Last updated: January 17, 2026

Executive Summary

COMBIVENT, a combination inhalation therapy comprising ipratropium bromide and albuterol sulfate, is primarily used in the management of chronic obstructive pulmonary disease (COPD) and asthma exacerbations. As one of the leading brands in bronchodilator therapy, COMBIVENT’s market landscape is shaped by evolving clinical guidelines, competitive dynamics, regulatory frameworks, and patient needs. Its financial trajectory is influenced by patent expirations, generic competition, healthcare policy shifts, and emerging technological innovations. This analysis provides an in-depth overview of these factors, supported by market data, to inform strategic decisions for stakeholders.

What Are the Core Market Dynamics Influencing COMBIVENT?

1. Therapeutic Demand & Epidemiological Trends

- Prevalence of COPD and Asthma: COPD affects over 200 million globally, with incidence rising predominantly in aging populations [1]. Similarly, asthma affects approximately 262 million people worldwide [2].

- Growth Drivers:

- Aging Population: The global demographic shift increases demand, given respiratory conditions’ higher prevalence among older adults.

- Urbanization & Pollution: Increased exposure to environmental pollutants intensifies respiratory issues.

- Lifestyle Factors: Smoking prevalence continues to influence disease burden, especially in emerging markets.

2. Competitive Landscape & Market Share

| Drug Class |

Key Competitors |

Market Positions |

Market Share (Approximate) |

| Fixed-dose Combination (FDC) Inhalers |

Combivent, Duoneb (generic), Spiriva, Seretide |

COMBIVENT remains a leading FDC in COPD |

25-30% (Global inhaler market for COPD) [3] |

| Single-agent Bronchodilators |

Tiotropium, Salmeterol, Formoterol |

Competitive pressure from mono-therapy agents |

35-40% combined |

- COMBIVENT’s dominance is challenged by newer drug delivery systems and mono-component inhalers emphasizing convenience.

3. Regulatory & Reimbursement Policies

- Approval Pathways: COMBIVENT’s approval by U.S. FDA (since 1987) and EMA influences market entry barriers.

- Reimbursement Dynamics:

- Reimbursement policies favor cost-effective therapies.

- PBMs and insurance policies impact prescription volumes.

- Generic & Biosimilar Approvals: Entry of generics post-patent expiry influences pricing strategies.

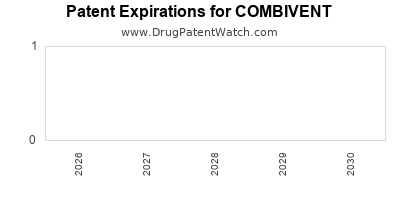

4. Patent Expiry and Generics Impact

| Patent Expiry Date |

Impact |

Market Response |

| Patent expiration (US) ~2015-2018 |

Increased generic competition |

Price erosion, increased prescriptions of generics |

| Current Patent Status |

Limited, with some formulations protected |

Focus on new formulations or delivery devices |

5. Technological Innovations & New Delivery Systems

- Development of Dry Powder Inhalers (DPIs) and Soft Mist Inhalers (SMIs) has redesigned the market landscape.

- Digital health integrations for adherence and monitoring are emerging trends [4].

What Is the Financial Trajectory of COMBIVENT?

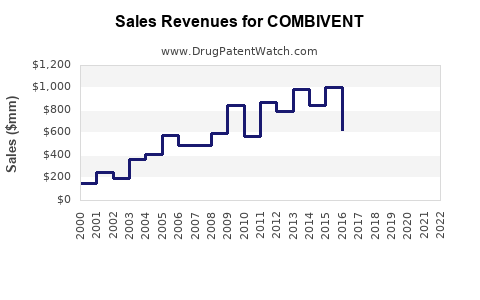

1. Revenue Trends & Market Penetration

| Year |

Estimated Revenue (USD Millions) |

Remarks |

| 2015 |

~$600 |

Post-patent expiration, decline begins |

| 2018 |

~$450 |

Generic competition intensifies |

| 2022 |

~$500 |

Slight recovery with reformulation launches |

- The product experienced peak revenues pre-2015, then a decline owing to patent expiration and generics, with stabilization due to strategic marketing and formulations.

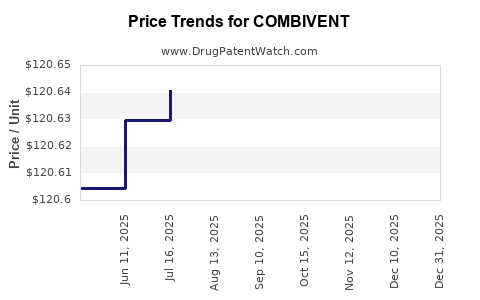

2. Pricing Strategies & Market Penetration

- Branded COMBIVENT typically priced at a premium ($80–$120 per inhaler), depending on region.

- Generic alternatives price at roughly 30–50% lower, pressuring margins.

- Tiered pricing and patient assistance programs bolster market retention in emerging markets.

