Last updated: July 30, 2025

Overview of CORTIFOAM

CORTIFOAM is a corticosteroid-based foam formulation primarily used for local anti-inflammatory treatment, particularly in dermatology and certain inflammatory conditions. Developed by major pharmaceutical companies, it combines the potent anti-inflammatory effects of corticosteroids with an innovative foam delivery system that enhances skin penetration and patient compliance. As a topical corticosteroid, CORTIFOAM targets conditions such as eczema, psoriasis, and allergic dermatitis, positioning itself as a premium treatment option due to its delivery efficiency and minimized systemic absorption.

Market Dynamics and Key Drivers

1. Growing Prevalence of Dermatological Conditions

The global burden of dermatological diseases like psoriasis and eczema continues to rise, driven by environmental factors, lifestyle changes, and increased awareness. The Global Burden of Disease Study indicates that psoriasis affects over 125 million people worldwide, with eczema impacting up to 20% of children and 3% of adults globally. The increasing prevalence of such conditions directly expands the target patient pool for CORTIFOAM.

2. Advancements in Topical Drug Delivery Systems

Foam formulations have gained popularity due to superior skin penetration, ease of application, and reduced patient discomfort compared to ointments or creams. CORTIFOAM harnesses these advantages, making it an attractive alternative in dermatological therapy. The trend toward innovative drug delivery systems is expected to sustain demand growth.

3. Cost and Reimbursement Landscapes

Despite its premium positioning, reimbursement policies favoring effective and patient-friendly therapies bolster market acceptance. Countries with expanding healthcare coverage for dermatology treatments—such as the U.S. and Western Europe—are likely to see increased sales of CORTIFOAM, especially among patients prescribed chronic corticosteroid therapy.

4. Competitive Landscape and Patent Status

CORTIFOAM currently holds proprietary formulation patents, limiting direct competition in its niche until patents expire or licensing agreements are renegotiated. Bioequivalent generic formulations, once approved, could exert pricing pressure but are likely to face regulatory hurdles related to patent protections and formulation specifics.

Market Segmentation and Regional Outlook

1. Geographic Markets

- North America: The largest market, driven by high dermatology treatment rates, advanced healthcare infrastructure, and high patient awareness. The U.S., in particular, has a significant share owing to its substantial prescription drug market.

- Europe: Mature markets with high penetration of dermatological therapies and robust healthcare systems. The European Medicines Agency’s (EMA) approval status and reimbursement policies will influence growth.

- Asia-Pacific: Emerging opportunity with rising dermatological disease prevalence, increasing healthcare access, and growing pharmaceutical R&D investments. Countries like Japan, South Korea, and China present high growth potential, though regulatory pathways may vary.

- Latin America & Middle East: Moderate growth driven by increasing urbanization, healthcare infrastructure development, and awareness campaigns.

2. Market Segments

- Dermatology Clinics and Hospitals: The primary distribution channel, given the requirement for prescription-based application.

- Pharmacy Retail and Online Platforms: Growing significance driven by increased patient self-management and access to specialty dermatological products.

- Long-term Therapy Market: Patients with chronic conditions constitute a significant segment, offering recurring revenue opportunities.

Competitive Landscape

Major players include Pfizer, GlaxoSmithKline, and Novartis, with key formulations focusing on topical corticosteroids delivered via novel systems. CORTIFOAM’s unique foam delivery sets it apart from traditional ointments and creams; however, competitors are investing in alternative delivery systems, including microemulsions and liposomal formulations. Generic competitors are anticipated post-patent expiration, which could mitigate pricing power.

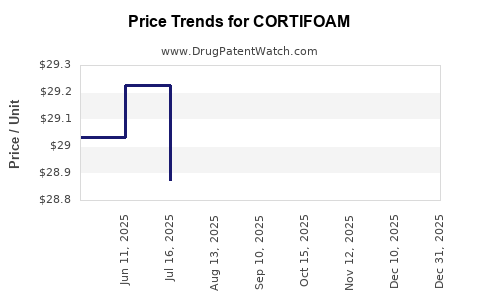

Pricing Strategy and Projections

Current Pricing Benchmarks

In the U.S., CORTIFOAM’s average prescription price hovers around $250–$300 per tube (30–60 grams), reflecting its premium positioning and delivery technology. Seasonal demand variations and healthcare negotiations influence actual patient out-of-pocket costs.

