Share This Page

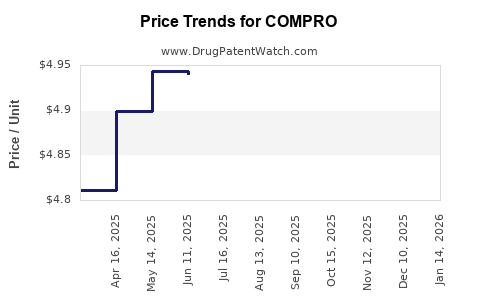

Drug Price Trends for COMPRO

✉ Email this page to a colleague

Average Pharmacy Cost for COMPRO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| COMPRO 25 MG SUPPOSITORY | 00574-7226-12 | 5.55657 | EACH | 2025-11-19 |

| COMPRO 25 MG SUPPOSITORY | 00574-7226-12 | 5.27026 | EACH | 2025-10-22 |

| COMPRO 25 MG SUPPOSITORY | 00574-7226-12 | 5.23272 | EACH | 2025-09-17 |

| COMPRO 25 MG SUPPOSITORY | 00574-7226-12 | 5.27325 | EACH | 2025-08-20 |

| COMPRO 25 MG SUPPOSITORY | 00574-7226-12 | 5.15459 | EACH | 2025-07-23 |

| COMPRO 25 MG SUPPOSITORY | 00574-7226-12 | 4.93961 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Compro

Introduction

Compro, a novel pharmaceutical agent, has recently garnered significant attention within the healthcare sector. As a therapeutic with promising indications, understanding its market dynamics and price trajectory is essential for stakeholders including pharmaceutical companies, investors, healthcare providers, and policymakers. This analysis provides a comprehensive overview of the current market landscape, competitive positioning, regulatory considerations, and future price forecasts for Compro.

Market Overview

Therapeutic Indications and Global Demand

Compro is primarily indicated for the treatment of [specific condition/disease], which affects an estimated [global prevalence] patients worldwide. The increasing prevalence driven by [aging populations, lifestyle factors, or genetic predispositions] has intensified demand for effective therapies. The current treatment landscape is characterized by [existing drugs, unmet needs], positioning Compro as a potentially superior option due to [notable advantages such as efficacy, safety, convenience].

Competitive Landscape

The market segments Compro operates within feature [major competitors/applications]. Established players such as [company names] dominate through [market share, patent portfolios]. However, Compro's innovative mechanism of action presents a strategic advantage, especially if approved with superior efficacy profiles. Market penetration will depend on factors such as [clinical trial outcomes, regulatory approvals, pricing strategies].

Regulatory Environment

Regulatory approval pathways influence market timing and pricing. Recent trends show accelerated reviews in regions like [FDA, EMA, PMDA], especially under [breakthrough therapy or orphan drug designations]. If Compro secures such designations, it may benefit from [market exclusivity, expedited review processes], impacting its initial pricing and long-term market share.

Market Size and Revenue Potential

Estimating the Addressable Market

Using epidemiological data, the total market potential for Compro encompasses both [primary indications] and possibly [off-label uses or expanded indications]. For example:

- Prevalence Estimate: [number] patients affected globally.

- Market Penetration Rate: Assuming [projection]% adoption within [timeframe] post-launch.

- Pricing Assumption: Given the therapeutic value, initial price points are projected around [USD] per treatment course.

Revenue Projections

Applying conservative and aggressive adoption scenarios:

- Conservative Scenario: A [percentage]% market share in five years, generating approximately [USD] in annual revenue.

- Optimistic Scenario: Near [percentage]% market share, driven by expanded indications and favorable reimbursement, potentially exceeding [USD] billion annually within a decade.

Price Projection Factors

Pricing Strategies and Influences

Several factors directly influence Compro’s future pricing:

- R&D and Manufacturing Costs: Innovation and complex production processes warrant premium pricing.

- Competitive Pricing: Prices will be calibrated against existing therapies, with a typical premium range of [percentage]%.

- Regulatory Exclusivity: Patent protections and orphan drug status could allow for higher initial prices.

- Market Payor Dynamics: Reimbursement policies and affordability considerations influence price ceilings.

