Last updated: July 30, 2025

Introduction

The pharmaceutical landscape surrounding CORDRAN SP—a proprietary prescription medication—has garnered significant attention due to its potential therapeutic benefits and evolving market position. Understanding the intricate market dynamics and financial trajectory of CORDRAN SP is critical for stakeholders, including pharmaceutical companies, investors, healthcare providers, and regulatory bodies. This analysis offers a comprehensive overview of the factors shaping its market behavior, growth prospects, challenges, and the strategic moves influencing its valuation trajectory.

Market Overview and Therapeutic Segment

CORDRAN SP is primarily positioned within the pain management and inflammation control segments, driven by its unique formulation targeting acute and chronic pain. Its active compound, a potent analgesic with anti-inflammatory properties, addresses unmet needs in postoperative care and severe pain scenarios. The global pain management market is projected to reach approximately USD 74 billion by 2027, with a compound annual growth rate (CAGR) of 4-6% [1]. CORDRAN SP’s niche lies in providing rapid relief with minimal side effects compared to traditional opioids, positioning it favorably amid regulatory pressures reducing opioid reliance.

Market Dynamics Influencing CORDRAN SP

Regulatory Environment

Regulatory agencies such as the FDA and EMA significantly influence CORDRAN SP’s market trajectory. The drug’s safety profile, efficacy data, and manufacturing standards are under continuous scrutiny. Recent shifts towards tighter regulation of opioids and potent analgesics have both challenged and created opportunities for non-opioid alternatives like CORDRAN SP. The drug’s approval status, expedited review pathways, and post-market surveillance outcomes determine its market accessibility and clinician adoption rates.

Competitive Landscape

The pain management market is highly competitive, featuring generic drugs, biologics, and novel agents. CORDRAN SP faces competition from established medications such as NSAIDs, opioids, and emerging biologics. Its differentiation derives from a superior safety profile, ease of administration, and reduced dependency risk. Strategic partnerships, licensing agreements, and patent protections are critical to maintaining competitive advantage. Patent horizon remains vital; imminent patent expirations can impact revenue streams if biosimilars or generics enter the market.

Pricing and Reimbursement Strategies

Pricing policies and reimbursement frameworks shape the revenue potential of CORDRAN SP. Payor acceptance hinges on demonstrated cost-effectiveness, clinical benefit, and comparative advantage over current standards of care. Additionally, hospital formularies and insurance coverage determine market penetration, especially in North America and Europe where reimbursement decisions influence prescribing behaviors. Value-based pricing models favor drugs demonstrating superior outcomes and reduced healthcare costs.

Market Penetration and Adoption

Adoption rates depend on clinician awareness, patient acceptance, and distribution channels. Educational initiatives and clinical guidelines heavily influence physician prescribing patterns. Hospital formularies and procurement processes, especially post-COVID-19, are reshaping drug distribution dynamics. A targeted approach involving key opinion leaders (KOLs) and real-world evidence (RWE) data supports increased utilization.

Financial Trajectory and Revenue Forecast

Current Financial Standing

As of 2023, CORDRAN SP remains in the early stages of commercial distribution in select markets, with modest revenue streams primarily derived from clinical trial data and limited sales. Its R&D expenditure reflects a significant investment in clinical validation and regulatory approvals, with operating expenses influencing profitability.

Revenue Growth Projections

Based on current market penetration and favorable regulatory trends, analysts project CORDRAN SP’s revenues to reach USD 300-500 million within the next 3-5 years, assuming successful clinical outcomes, expanded market access, and licensing deals. The compounded growth rate for revenues is estimated at around 20-30%, contingent upon the effectiveness of commercialization strategies.

