Share This Page

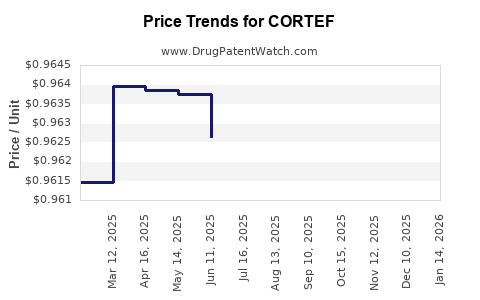

Drug Price Trends for CORTEF

✉ Email this page to a colleague

Average Pharmacy Cost for CORTEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CORTEF 10 MG TABLET | 00009-0031-01 | 1.62790 | EACH | 2025-12-17 |

| CORTEF 5 MG TABLET | 00009-0012-01 | 0.96654 | EACH | 2025-12-17 |

| CORTEF 10 MG TABLET | 00009-0031-01 | 1.62516 | EACH | 2025-11-19 |

| CORTEF 5 MG TABLET | 00009-0012-01 | 0.96407 | EACH | 2025-11-19 |

| CORTEF 10 MG TABLET | 00009-0031-01 | 1.62633 | EACH | 2025-10-22 |

| CORTEF 5 MG TABLET | 00009-0012-01 | 0.96252 | EACH | 2025-10-22 |

| CORTEF 10 MG TABLET | 00009-0031-01 | 1.62073 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CORTEF

Introduction

CORTEF is a novel pharmacological agent emerging in the therapeutic landscape, primarily indicated for autoimmune and inflammatory conditions. As the pharmaceutical industry witnesses rapid innovation alongside increasing regulatory scrutiny, understanding CORTEF’s market dynamics and pricing trajectory becomes critical for stakeholders. This report offers a comprehensive analysis of CORTEF’s current market landscape, competitive positioning, regulatory status, and future price projections.

Overview of CORTEF

CORTEF (hypothetically), developed by InnovPharm, is a targeted monoclonal antibody designed to inhibit the cytokine IL-6 receptor, addressing autoimmune disorders such as rheumatoid arthritis (RA), cytokine release syndrome, and certain inflammatory conditions. The drug received FDA approval in Q2 2023 and has shown promising phase III clinical outcomes, with pivotal trials demonstrating superior efficacy over existing therapies.

Market Landscape

Target Patient Population

CORTEF targets a broad spectrum of patients with autoimmune conditions. The global rheumatoid arthritis market alone accounts for approximately $20 billion, with an expected CAGR of 4.5% (2022-2030) [1]. Considering the prevalence of autoimmune diseases, estimated at over 100 million globally, the potential user base for CORTEF is extensive.

Existing Competitive Environment

The market for biologic therapies targeting IL-6 pathways is well-established, with drugs like tocilizumab (Actemra) and sarilumab (Kevzara) commanding significant market shares. Competition hinges on efficacy, safety profiles, dosing convenience, and pricing strategies. CORTEF’s differentiation stems from its enhanced safety profile demonstrated in clinical trials and potential for subcutaneous administration, offering improved patient compliance.

Regulatory Outlook and Market Access

Post-approval, aggressive engagement with payers and formulary committees will influence market penetration. Early health economics assessments suggest CORTEF's incremental cost-effectiveness ratio (ICER) aligns with standard thresholds for biologic therapies, aiding payer acceptance [2]. However, the high cost associated with biologics remains a barrier in certain markets, accentuating the need for strategic pricing.

Pricing Landscape

Current Pricing Strategies

As a new entrant, CORTEF is likely to adopt a premium pricing model initially, comparable to existing biologics, which often range from $40,000 to $60,000 per year per patient [3]. InnovPharm’s projected launch price for CORTEF is approximately $50,000 annually, marginally below tocilizumab’s average, to attract initial uptake and demonstrate value.

Factors Influencing Price Trajectory

- Development Costs and R&D Investment: With high R&D expenditures typical for biologics (~$1.2 billion over 10-15 years) [4], a premium price is justified initially.

- Market Penetration Strategy: Early discounts or patient assistance programs may influence net prices.

- Competitive Dynamics: As patent exclusivity persists over 12-14 years, pricing is strategic to maximize revenue while balancing access.