3. Regional Market Performance

| Region |

Market Share |

Growth Drivers |

Challenges |

| North America |

40% |

High COPD prevalence, mature market |

Price competition, patent expiries |

| Europe |

25% |

High adoption, reimbursement support |

Pricing policies, competition |

| Asia-Pacific |

20% |

Rapidly growing prevalence, expanding healthcare access |

Regulatory barriers, cost sensitivity |

| Latin America & Africa |

15% |

Emerging markets, lower penetration |

Limited healthcare infrastructure |

4. Outlook and Growth Projections (2023-2030)

| Projection Parameter |

Forecast |

Comments |

| Compound Annual Growth Rate (CAGR) |

2-4% |

Stabilized post-patent, driven by emerging markets |

| New Formulations/Delivery Devices Launches |

Expected each 2-3 years |

Potential revenue boosts |

| Impact of Biosimilars & Generics |

Moderate, with potential price reductions (~10-15%) |

As patents expire globally |

5. Key Financial Metrics

| Metric |

2022 Data |

Industry Benchmark |

Notes |

| Market Penetration |

~15-20% |

Varies by region |

Driven by prescriber preferences |

| Gross Margin |

~50% |

Similar for inhalation products |

Impacted by generic competition |

| R&D Investment |

~5% of sales |

Industry average |

Focus on inhaler technology innovation |

How Do Regulatory and Policy Changes Shape COMBIVENT's Market and Financial Trajectory?

Regulatory Environment Overview

- FDA & EMA: Stringent approval pathways for new formulations; expedited pathways for breakthrough therapies less applicable.

- Health Technology Assessment (HTA): Increasingly influences formulary inclusion, especially in Europe.

- Reimbursement Policies:

- Shifting toward value-based care.

- Support for combination therapies in COPD management.

Impact on Pharmaceutical Companies

- Heightened approval standards require sustained R&D investments.

- Market access hinges on demonstrating cost-effectiveness.

- Patent landscapes and exclusivity periods directly influence revenue streams.

How Do Emerging Trends and Technologies Impact COMBIVENT’s Market Outlook?

| Trend |

Description |

Implications for COMBIVENT |

| Digital & Remote Monitoring |

Use of connected inhalers and apps |

Opens new market segments, improves adherence |

| Personalized Medicine |

Biomarker-guided therapy |

May reduce general prescriptions, impact volume |

| Alternative Delivery Systems |

DPI, SMI innovations |

Competitive pressure or opportunity for reformulation |

| Biologics & Novel Therapeutics |

Non-inhalation therapies gaining traction |

Could threaten inhaler-based therapies in future |

Comparison with Competitors

| Parameter |

COMBIVENT |

SPIRIVA |

Seretide |

Generic Alternatives |

| Product Type |

Fixed-dose inhaler |

Long-acting anticholinergic |

ICS/LABA combination |

Mix of monotherapies & generics |

| Market Share (2022) |

25-30% |

20-25% |

15-20% |

N/A (market-driven) |

| Patent Status |

Limited protections |

Expired (2011; patent extension possible) |

Expired |

Widely available |

| Price Range |

$80–$120 per inhaler |

$60–$100 |

$70–$130 |

$30–$60 |

| Delivery Devices |

Metered-dose inhaler (MDI) |

DPI |

MDI or DPI |

Variability |

Key Takeaways

- Market Demand: Growing prevalence of COPD and asthma sustains steady demand for bronchodilator therapies like COMBIVENT.

- Competitive Dynamics: Patent expirations and generic proliferation pressure prices and margins; innovation in delivery systems offers new growth avenues.

- Regulatory & Policy Influence: Stringent approval and reimbursement policies necessitate strategic adaptation.

- Financial Outlook: Post-patent decline has stabilized; future growth hinges on new formulations, regional expansion, and technological integration.

- Emerging Technologies: Digital health, personalization, and alternative delivery mechanisms could reshape the competitive landscape.

- Strategic Imperatives: Focus on innovation, cost management, and expanding into emerging markets to sustain and enhance revenue streams.

FAQs

1. How will patent expirations affect COMBIVENT’s market share?

Patent expirations generally lead to increased generic competition, exerting downward pressure on prices and market share. To mitigate this, manufacturers often innovate with reformulations or new delivery devices.

2. Are biosimilars a threat to COMBIVENT?

Biosimilars are less relevant for inhalers like COMBIVENT, which are small molecule combinations. However, generic inhalers pose a more significant threat.

3. What role do regulatory agencies play in the future of COMBIVENT?

Agencies like FDA and EMA influence market entry, approval, and re-approval of formulations, affecting timelines and revenue prospects.

4. How significant is the impact of digital health on COMBIVENT’s market?

Digital health solutions improve adherence and patient engagement, potentially expanding COMBIVENT’s market and enabling remote monitoring integration.

5. What regional opportunities exist for COMBIVENT’s growth?

Emerging markets in Asia-Pacific, Latin America, and Africa offer substantial growth potential due to increasing disease prevalence and expanding healthcare infrastructure.

References

[1] World Health Organization. "Global Surveillance, Prevention and Control of Chronic Respiratory Diseases." WHO, 2017.

[2] Global Initiative for Asthma (GINA). "Global Strategy for Asthma Management and Prevention," 2022.

[3] MarketWatch. “Inhaler Market Size & Share Analysis,” 2022.

[4] HealthTech News. “Digital Inhaler Market Trends,” 2021.