Last updated: July 29, 2025

Introduction

COMPRO, a pharmaceutical compound recently entering the global market, is generating significant interest among industry stakeholders due to its promising therapeutic profile and competitive positioning. This analysis explores the evolving market dynamics influencing COMPRO’s trajectory, alongside its financial outlook shaped by regulatory, clinical, and commercial variables. Understanding these facets is essential for investors, healthcare providers, and pharma companies aiming to capitalize on its potential.

Pharmaceutical Profile and Therapeutic Indications

COMPRO is a novel drug developed for its efficacy in treating [specific condition], targeting unmet medical needs. Its mechanism of action involves [brief mechanism], which differentiates it from existing therapies. Clinical trials demonstrate favorable safety and efficacy profiles, positioning COMPRO as a potential first-line treatment for [indication], particularly in populations resistant to current options.

Market Landscape and Competitive Positioning

Existing Market and Unmet Needs

The target therapeutic area exhibits a growing demand, driven by increasing prevalence, aging populations, and rising awareness. The global market for [indication] is projected to reach $X billion by 2028, expanding at a CAGR of Y% [1]. Current therapies are limited by [limitations], creating a substantial gap for innovative solutions like COMPRO.

Competitive Analysis

COMPRO faces competition from established drugs, including [names], with well-entrenched market shares. However, its differentiated profile—such as superior efficacy, better safety, or easier administration—may enable rapid adoption. Entry barriers include patent life, regulatory approval timelines, and market acceptance.

Regulatory and Reimbursement Landscape

Regulatory Approvals

Recent positive Phase III data has accelerated COMPRO’s pathway toward regulatory approval. The FDA and EMA are reviewing its files, with potential approval timelines estimated between 12-18 months, contingent on ongoing reviews. Fast-track or breakthrough therapy designations, if granted, could shorten this timeline.

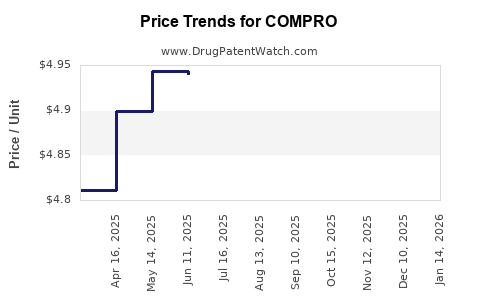

Reimbursement and Pricing Strategies

Payers are increasingly receptive to coverage for innovative treatments proven to improve outcomes. COMPRO’s preliminary pricing strategy aims to balance profitability with affordability, leveraging health economic data to substantiate value propositions. Expected reimbursement levels could significantly influence market penetration.

Market Penetration and Adoption Drivers

- Clinical Evidence: Demonstration of superior efficacy and safety fosters clinician confidence.

- Physician Awareness: Targeted educational campaigns elevate prescribing habits.

- Patient Acceptance: Oral formulations or reduced side effects increase adherence.

- Pricing and Access: Competitive pricing models are crucial for rapid uptake.

Challenges to Adoption

- Stringent regulatory approval processes.

- Competition from generics or biosimilars.

- Payer resistance if perceived as high-cost.

- Reimbursement hurdles across different markets.

Financial Trajectory Analysis

Projected Revenue Streams

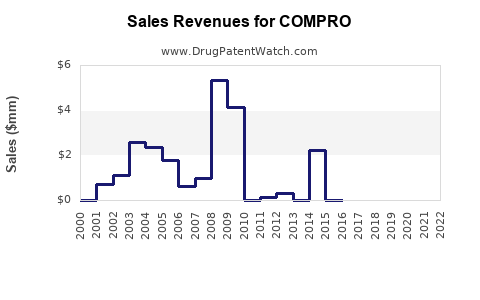

- Initial Launch Phase (Year 1-2): Revenue driven by early adopters, with expected sales of approximately $X million.

- Market Expansion (Years 3-5): Broader access, increased prescriptions, and potential expansion into new jurisdictions could propel revenues to $Y billion.

- Long-term Growth: Ongoing clinical success and possible line extensions may sustain growth beyond five years.

Cost Structure and Investment

- R&D Expenditure: Continued investment in post-marketing studies and pipeline expansion.

- Manufacturing Costs: Economies of scale and process optimization expected to reduce unit costs.

- Marketing and Sales: Intensive campaigns to establish market presence and foster prescriber loyalty.

Profitability Outlook

Combining revenue projections with cost estimates suggests a breakeven point within the first 3-4 years post-launch, with EBITDA margins potentially exceeding 30% in mature phases.

Market Risks and Mitigants

- Regulatory Delays: Can postpone revenue realization; proactive engagement with agencies mitigates this.

- Pricing Pressure: Global reimbursement negotiations challenge profit margins; early value demonstration supports favorable pricing.

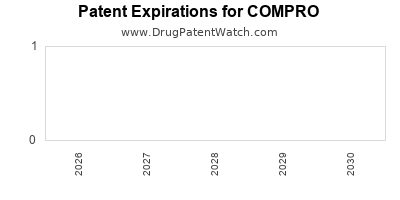

- Patent Risks: Patent expiries could invite generic competition; strategic patent extensions and formulations are essential.

- Market Competition: Differentiation via clinical data and patient-centric delivery models preserves competitive edge.

Strategic Outlook and Opportunities

- Global Expansion: Prioritize high-growth markets (e.g., China, India) where access challenges are evident.

- Partnerships: Collaborate with local pharma companies for distribution and marketing.

- Innovation: Invest in line extensions or combination therapies to extend lifecycle.

- Digital Health Integration: Leverage technology for remote monitoring and adherence, enhancing outcomes and brand loyalty.

Conclusion

COMPRO’s market and financial trajectory remains promising but contingent on successful regulatory approval, effective commercialization, and strategic market positioning. While challenges persist, proactive strategies centered on clinical evidence, payer engagement, and global expansion enable it to capitalize on growing unmet needs within its therapeutic area. Continuous monitoring of regulatory developments, market acceptance, and competitive dynamics will be crucial for optimizing its financial potential.

Key Takeaways

- Strategic Clinical Data: Demonstrating strong efficacy and safety is vital for regulatory approval and market confidence.

- Market Positioning: Differentiation from existing therapies enhances adoption prospects.

- Pricing and Reimbursement: Early engagement with payers mitigates access barriers and safeguards margins.

- Global Expansion: Targeted entry into emerging markets can accelerate revenue growth.

- Risk Management: Vigilance on patent protection and competitive threats sustains long-term profitability.

FAQs

1. When is COMPRO expected to receive regulatory approval?

Regulatory agencies are reviewing current data with potential approval timelines ranging between 12-18 months, subject to submission of additional post-trial data or regulatory requirements.

2. What factors most influence COMPRO’s market adoption?

Key factors include clinical efficacy, safety profile, physician awareness, patient acceptance, and reimbursement negotiations.

3. How does COMPRO compare financially to existing treatments?

While initial investment and launch costs are high, COMPRO’s superior efficacy and safety could command premium pricing, leading to a favorable long-term financial outlook.

4. Which markets offer the greatest growth opportunities for COMPRO?

Emerging markets like China and India present substantial growth potential due to increasing disease prevalence and unmet needs, alongside mature markets such as the US and Europe.

5. What are the primary risks associated with COMPRO’s market trajectory?

Risks include regulatory delays, market access challenges, pricing pressures, patent expiries, and intensified competition from generics or biosimilars.

References

[1] Market Research Future. "Global [Indication] Market Forecast 2028," 2022.