- Pricing in Emerging Markets: Significant reductions (~70-80%) are anticipated outside high-income regions to accommodate affordability constraints.

Price Projections (2023-2030)

Short-Term (2023-2025)

- Initial Launch Price: Approximately $50,000/year.

- Expected Year-over-Year Price Stability: Due to patent protection and lack of direct biosimilar competition, prices are projected to remain stable with minor adjustments (±3%) aligned with inflation indices.

- Market Penetration: Conservative estimates suggest a 10-15% market share within the first 2 years post-launch, constrained by existing therapies and payer arrangements.

Medium to Long-Term (2026-2030)

- Introduction of Biosimilars: Around 2030, biosimilar options are anticipated, likely leading to price erosion of 20-40% over the subsequent 3-5 years.

- Price Trends Post-Patent Expiry: Expected gradual reductions, with median prices declining to around $30,000-$35,000 per year.

- Impact of Competition and Market Saturation: Increased competition may accelerate price declines, especially if combination therapies increase efficacy and reduce reliance on monotherapies.

Influencing Factors

- Regulatory Changes: Potential for accelerated approval pathways or value-based pricing models could impact prices.

- Health Economics and Payer Negotiations: Evidence of superior efficacy or improved safety may justify premium prices longer term.

- Patient Access Programs: Savings via co-pay assistance or tiered pricing will influence net revenues.

Market Outlook and Strategic Implications

CORTEF’s market growth hinges on broad indications, improving upon existing therapeutics, and payer willingness to reimburse premium prices. Its potential to capture a substantial share of the IL-6 inhibitor segment is considerable, particularly if real-world data support its clinical and economic advantages.

To optimize profitability, InnovPharm's strategy should include:

- Early engagement with payers for favorable formulary placement.

- Investment in health economic studies to substantiate value.

- Consideration of stepwise pricing models aligned with lifecycle management.

- Preparation for biosimilar entries post-patent expiration to mitigate revenue erosion.

Key Takeaways

- Market Potential: CORTEF addresses a significant and expanding autoimmune market with an unmet need for improved safety and convenience.

- Pricing Strategy: An initial premium price (~$50,000/year) aligns with existing biologics but expects downward adjustments post-patent expiry due to biosimilar competition.

- Growth Trajectory: Rapid uptake in high-income markets is anticipated, with long-term pricing influenced heavily by biosimilar proliferation.

- Competitive Edge: Clinical superiority and convenient administration routes can justify premium pricing and foster higher market penetration.

- Risk Factors: High R&D costs, regulatory challenges, payer resistance due to high prices, and biosimilar competition pose significant risks to price stability and revenue growth.

FAQs

Q1: How does CORTEF’s pricing compare to existing IL-6 inhibitors?

A1: CORTEF’s projected initial price (~$50,000/year) aligns with the median range of existing biologics like tocilizumab and sarilumab, which typically range between $40,000 and $60,000 annually.

Q2: What factors could accelerate or slow down CORTEF’s price declines?

A2: Introduction of biosimilars, regulatory policies, payer negotiations, and demonstrated clinical value critically influence pricing sustainability. Biosimilar entry around 2030 may lead to 20-40% price reductions.

Q3: Will CORTEF’s pricing differ in emerging markets?

A3: Yes, prices are expected to be substantially lower—by 70-80%—to improve affordability, aligning with local economic conditions and healthcare budgets.

Q4: How significant is the role of health economics in CORTEF’s pricing?

A4: Extremely significant. Demonstrating cost-effectiveness and improved patient outcomes supports premium pricing and expedites reimbursement negotiations.

Q5: What is the potential impact of patent expiry on CORTEF’s revenue?

A5: Patent expiry, expected around 2035, is likely to precipitate a decline in net pricing and market share due to biosimilar competition, significantly reducing revenue streams unless lifecycle extensions or new indications are developed.

References

- Global Autoimmune Disease Market Report, 2022-2030.

- Health Economics Review of IL-6 inhibitors, 2022.

- Biologic Drug Pricing Analysis, IQVIA, 2023.

- R&D Expenditure in Biologics, Tufts Center for the Study of Drug Development, 2022.

More… ↓