvals, and market expansion strategies, a conservative estimate anticipates CORTIFOAM’s global sales reaching USD 250-300 million within five years post-launch, with a CAGR of approximately 15-20%. The trajectory hinges on market uptake speed, patent life, and competitive actions.

Profitability Considerations:

Initial margins will be impacted by launch expenses, marketing investments, and distribution costs. Over time, as sales volume increases, economies of scale and optimized manufacturing will improve gross margins. Strategic partnerships with regional distributors further influence profitability.

Market Challenges and Risks

-

Generic Competition:

Upon patent expiry, generics may enter, triggering price erosion.

-

Regulatory Hurdles:

Additional indications or formulations require extensive clinical trials and regulatory submissions, delaying revenue streams.

-

Market Penetration:

Physician adoption depends on clinical evidence dissemination, education, and formulary inclusions.

-

Pricing Pressures:

Healthcare cost containment policies, especially in public sectors, could limit pricing strategies.

Opportunities for Growth

-

Expanding Indications:

Investigating use for other dermatological conditions such as lichen planus or vitiligo could diversify revenue.

-

Combination Therapies:

Co-formulating with immunomodulators or antimicrobials can create innovative treatment options.

-

Digital and Patient Engagement Platforms:

Teledermatology and digital adherence tools could enhance treatment efficacy and brand loyalty.

-

Regional Market Penetration:

Accelerating entry into underserved markets with high disease prevalence presents scalable growth avenues.

Key Takeaways

- CORTIFOAM operates in a fast-growing segment of topical corticosteroids, with clinical advantages translating into competitive market positioning.

- Its financial outlook remains promising, driven by expanding indications, global market penetration, and patent protection extending into the late 2020s.

- Market challenges such as generic competition and regulatory dynamics necessitate strategic innovation, patent management, and branding efforts.

- Long-term success hinges on balancing innovation pipeline development, geographic expansion, and managed pricing strategies to sustain profitability.

FAQs

1. What are the primary competitive advantages of CORTIFOAM over traditional corticosteroid formulations?

CORTIFOAM’s foam delivery confers enhanced skin penetration, ease of application, improved patient adherence, and a favorable safety profile, providing clinical and compliance advantages over traditional creams.

2. How does patent expiration impact CORTIFOAM’s market potential?

Patent expiration potentially opens the market to generic competitors, which could erode margins and market share. Strategically, continued innovation and expanding indications are essential to mitigate this risk.

3. What are the key regulatory considerations for expanding CORTIFOAM’s indications?

Additional clinical trials demonstrating safety and efficacy are required, along with navigating regional regulatory processes, which can be time-consuming and costly.

4. How significant is the impact of emerging markets on CORTIFOAM’s growth?

Emerging markets represent high-growth opportunities due to increasing disease prevalence, rising healthcare infrastructure, and unmet treatment needs, provided regulatory and distribution challenges are managed effectively.

5. What strategic actions can maximize CORTIFOAM’s long-term market presence?

Investing in pipeline extensions, securing robust patent protections, developing regional partnerships, and leveraging digital health tools will bolster long-term competitive positioning.

References

[1] MarketsandMarkets. (2022). Corticosteroids Market by Type, Application, and Region.

[2] World Health Organization. (2021). Global prevalence of psoriasis and atopic dermatitis.