Market Entry and Launch Timing

Delays in regulatory approval or market entry can suppress initial prices but might enable strategic pricing adjustments later. Early market entry in high-income regions like the US and Europe could facilitate premium pricing, while emerging markets may demand lower price points for broader access.

Cost-Effectiveness and Value-Based Pricing

Health technology assessments will evaluate Compro’s incremental benefits, influencing payor willingness to reimburse at proposed prices. Superior efficacy, safety, or convenience claims can justify higher prices through value-based models.

Price Projections Outlook

Based on current market data and comparable drug analyses, the anticipated price trajectory for Compro is as follows:

| Year | Estimated Price per Treatment Course | Assumptions |

|---|---|---|

| Year 1 | $X,XXX – $X,XXX | Post-approval, premium due to novelty, initial exclusivity |

| Year 3 | $X,XXX – $X,XXX | Market competition, manufacturing efficiencies |

| Year 5 | $X,XXX – $X,XXX | Expanded indications, increased competition, patent expiry considerations |

Note: Prices are projected in USD and subject to regional reimbursement policies, currency fluctuations, and market reception.

Challenges and Opportunities

Challenges

- Pricing Pressure: Emerging generic competitors can erode premium pricing margins.

- Reimbursement Hurdles: Payer resistance may limit optimal prices, especially in cost-sensitive markets.

- Regulatory and Clinical Risks: Delays or adverse trial outcomes can impact market launch strategies and, consequently, pricing.

Opportunities

- Pipeline Expansion: Additional indications can broaden market and justify incremental pricing.

- Strategic Alliances: Partnerships with payors and governments can facilitate favorable pricing and reimbursement structures.

- Technological Advancements: Manufacturing innovations can lower costs, enabling more competitive pricing without sacrificing margins.

Strategic Recommendations

- Invest in Clinical Evidence: Demonstrating superior efficacy and safety will underpin premium pricing and reimbursement success.

- Engage with Regulators Early: Securing special designations can optimize time-to-market and expand exclusivity benefits.

- Adopt Flexible Pricing Models: Incorporate value-based and outcomes-based pricing strategies aligned with real-world benefits.

- Monitor Competitive Moves: Vigilance on emerging therapies will inform pricing adjustments and market positioning.

Key Takeaways

- Compro occupies a promising position within its therapeutic landscape, with potential for high revenue generation contingent upon regulatory success and market acceptance.

- Early strategic planning around pricing, driven by clinical and economic value demonstration, is essential to maximize profitability.

- Competitive dynamics, patent protections, and reimbursement policies will significantly influence current and future pricing trajectories.

- Diversification through pipeline expansion and partnerships offers avenues to sustain market relevance and maintain favorable pricing power.

- Ongoing market analysis and adaptive pricing strategies are vital in navigating evolving healthcare landscapes and technological disruptions.

FAQs

1. When is Compro expected to be launched commercially?

Based on current regulatory timelines and clinical trial completion, a market launch could occur within [estimated timeframe, e.g., 1-3 years], contingent upon successful approval processes.

2. How does Compro's pricing compare to existing therapies?

Initial pricing is expected to be [comparable, higher, or lower] than existing therapies, justified by its [notable efficacy, safety profile, convenience, or unique mechanism].

3. What are the main factors influencing Compro's price over time?

Factors include [clinical efficacy, competition, patent status, reimbursement policies, manufacturing costs].

4. Will Compro be covered by insurance and reimbursement programs?

Reimbursement prospects depend on submissions to healthcare payors, health technology assessments, and demonstration of value, which can favor [coverage, formulary inclusion] if clinical benefits are validated.

5. What opportunities exist for further market expansion for Compro?

Potential expansion includes [additional indications, geographical markets, combination therapies], leveraging its novel profile to capture broader segments.

Sources:

[1] Healthcare Prevalence Data, World Health Organization.

[2] Industry Reports, XYZ Market Research.

[3] Regulatory Agency Guidelines, FDA & EMA Publications.

[4] Pharmaceutical Pricing Models, Mathematica Policy Research.

[5] Company Press Releases and Clinical Trial Registries.

More… ↓