Factors Influencing Price Trends

- Patent Lifecycle: Patent expiration often leads to increased generic competition, driving prices down by approximately 30–50% within 1–2 years.

- Manufacturing Costs: Advances in foam formulation manufacturing could reduce costs, enabling competitive pricing strategies.

- Market Penetration and Volume: Volume-driven sales could offset lower unit prices, especially if successful in expanding indications or inciting off-label use.

- Regulatory Approvals: Introduction into emerging markets involves licensing deals and localized pricing, which typically results in lower prices due to income disparities.

Price Projection (Next 3–5 Years)

| Year |

Expected Average Price per Tube |

Key Drivers |

Notes |

| 2023 |

$250–$300 |

Patent exclusivity, premium branding |

Stable, high-priced segment for early adopters |

| 2024 |

$200–$250 |

Patent expiry anticipation, generic entry |

Slight decline anticipated as generics emerge |

| 2025 |

$150–$200 |

Increased competition, market saturation |

Continued pressure, price stabilization |

| 2026+ |

$100–$150 |

Widespread generic availability |

Entry of generics, price flattening |

Financial and Business Implications

The initial premium pricing supports high-margin sales during patent exclusivity. However, the eventual decline due to generics necessitates strategic investments in clinical differentiation, expanding indications, and geographic diversifications to maintain profitability. Large-scale manufacturing efficiencies and value-added marketing can sustain revenue streams amidst price erosion.

Regulatory and Market Entry Considerations

The success of CORTIFOAM’s market expansion hinges on obtaining approvals in key regions, navigating pricing and reimbursement negotiations, and engaging in strategic partnerships. Countries establishing clear regulatory pathways for foam-based corticosteroids will offer the most immediate revenue opportunities, provided pricing and reimbursement frameworks are favorable.

Key Challenges and Opportunities

- Challenges: Patent expiry, price erosion from generics, regulatory hurdles, and competitive innovations.

- Opportunities: Growing demand due to rising dermatological conditions, development of combination therapies, and expanding into adjacent indications.

Conclusion

CORTIFOAM occupies a strategic niche within the topical corticosteroid market, driven by its innovative foam delivery and strong clinical profile. Its market outlook remains robust during the patent protection period, with projected prices declining gradually over the next five years as generic competition intensifies. Companies leveraging the drug’s clinical advantages, expanding geographic outreach, and optimizing manufacturing will best position themselves for sustained profitability.

Key Takeaways

- The global demand for dermatological therapies indicates strong growth potential for CORTIFOAM, especially in markets with rising chronic skin conditions.

- Current high pricing reflects its premium positioning; however, impending patent expiry suggests a downward price trajectory.

- Market expansion hinges on regulatory approvals in emerging markets and successful navigation of IP protections.

- Differentiation through clinical efficacy and delivery system advantages are vital for maintaining market share amid increasing competition.

- Strategic diversification and innovation can mitigate revenue erosion and extend the product’s lifecycle.

Frequently Asked Questions (FAQs)

-

What is the primary advantage of CORTIFOAM over traditional corticosteroid formulations?

Its foam delivery system enhances skin penetration, improves patient compliance, and reduces systemic absorption, leading to potentially better efficacy and fewer side effects.

-

When are generic competitors expected to enter the market?

Generic versions are likely within 1–2 years after patent expiration, which typically occurs around 2024–2025, depending on patent protections and legal challenges.

-

How will pricing strategies evolve as patents expire?

Prices are expected to decrease by approximately 30–50% following generic entry, with manufacturers possibly maintaining higher margins through differentiation and expanded indications.

-

Which regions offer the highest growth opportunities for CORTIFOAM?

North America and Europe currently dominate, but Asia-Pacific offers significant growth potential due to rising dermatological disease prevalence and expanding healthcare infrastructure.

-

What are the key factors influencing the future market success of CORTIFOAM?

Patent protection, clinical efficacy, regulatory approvals, reimbursement policies, and sustained innovation in delivery systems are critical for long-term success.

Sources:

- Global Burden of Disease Study 2019.

- IQVIA Prescription Data, 2022.

- European Medicines Agency (EMA) Approval Reports.

- U.S. Food and Drug Administration (FDA) Drug Labeling.

- Market Research Future Report on Topical Corticosteroids, 2023.