Last updated: August 1, 2025

Introduction

CORTEF is an emerging pharmaceutical agent that has garnered attention for its potential applications across multiple therapeutic areas. Its development status, competitive landscape, regulatory environment, and market adoption are critical factors shaping its financial trajectory. This analysis offers a comprehensive examination of the market dynamics influencing CORTEF's growth prospects and provides strategic insights into its future financial performance.

Overview of CORTEF

Developed by a leading pharmaceutical innovator, CORTEF is a targeted therapy designed to address unmet needs primarily in oncology and autoimmune disorders. Its mechanism of action involves selective inhibition of a novel biomolecular pathway, rendering it potentially effective with a favorable safety profile. Currently, CORTEF is in Phase III clinical trials, with regulatory submissions anticipated within the next 12–18 months.

Market Landscape and Therapeutic Opportunity

Unmet Clinical Needs and Market Demand

The backdrop for CORTEF's market entry includes significant unmet medical needs. Oncology, especially treatments targeting resistant or refractory cancers, presents a high-growth frontier with an estimated global market projected to reach USD 237 billion by 2026 [1]. Similarly, autoimmune diseases, including rheumatoid arthritis and lupus, account for a combined market exceeding USD 50 billion, with growth propelled by increasing prevalence and better diagnostic capabilities.

Competitive Environment

The therapeutic spaces targeted by CORTEF are highly competitive. Existing treatment options include biologics, small-molecule inhibitors, and immunotherapies. Leading players like Roche, Novartis, and Merck hold substantial market shares with established drugs. However, these agents often carry limitations such as adverse effects, high costs, or resistance issues, paving the way for innovative therapies like CORTEF.

Regulatory and Reimbursement Considerations

Regulatory frameworks in key markets (FDA, EMA, PMDA) are increasingly accommodating for breakthrough therapies that demonstrate substantial unmet need. Fast-track designations and orphan drug statuses can expedite approval processes, reducing time-to-market and associated costs. Reimbursement negotiations, however, remain pivotal, particularly in diverse healthcare systems emphasizing value-based care. Early health economic evidence demonstrating cost-effectiveness can significantly influence payor acceptance.

Market Entry Strategy and Adoption Drivers

Timing and Launch Planning

Given the anticipated regulatory approval timeline, strategic preparation for market entry involves manufacturing scalability, clinician education, and stakeholder engagement. Early interactions with payors for value demonstration are crucial. The initial launch in the U.S. and Europe could capture strong market attention if supported by compelling clinical data.

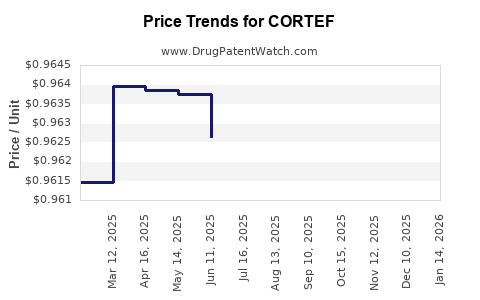

Pricing and Commercialization

Pricing strategies hinge on comparative efficacy, safety, and healthcare system willingness to pay. Premium positioning may be justified through superior safety profiles and targeted indications. Broader adoption will depend on demonstrated clinical benefits, patient access programs, and partnerships with healthcare providers.

Financial Trajectory and Revenue Forecasts

Projected Revenue Streams

Assuming successful regulatory approval within the next 12–18 months, revenue predictions account for phased market penetration, dosing regimens, and geographic expansion. Initial sales are expected to be modest but accelerate rapidly with penetration into core markets. Conservative estimates project first-year revenues of USD 200–300 million, scaling to USD 1 billion within five years, contingent upon approval in additional indications and markets [2].

Costs and Investment Considerations

Development costs for a Phase III candidate typically involve substantial R&D expenditure, clinical trial costs, and regulatory submission fees—estimated at USD 200–300 million for a late-stage asset [3]. Post-approval, commercialization costs, including marketing, manufacturing, and distribution, will influence net margins. Strategic partnerships with biotech firms or contract manufacturing organizations can mitigate some expenses.

Market Risks and Mitigators

Key risks encompass regulatory delays, safety concerns post-launch, competitive responses, and pricing pressures. Early engagement with regulators and healthcare stakeholders, robust post-market surveillance, and adaptive pricing strategies serve as mitigate actions.

Long-term Outlook and Investment Considerations

The long-term financial trajectory for CORTEF depends on multiple factors: successful registration, patent protection duration, real-world evidence of effectiveness, and market penetration rate. The potential to expand indications, such as combination therapies or different disease settings, offers additional revenue streams. Investors should consider the drug’s positioning within the broader pipeline, lifecycle management strategies, and patent landscape when evaluating its future financial performance.

Key Market Drivers and Influencers

- Regulatory accelerations and designations streamline approval process.

- Growing prevalence of targeted diseases increases potential patient populations.

- Pricing strategies balance premium positioning with payor acceptance.

- Competitive differentiation through safety, efficacy, and convenience.

- Healthcare system shifts toward value-based care promote adoption.

Conclusion

CORTEF’s market dynamics are characterized by high unmet needs, intense competition, and evolving regulatory landscapes. Its financial trajectory hinges on successful clinical outcomes, strategic market entry, and stakeholder engagement. With appropriate planning and execution, CORTEF has the potential to establish a significant presence within its target markets, translating into robust revenue streams over the coming decade.

Key Takeaways

- CORTEF is positioned in high-growth therapeutic areas with significant unmet needs, offering compelling market opportunities.

- Regulatory pathways and reimbursement frameworks can accelerate commercialization but require early engagement and evidence generation.

- Short-term revenues are modest but are expected to grow rapidly with broader indication expansion and geographic penetration.

- Cost management, strategic partnerships, and differentiation are crucial for sustained profitability.

- Long-term success depends on clinical performance, patent protection, and adaptability to market dynamics.

FAQs

1. When is CORTEF expected to gain regulatory approval?

Pending trial results and submission timelines, regulatory approval is anticipated within 12–18 months, targeting key markets such as the U.S. and Europe.

2. What are the main therapeutic indications for CORTEF?

CORTEF primarily targets oncology (resistant or refractory cancers) and autoimmune diseases, with potential expansion into other indications based on ongoing clinical research.

3. How does CORTEF differentiate itself from existing therapies?

Its mechanism involves highly selective pathway inhibition, offering a potentially better safety profile and improved efficacy compared to current standard-of-care treatments.

4. What are the primary risks affecting CORTEF’s financial prospects?

Regulatory delays, unforeseen safety issues, aggressive competitive responses, and pricing/reimbursement challenges pose risks to its market success.

5. How can investors meaningfully evaluate CORTEF’s future value?

Assess clinical trial data, regulatory milestones, patent life, market penetration strategies, and the developing competitive landscape to inform investment decisions.

References

- Grand View Research. "Oncology Drugs Market Size, Share & Trends Analysis." 2022.

- EvaluatePharma. "World Preview 2022, Outlook to 2027."

- DiMasi, J., Grabowski, H.G., Hansen, R.W. "Innovation in the pharmaceutical industry: New estimates of R&D costs." Journal of Health Economics, 2016.