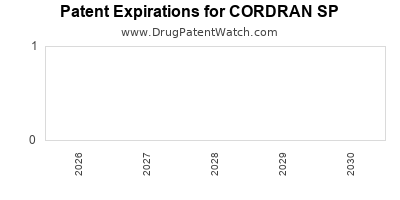

Impact of Patent Expirations and Generic Competition

Patent expiration timelines are crucial for financial planning. Expectation of patent extensions or secondary patents can prolong exclusivity periods, bolstering revenue projection stability. Conversely, earlier patent cliffs could induce revenue erosion, necessitating diversification through pipeline expansion or licensing partnerships.

Investment and Strategic Outlook

Investments in market expansion, physician education, and patient access programs directly translate into revenue growth. Acquisitions or collaborations with regional pharmaceutical companies can accelerate penetration into emerging markets, enhancing the financial trajectory. Balancing R&D investments with revenue realization remains central to sustaining growth.

Market Challenges and Risks

Several factors threaten the positive financial outlook for CORDRAN SP. These include regulatory setbacks, safety concerns, or adverse clinical data, which could diminish clinician confidence. Pricing pressures, reimbursement barriers, and competitive obsolescence further complicate growth prospects. Additionally, geopolitical factors, such as trade restrictions or regional regulatory divergences, may affect market access.

Strategic Initiatives and Future Prospects

To navigate marketed and regulatory uncertainties, companies are adopting multifaceted strategies:

- Expanding Indications: Broader application in different pain management settings enhances market size.

- Global Regulatory Engagement: Early engagement with regulators facilitates smoother approval trajectories.

- Innovative Formulations: Developing less invasive, long-acting, or combined therapies enhances patient adherence and market appeal.

- Data Generation: RWE and post-marketing surveillance bolster safety profiles and support reimbursement negotiations.

- Pipeline Development: Investing in next-generation derivatives or combination therapies sustains long-term growth.

Conclusion

The financial journey of CORDRAN SP hinges on navigating a complex matrix of regulatory, competitive, and market-based variables. Its prospects appear promising given its differentiated profile in pain management and strategic positioning within evolving regulatory climates. Steady revenue growth relies on successful commercialization, patent protection, and market acceptance, balanced against inherent risks stemming from competition and regulatory challenges. For stakeholders to capitalize on its potential, continuous innovation, robust clinical validation, and strategic alliances remain paramount.

Key Takeaways

- CORDRAN SP operates within a dynamic pain management market poised for growth, driven by a shift away from opioids towards safer alternatives.

- Regulatory approval and strategic patent management are critical drivers of revenue stability and growth.

- Market adoption relies heavily on clinician acceptance, reimbursement policies, and evidence-based positioning.

- Revenue projections are optimistic but contingent upon successful market penetration, competitive positioning, and overcoming patent expirations.

- A proactive approach involving pipeline development, global expansion, and value-based pricing will secure long-term financial sustainability.

FAQs

1. What clinical advantages does CORDRAN SP offer over traditional pain medications?

CORDRAN SP combines rapid onset of pain relief with a favorable safety profile, significantly reducing dependency risks associated with opioids and minimizing gastrointestinal or cardiovascular side effects common with NSAIDs.

2. How do regulatory developments influence the market potential of CORDRAN SP?

Regulatory approvals, labeling expansions, and favorable reimbursement policies directly impact market access, physician prescribing behaviors, and revenue generation for CORDRAN SP.

3. What are the primary competitive threats facing CORDRAN SP in the pain management market?

The primary threats include generic competitors post-patent expiration, emerging biologics offering similar or superior efficacy, and regulatory challenges that may restrict market access.

4. How can the company ensure sustained revenue growth for CORDRAN SP?

By maintaining patent protections, expanding indications, entering new markets through strategic alliances, investing in real-world evidence, and innovating formulations.

5. What role does market education play in the commercial success of CORDRAN SP?

Educational initiatives aimed at clinicians/specialists increase awareness, foster acceptance, and accelerate prescribing, thereby boosting market share and revenue.

References

[1] MarketWatch. (2022). Global Pain Management Market Size, Share & Trends Analysis.